Dark clouds on the horizon as woes drag on

Updated: 2017-01-17 07:57

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

Hong Kong's tottering economy will continue to be clouded by uncertainties this year amid subdued global growth, fragile exports and weak consumption restrained by a volatile equity market and an overheated property market.

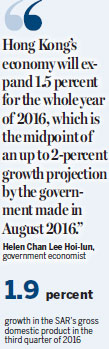

The SAR's gross domestic product grew 1.9 percent in the third quarter of 2016, compared to a 1.7-percent increase in the previous quarter, as the global economy stabilized with relative improvement in external trade and a drastic strengthening of domestic consumption.

"Hong Kong's economy will expand 1.5 percent for the whole year of 2016, which is the midpoint of an up to 2-percent growth projection by the government made in August 2016," Government Economist Helen Chan Lee Hoi-lun said in November last year.

If this materializes, it would be the slowest growth since the 2008 global financial crisis and drastically lower than the 10-year average growth of 3.4 percent.

The SAR will announce its economic growth figures for 2016 when it announces the 2017-18 Budget next month.

Both Bank of China (Hong Kong) (BOCHK) and the Washington-based International Monetary Fund (IMF) have predicted that Hong Kong's economy would expand by 1.5 percent last year. For this year, both expected the city's economy to grow 1.8 percent and 1.9 percent, respectively.

Swiss-based investment bank UBS has also voiced caution over Hong Kong's economic growth, revising the city's GDP forecast downward by 0.2 percentage points to 1.7 percent for 2017, and projecting that the local economy would expand 1.3 percent in 2016.

The three key factors that will have a critical impact on the local economy are:

Sluggish global economic growth that would have a negative impact on Hong Kong's economy, with the IMF estimating that the world economy will expand 3.1 percent in 2016 and 3.4 percent in 2017 due to weak demand dented by slow economic growth and asset market volatility.

"The rapid decline in productivity and an aging population are inhibiting US economic growth. Although US President-elect Donald Trump has pledged to stimulate economic growth through infrastructure investments and tax cuts, it's still not certain whether the US economy can be ignited," warned a BOCHK report released last month.

Secondly, global sluggish economic growth is also creating an unfavorable backdrop for Hong Kong in boosting economic growth through goods and services exports.

Euler Hermes, a trade credit insurer backed by German asset manager Allianz Group, forecast that global trade in value terms would contract 2.9 percent, while the trade volume would grow 2.1 percent in 2016.

As a small and international economy, Hong Kong's goods and services exports will be negatively impacted by these trends in global trade. The political and economic uncertainties unleashed by Britain's decision in June last year to abandon the European Union, the outcome of elections in France, Germany and the Netherlands this year, the continued strengthening of the US dollar, as well as Trump's new economic and trade policies, may further drag Hong Kong's goods export performance.

Thirdly, resilient local consumption, seen as the bastion of Hong Kong's economic growth, may be curtailed if triggered by a severe downward correction of the volatile stock and property markets.

"The current price-to earnings (P/E ratio) of the Hang Seng Index (HSI) stands at about 12.7 times which is higher than its 10-year average of 10.6 times, indicating there'll be little room for upward revision of the index's valuation, thus less catalyst for the gauge to jump in the near future," said Alex Fan Kwan-ming, managing director at GF Securities (Hong Kong) Brokerage.

"We've assigned a neutral rating for the HSI performance in 2017 as it may exhibit 10-percent up or down volatility."

Elevated Hong Kong property valuations are also putting Hong Kong's economic growth at risk. The IMF said stretched property valuations mean that the city's economy is vulnerable if interest rates rise faster than expected.

The US second federal funds rate hike in December last year - the first time in a decade - has riled Hong Kong financial markets with local mortgage loan interest rates slated to follow suit this year. A spike in mortgage loan rates definitively will hamper discretionary consumer spending of local households which, in turn, would dampen economic growth prospects.

"With stretched valuations, there's the risk of an accelerated (homes) price adjustment should interest rates rise faster than expected," the IMF warned in its annual assessment report on Hong Kong. "There's a risk to the real economy from an adverse spiral of negative wealth effects, lower collateral values, slower credit growth, as well as weaker household and corporate spending."

"The current (homes) price-to-income ratio currently stands at 20 times which is well above the historical average and among the highest in the world. Current home prices increase the risk of a prolonged property market correction when interest rates rise and labor market conditions weaken," US-based credit rating agency Moody's Investors Service cautioned.

"Should interest rates go up by three percentage points to a more normal level, the housing affordability ratio (percentage of incomes used to repay mortgage loans) would soar (from 59 percent in the third quarter) to 77 percent, far exceeding the long-term average of 46 percent in the past 20 years," Chan warned in November.

"Hong Kong's economy had been too accustomed to a long period of ultra-low interest rates in the last decade so that any interest rate upshot will lead to drastic sell-offs in the equity market," Deutsche Bank said. "Amid the coming interest-rate hike cycle, it would exert a huge negative impact on the local property sector."

Hong Kong homes prices hit an all-time high late last year as the private residential unit price index soared for the eighth month running, rising 4.5 percent on a yearly basis.

Improved global trade is the first ingredient needed for recovery. Hong Kong's goods exports in the third quarter of last year jumped 1.9 percent as Asia's exports stabilized. While exports to the Chinese mainland continued to strengthen, exports to some other Asian markets all registered notable growth during the period.

Services export will be another catalyst stimulating economic recovery. There was also improvement in services export, with the year-on-year decline narrowing to 1.8 percent in the third quarter of 2016 as global trade and cargo flows stabilized along with a revival in initial public offering activities. "Hong Kong's services trade will grow at about 7 percent annually over the next 15 years, led by the restructuring of mainland economy toward consumption and services," HSBC said.

oswald@chinadailyhk.com

|

Stock market volatility and a runaway property sector are among some of the obstacles that threaten Hong Kong's economic performance this year. But, despite the uncertainties, there are also essential ingredients to kick-start the city's economic growth. SeongJoon Cho / Bloomberg |

(HK Edition 01/17/2017 page1)