Pop goes the art market bubble

Updated: 2016-10-25 09:23

By Chitralekha Basu(HK Edition)

|

|||||||

Art sales in HK continue to rise, in apparent defiance of a worldwide economic downturn. Then there could be more than just multi-million-dollar purchases to this story. Chitralekha Basu reports.

The chips are down. The stocks seem to be taking a tumble in the US market and in Hong Kong too property stocks - one of the main drivers of the city's economy - are plummeting. And yet Hong Kong's various channels of art trading seem to be charged by a renewed buoyancy.

The swings of the art market here seem to follow a logic independent of the stock index. Investing in a Damien Hirst or a captivating geometric maze created by Hong Kong's own Wucius Wong seems to make better sense than playing the stocks. Art consultant Jehan Chu of Vermillion Art Collections has been watching the way art came to be progressively "assetized" in Hong Kong over the past decade from up close. "Art being a relatively accessible asset class is perhaps increasingly seen as a safe haven for cash," says Chu. "It's portable, unregulated, easy to transfer cross-border, relatively. It's a natural reservoir for excess cash."

And the volume of art trade in Hong Kong as well as the Chinese mainland seems to keep growing, in apparent defiance of the global trend. "Defying all forecasts the Chinese mainland upped 18 percent, dominating the global art market in the first half of 2016", taking the lead over American markets, according to Artprice - an online platform for monitoring art sales globally. Hong Kong too "posted a H1 growth of 10 percent", thus giving a sock to the projection by The Guardian less than a year ago that "the art market might have reached terminal velocity in 2015". Far from the doomsday for art traders envisaged in that article, art sales in Hong Kong show no signs of abeyance. Then this might be a qualified truth.

First, let's list the positives. As many as seven auctions and an art fair - Fine Art Asia - were held in Hong Kong in the first two weeks of October, and the hosts aren't complaining. The mood is upbeat at Sotheby's who have sold Shen Zhou's landscapes for HK$17.36 million at "more than eight times its pre-sale estimate".

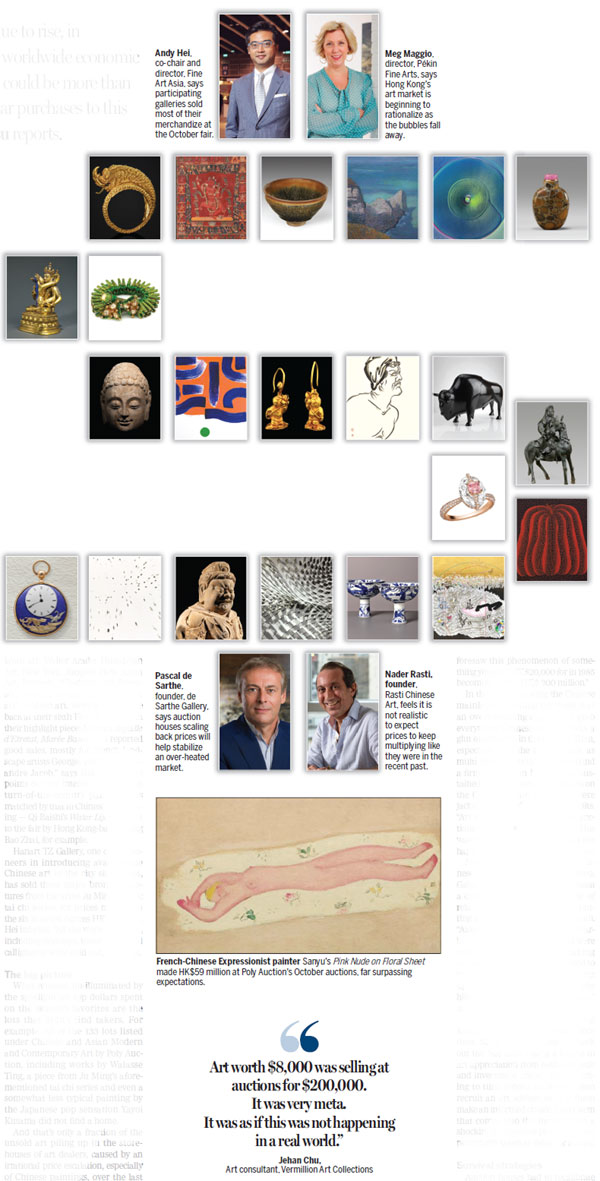

Poly Auction Hong Kong managing director Alex Chang Yi-hsiu was happy to have Chinese-French Expressionist Sanyu's painting, Pink Nude on Floral Sheet, make HK$ 59 million in the autumn auction. Wu Guanzhong's A Lotus Pond was snapped up for HK$106.2 million, far surpassing expectations. These were just two among several others that received the love of collectors, "proving that our strategy of art selection and promotion has been acknowledged and supported by connoisseurs around the world," says Chang.

It was also party time at Fine Art Asia, which arrived close on the heels of Asia Contemporary Art Show in mid-September. This was a relatively lean season, considering art fair fervor peaks in Hong Kong during Art Basel Week in March, when a huge number of people who aren't serious collectors do their annual art shopping. And yet business wasn't bad at all.

Andy Hei, co-chairman and director of Fine Art Asia, mentioned several of the participating galleries had managed to sell most of their merchandize at the October fair. These include Tenzing Asian Art of San Francisco, which specializes in Himalayan art; Walter Arader Himalayan Art, New York, Jacques How Asian Art, Brussels. "Gladwell and Patterson, London, dealing in Impressionist and modern art, were excited to be back at their sixth Fine Art Asia with their highlight piece: Monet's Aiguille d'Etretat, Mare Basse, and reported good sales, mostly for French landscape artists Georges Robin and Alexandre Jacob," says Hei, even as he points out the interest in European turn-of-the-century painters was matched by that in Chinese ink painting - Qi Baishi's Water Life, brought to the fair by Hong Kong-based Rong Bao Zhai, for example.

Hanart TZ Gallery, one of the pioneers in introducing avant garde Chinese art to the city since 1984, has sold three major bronze sculptures from the artist Ju Ming's iconic tai chi series, for prices ranging in the six to seven figures HK$ bracket, Hei informs. "All the works on paper, including drawings, water colors and calligraphy were sold out," he adds.

The big picture

What remains un-illuminated by the spotlight on top dollars spent on the season's favorites are the lots that didn't find takers. For example, 52 of the 133 lots listed under Chinese and Asian Modern and Contemporary Art by Poly Auction, including works by Walasse Ting, a piece from Ju Ming's afore-mentioned tai chi series and even a somewhat less typical painting by the Japanese pop sensation Yayoi Kusama did not find a home.

And that's only a fraction of the unsold art piling up in the storehouses of art dealers, caused by an irrational price escalation, especially of Chinese paintings, over the last two decades. "The market was much smaller 20 years ago and you could buy a Yue Minjun for HK$5,000," says Mark Saunderson, director of Asia Contemporary Art Show. "Nobody foresaw this phenomenon of something you paid HK$20,000 for in 1985 becoming worth HK$ 200 million."

In the years following the Chinese mainland's opening up there was an overwhelming appetite to grab everything Chinese as there was a glut of artworks in the market. Then, especially over the last 10 years, as multi-national auction houses found a firm foothold in Hong Kong, sustained largely by new millionaires on the Chinese mainland, prices were jacked up beyond conceivable limits. "Art worth $8,000 was selling at auctions for $150,000 to $200,000. This was very meta. It was as if it was not happening in a real world," says Chu.

Nader Rasti, founder, Rasti Chinese Art gallery, blames it on greed. Galleries did not distinguish between a creative genius and an artist of relatively average talent while putting astronomical price tags on both. "Also there's too much art in the market, because the auction houses were selling so much stuff and making too much money and they wanted to make more. It can't just keep going up in that sort of context. The violent hikes in prices were just not realistic," says Rasti.

Collectors buying from the Hong Kong market have gotten wiser since then. Many of them come to check out the fare after taking a course in art appreciation from both aesthetic and investment angles. Those wishing to turn serious collectors often recruit an art adviser to help them make an informed choice. Every item that comes into the market with a shockingly expensive price tag is not necessarily taken as value for money.

Survival strategies

Auction houses had to recalibrate their pricing strategy in view of the fact that collectors now know better. They no longer guarantee their top lots (i.e. pledge to buy the piece themselves for a minimum price, in case it remains unsold). "That prompted collectors to be less inclined to consign major works to auction and therefore reduce the chances of a successful sale. The shift is beneficial to dealers who sell the works privately, preventing the chances of being unsold at auction," says Pascal de Sarthe, founder of de Sarthe Gallery.

On the flip side, such a move has prompted collectors to hold on to their finest pieces, wait until the market begins to look bullish again. Until then auction houses are left with "a larger percentage of second-tier artworks and these do not get premium prices" remarks de Sarthe. "Auction houses are scaling back expectations and that changes the dynamic of the market." Which isn't a bad thing at all, as "this would help stabilize an over-heated art market and prompt gallery owners to re-think the way they manage their business," he adds.

Slowdown? What slowdown?

Meg Maggio, who sits on the board of Hong Kong Art Gallery Association and is also director of Pkin Fine Arts gallery, insists Hong Kong's art scene is, in fact, on the upswing. She believes the test of a market's health is best measured in terms of its social and cultural impact rather than the moolah generated by a few over-priced objects of art. Hong Kong's art eco system - which also includes public and private museums, non-profit initiatives for promotion of the arts, corporate firms sponsoring the display of public art, cultural institutes supporting exhibitions, workshops and panel discussions, besides the obvious galleries and auction houses - says Maggio, has never been in more robust health or more engaged with the public.

"I don't buy the idea that there is a slowdown in the art market in Hong Kong," says Maggio. "Maybe some of the auction houses are having trouble. A lot of them went through management restructuring recently. Also there are too many auction houses vying for the top slot."

"I think the local art market is doing fine. Artists continue to produce fabulous work, not dictated by the market. Nothing has slowed down," she adds.

For one, she thinks that cutting back on prices is a positive development. It's a sign of "the infrastructure growing and maturing in Hong Kong," she says, as a result of which "the art market bubbles fall away and the market rationalizes".

As art becomes more affordable, mental barriers collapse too. Fine Art Asia drew 25,800 visitors. Art Basel had 60,000. Evidently, one doesn't have to be a tycoon to think of owning a piece of art any more. "I would call this a democratizing of art which is no longer exclusively in the domain of the elite," says Maggio. "I see middle-class parents taking their children to art fairs. The days of the super-rich art patrons are over."

The enthusiasm and energy evident in Hong Kong's art scene is a reflection of "a pan-Asian phenomenon" says Maggio, a trend that is also evident in Singapore, South Korea and India. "As economies across Asia grow and stabilize, as the middle-classes get more educated, there is an aspiration towards a better cultural growth."

Materialistic, profit-driven Hong Kong now seems to be in the forefront of a race to appreciate the finer things of life.

Contact the writer at basu@chinadailyhk.com

(HK Edition 10/25/2016 page8)