Is going cashless a bankable option?

Updated: 2016-09-13 07:02

By Shadow Li(HK Edition)

|

|||||||

Octopus-credit card combo dominates.Mobile payment for cross-border tourists?

The Chinese mainland's mobile connectivity and vast domestic market, along with the absence of a credit card legacy, has enabled its internet giants to connect consumers to services with rictionless mobile phone transactions. Shadow Li investigates the reasons for the lag in Hong Kong's digital payments landscape.

New chapter in retail payment

On Aug 25, the Hong Kong government issued licenses to five service providers under the Stored Value Facility (SVF) Ordinance, a regulatory framework which came into effect on Nov 13, 2015, to facilitate mobile payment. Norman Chan Tak-lam, chief executive of the Hong Kong Monetary Authority (HKMA), hailed the move as "turning a new page in retail payment development in Hong Kong".

The five mobile e-wallet service providers granted SVF licenses include two mainland companies, Tencent (WeChat) and Alibaba (Alipay), along with three local entities, HKT (Tap & Go), TNG Asia (e-Wallet) and Octopus (O! ePay).

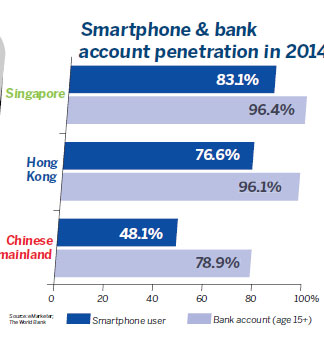

Mobile payment on the Chinese mainland has leapfrogged the credit card era to smartphones as the ubiquitous consumer transaction tool. Similarly, countries and regions in developing Asia, Africa and South America with huge rural and semi-urban populations outside the middle-class credit card banking catchment, are well placed to rapidly adopt stored value mobile phone payments.

The Chinese mainland's internet giants lead the world in embracing "fintech" for peer-to-peer lending and e-commerce in the collectively named "BAT" trio: Baidu, Alibaba, and Tencent. They innovated technology and applications to mine the vast mobile base of Chinese consumers. The recent Visual Capitalist report shows eight Chinese Unicorns (start-ups valued at $1 billion or more) having a combined valuation of $96.4 billion.

The scale that social inclusiveness creates, is a bonanza for well-structured online portals which offer value, quality, convenience and trust. The mobile payment facility allows consumers to exercise choice irrespective of social class, geography or lack of retail banking services.

HK mobile transactions

Senior vice-president of product, business development and card operations at HKT Alex Kun Kei-tung labels mobile payments as money 3.0, compared to credit cards as money 2.0 and bank notes as money 1.0.

HKT's Tap & Go handed out a cash rebate of about HK$350 to each user at launch. Kun told China Daily they explored ways to work with government and quasi-government groups, having already collaborated with the Education Bureau on payment for textbooks via the smartphone application.

TNG e-Wallet increased its visibility in Hong Kong by partnering with 759 Store - a retail grocery chain with 270 outlets founded by businessman Coils Lam Wai-chun, and Pricerite with 31 outlets. It has also signed up city taxis. Since Nov 2015, TNG has registered 370,000 users (about 5 percent of the Hong Kong population).

Octopus O! ePay allied with Standard Chartered online banking to facilitate splitting of bills among friends, peer-to-peer (P2P) money transfers and online top-up of Octopus stored value.

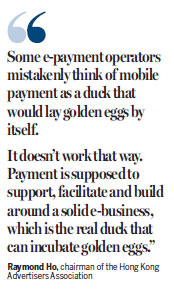

Chairman of the Hong Kong Advertisers Association Raymond Ho believes it would be difficult for a local player to make a significant impact on the mobile payment scene in Hong Kong. He feels some of the operators mistakenly think of mobile payment as a duck that would lay golden eggs by itself. "It doesn't work that way. Payment is supposed to support, facilitate and build around a solid e-business, which is the real duck that can incubate golden eggs," said Ho.

The newly approved local mobile payment service providers, says Ho, seem to focus only on payment, without a comprehensive portfolio of other services to keep consumers using their platform. Payment is just one facet within a useful portal.

Octopus rules for now

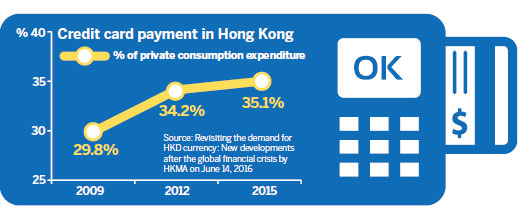

Associate professor Michael Wong Chak-sham from the Department of Economics & Finance at the City University of Hong Kong believes Hong Kong is a small market with an entrenched stored-value card company Octopus dominating. The market is well served by the hybrid ecosystem of stored-value Octopus and credit card-based payment networks. This ubiquity and convenience may inhibit consumers from switching to alternative digital payment systems.

Octopus' sales and marketing director Rita Li confirms that Octopus's 30 million subscribers account for 99 percent of the Hong Kong population and more, yielding a daily spend of HK$173 million. The Hong Kong resident population is only 7 million. Octopus will maintain its physical card and e-payment applications even as it adds mobile payment facility with its new SVF license. However, to make smartphone payment seamless, Octopus will be challenged to partner the range of handset makers and mobile service providers.

Amit Goel, co-founder and managing director of the Let's Talk Payments portal, advises Fortune 500 companies on e-commerce, technology and digital payments strategies. After a week's visit to Hong Kong in April 2016, he posted his assessment titled "Probably the Best Payments System in the World has Little or No Mobile to it". He describes the Octopus card as "the anywhere commerce system, the utopian system we talk about"

"It's available widely, you can top it up anywhere, and use it at every merchant (from big box retailers, subway, buses, to mom and pop shops and even remote tourist places). It has a mobile option as well (sim card) but it's not used much because of lack of handset and platform support beyond a bunch of approved handsets. So I have been thinking - are mobile wallets really required? The Octopus card is the anywhere commerce system, the utopian system we talk about, isn't it? It enables rewards, loyalty, works at transit as well as retail and public services and seamlessly integrates payments in commerce."

Associate professor Wong observes that the Hong Kong government has the mindset of a regulator, rather than an innovator. A regulator, whose job is to make sure rules are followed, cannot also encourage innovation, which is mostly about circumventing existing systems for a way out of the box. Wong says we can't wait until something is 100 percent safe before using it. Wong also feels government policy is not particularly supportive of e-commerce startups, imposing heavy financial hurdles on them.

Can startups afford it?

Under the Payment Systems & Stored Value Facilities Ordinance, only companies with a capital of more than HK$25 million can apply for a license, ruling out contenders like Tim Lee Ying-ho, the young co-founder of Beijing QFPay Technology Co Ltd, a company that built a mobile-payment system used by millions of small merchants on the mainland.

Lee's native Hong Kong is unfortunately not as easy to penetrate. "For most startups, it is almost impossible to meet the requisite investment amount. Even if I have venture capital investment of HK$25 million, I wouldn't put the money into the Hong Kong market. Not to mention that no venture capitalist would invest that much money in a small market like Hong Kong," said Lee.

In Hong Kong stability trumps innovation that entails risk-taking, says Lee. By comparison, the US, also a mature financial society, is much more suitable for creativity and innovation, with the advantage of market size.

Hong Kong and the mainland are two different worlds in terms of mobile payment and e-commerce, says Lee. In Hong Kong online and offline services are almost always independent of each other, whereas they converge on the mainland.

Growing customer loyalty

QFPay is now a major ancillary to WeChat, the Chinese messenger-turned-mobile-payment giant owned by Tencent. The company assists merchants, who subscribe a monthly fee, by linking an e-loyalty scheme to ensure its offline customers keep coming back to the portal.

Here's how the system typically works: a customer dropping by for a cup of coffee at a caf in an office building in Beijing would pay by using WeChat. The payment would earn the user an instant loyalty card issued by the caf. They would treat her WeChat account as her online identity. From then on, the caf will keep her posted about its promotional offers, and each subsequent purchase would earn her bonus points. It's the same for Alipay account users.

China's mobile payment giants - WeChat pay and Alipay - not only allow customers to make instant payments via smartphones, but also offer multiple additional benefits. Both service providers actively engage their clients - WeChat by creating a "friends' circle" for users through its online club, offering privileges and benefits which encourage online transactions. Alipay users enjoy the convenience of online shopping on Taobao, its e-shopping website.

Market of cross-border travellers

After his company QFPay was able to reach out to more than a million merchants in five years on the Chinese mainland, generating an annual transaction worth 60 billion yuan ($9 billion) in 2015, Lee returned to test his business model in Hong Kong. In six months, QFPay secured 800 merchants in Hong Kong. The company started a word-of-mouth campaign through tourists from the mainland, which seems to have paid off. He believes the scale available on the mainland can be tapped for visitors to Hong Kong.

"Cross-border payment is very effective in tourist-led economies like Hong Kong, South Korea and Japan. That's why we need to become stronger before we come back to cities like Hong Kong," said Lee.

The secret of his success, says Lee, lies in being able to connect offline consumption with online spending. Offline marketing requires substantial investment in hiring people, making it harder to expand than an online operation. Online is the more cost-effective system startups prefer.

Lee noted that WeChat and Alipay won over mainland smartphone users in less than three months. He hopes it might be possible for the model to catch on in Hong Kong in another five to 10 years, when a younger generation of digital consumers arrives. "A vast market guarantees niche markets for small players, despite the existence of major players," he said, explaining his success on the mainland.

Not just about payment

"When talking about mobile payment, you need to understand that payment is not the main game. It is behind the application just like math is behind application," Lee, told China Daily.

Payment, a way to effect transactions, comes after concrete content and understanding of consumer behavior. That insight has proven valuable for WeChat and Alipay, which have both developed rapidly. Data covering the first half of 2016 shows WeChat has an active user base of more than 800 million, spanning roughly 200 countries and regions, a 34 percent increase compared to the same period last year. Advertisement revenue through WeChat is up by 80 percent, touching 3.6 billion yuan.

WeChat pay, invented to facilitate payment for different social activities using the WeChat app, evolved into more than just a system for sending a relative a red envelope during the Chinese New Year or sharing the lunch bill with friends. It grew into a multi-functional platform, providing financial services, including investments, loan applications, and everyday activities like hiring a cab, ordering take-outs or buying drinks from a vendor.

Similarly, Alipay, a system initially created to process payments through the e-commerce giant Taobao, has also expanded to serve many other needs.

Fintech to rejuvenate HK?

Associate professor Wong believes Hong Kong is a springboard to deploy the cash hoard moneyed people from the mainland seek to invest. It is also a free port through which world trade flows into and out of the Chinese mainland. Hong Kong could well use its twin advantages to integrate the different payment gateways, be it Alipay, WeChat, Apple pay or Octopus.

Such an integration would facilitate Hong Kong's visiting mobile population - tourists and merchants - to transact without difficulties, saving them the hassles of currency exchange and commission costs. Wong suggests the new Innovation & Technology Bureau work with the HKMA to enable fintech start ups to evolve a creative financial ecosystem.

The Hong Kong government places high hopes on "fintech" (technology to make financial services more efficient) to rejuvenate Hong Kong's financial markets. For example, fintech can simplify payment for mainland people to buy Hong Kong insurance products without visiting the city, said Lee. Fintech could facilitate crowd funding, connecting enterprises seeking funds from the public, where the low threshold could make investment affordable.

The internet has lowered the cost of reaching potential retail investors. Lee suggested the Asian Infrastructure Investment Bank (AIIB) could underwrite infrastructure projects for the Belt & Road Initiative, and then invite the general public to invest.

Contact the writer at

stushadow@chinadailyhk.com

(HK Edition 09/13/2016 page8)