HK startups set for the world with a huge lift from Alibaba

Updated: 2016-05-11 07:52

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

|

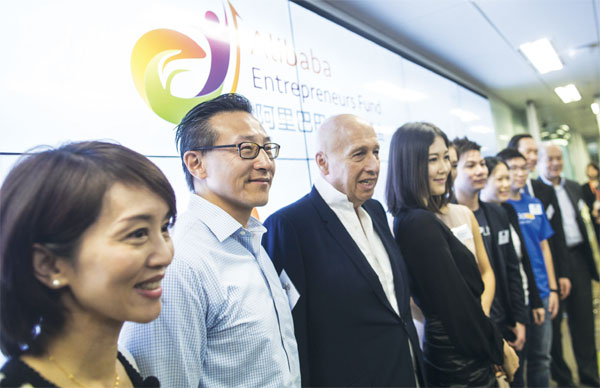

Cindy Chow (from left), executive director of Alibaba Group Holding Ltd's Hong Kong Entrepreneurs Fund; Joseph Tsai, co-vice- chairman of Alibaba Group; and Allan Zeman, chairman of Lan Kwai Fong Holdings Ltd, pose for photographs with other guests during a news conference in Causeway Bay on May 5. Besides securing the funding, the three Hong Kong startups that broached Alibaba's minority-stake investment will have the chance to leverage resources from Alibaba's ecosystem to expand into other markets. Justin Chin / Bloomberg |

The Hong Kong Entrepreneurs Fund - a HK$1-billion fund set up by mainland e-commerce giant Alibaba Group Holdings to give budding entrepreneurs in the SAR a shot in the arm - landed a fresh punch last week by picking three local internet startups for investments in the city.

The move is also seen as giving a big lift to Hong Kong, which has been falling behind global centers in financial technology developments.

Although the exact amount of the investments has not been revealed, the first batch of startups - intra-city logistics provider GoGoVan, online designer apparel rental business YEECHOO, and cloud-computing solutions provider for small and medium-sized enterprises (SMEs) Shopline - not only broached Alibaba's minority-stake investment, they will foster mutual beneficial business relationships with the mainland e-commerce juggernaut and are poised to make a broader footprint on the world stage.

GoGoVan was set up in Hong Kong in mid-2013 with Steven Lam at the helm and a vision to grab a slice of the traditional logistics industry by building up a platform of mobile and cloud solutions linking customers and drivers.

The company has, of late, expanded to the Chinese mainland, Taiwan, South Korea, India and Singapore. With more than 2 million app downloads and a network of 150,000 commercial vehicles and registered drivers, the logistics startup has so far secured more than 20 million orders valued in excess of $200 million.

"We're devising a bottom-up strategy to transform the global logistics system. We want to create a new business model - LaaS (Logistics as a Service) - which means logistics companies can optimize costs by utilizing technology and big data analytics in the whole delivery value chain," says Chief Executive Officer Lam.

"Logistics as a Service" is not entirely a new concept. Besides customer logistics services, Lam aims to push business development to new highs. GoGoVan has launched GoGoEnterprise - a logistics delivery management platform that provides order management, route optimization, real-time tracking and instant delivery confirmation - to meet the logistics solution needs of both individual online retailers and multinational enterprises.

With the goal of revolutionizing the global logistics industry, GoGoVan needs a lever that has come from Alibaba, whose e-commerce ecosystem has spawned into business-to-customer (B2C), customer-to-customer (C2C), business-to-business (B2B) platforms, payment solutions, and cloud business.

"Alibaba can help us forge a low-cost logistics network," Lam reckons. "We need to cooperate with Alibaba in the logistics sector although it has yet to materialize."

Besides securing the funding, the three Hong Kong startups will have the chance to leverage resources from Alibaba's ecosystem in order to expand into other markets.

Tony Wong, co-founder and chief executive officer of Shopline, says: "Alibaba is the world's largest e-commerce company with expertise in payment, logistics and cloud services that are all core to e-commerce. The Entrepreneurs Fund investment will help us strengthen our market position in Hong Kong and Taiwan, and fuel the next stage of our growth."

Shopline boasts some 60,000 SME clients in Hong Kong, Taiwan and Southeast Asia. Having posted a five-fold increase in business revenue since its launch in 2014, the company has set its sights on Japan, South Korea and the Chinese mainland.

"We're leveraging each other's business strengths. Through this investment, we can utilize Alibaba's experience to learn about service distribution, payment services and building customer relationships. Our Taiwan clients would like to know more about how to establish their footprints in the Chinese mainland market," Wong says. "On the other hand, Alibaba also wants to capitalize on our experience in business expansion in Southeast Asia."

Shopline - a B2B e-commerce platform that allows merchants to set up online shops - had solicited two rounds of fundraising so far, including Alibaba's minority-stake investment. It had also won a HK$9.3-million investment through its first round fundraising in 2014. The company sees being able to break even in the next two years.

According to global financial services firm Daiwa Capital Markets, Alibaba's current stock valuation has yet to fully reflect its multiple monetization potential in cloud, video and programmatic advertising and its dominant position in the Chinese mainland's e-commerce space.

A recent HSBC global research report said: "Underpinning this is a huge amount of customer data the management is beginning to offer to merchants to increase its value even further. This is leading to higher monetization and revenue acceleration."

The report maintained a "buy" rating for the stock, saying it can leverage data to raise the value of its platform, benefit from rising rural consumption on the Chinese mainland, improve delivery and expand more quality services.

The Hong Kong Entrepreneurs Fund, created in November last year, is part of mainland tech tycoon Jack Ma Yun's vow to help Hong Kong's budding businesspeople get off the ground and promote the city's entrepreneurial drive.

oswald@chinadailyhk.com

(HK Edition 05/11/2016 page7)