Mainland 'rapidly moving up' the trade value chain

Updated: 2016-05-04 08:03

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

The Chinese mainland's latest trade data have painted a mixed picture for the country's trade and economic prospects amid moves by the government to shore up the manufacturing industry hit by sluggish global demand.

Experts say they're confident the country can cope with the difficulties despite the looming challenges.

According to statistics from the General Administration of Customs released last month, the mainland's exports in March jumped the most in a year while declines in imports had narrowed, suggesting that the manufacturing sector in the world's second-largest economy is stabilizing.

US dollar-denominated exports rose 11.5 percent year-on-year to $160.86 billion, beating market expectations and recovering from February's 25.4-percent slump that marked a seven-year trough.

Imports fell an annual 7.6 percent - unchanged from February - generating a trade surplus of $29.86 billion for March against the previous month's surplus of $32.58 billion.

Industrial production was better than expected - rising 6.8 percent year-on-year in March, against a market consensus of 5.9 percent.

However, the latest Caixin China General Manufacturing PMI (purchasing managers' index) released on Tuesday edged down to 49.4 last month, indicating that domestic economic recovery has yet to stabilize.

The private survey, which tracks activity in the country's factories and workshops, found that relatively weak market conditions and softer client demand had led firms to be cautious with their production schedules, while new order books stagnated following a slight expansion in March.

"I'm not that pessimistic about China's capability to adjust the export market," said Hinrich Foundation founder Merle Hinrich. "I frankly believe that the present level of growth is reasonable and practical."

Hinrich Foundation - a Hong Kong-based charity organization - was founded in 2012 to promote sustainable international trade by granting trade scholarships, providing export trade assistance and conducting international trade research.

"The scope of products coming out of Chinese companies is more sophisticated, and I frankly believe we can see a continuation of that," Hinrich said.

The mainland is embarking on various campaigns to promote "Made in China 2015" and "Internet Plus" initiatives in a bid to climb up the value chain ladder and to revive the flagging domestic manufacturing sector battered by anemic global demand.

Hinrich noted that multinational firms are already operating on the mainland, but Chinese enterprises are also upgrading their technology and quality levels. "For example, China is competing for bullet-train service contracts around the world and it's going up the value chain," he said.

He cited Japan whose exports used to be low-end products in the 1960s, but have since rapidly moved into more technology-intensive products. "China will exactly do the same thing. There has been substantial investment in technology and that investment is made in education. There are now more engineering students in China than elsewhere which is important," Hinrich reckoned.

Meanwhile, the latest 2016 Global Manufacturing Competitiveness Index report by auditing advisory firm Deloitte and the US Council on Competitiveness says it expects the US to become the world's most competitive manufacturing nation, while China will slip into second place.

It suggests that the Chinese mainland's manufacturing field has to overcome some development concerns, such as an aging population, the country's economic slowdown and rising labor costs.

"China's success in moving up the value chain depends on how well it can focus on technology commercialization and how effective it can help manufacturing companies attract venture capital investments," said Zhang Tianbing, Deloitte China's industrial products and services consulting partner.

Despite optimism that China can move up the industry's value chain, the mainland's export sector faces various challenges.

Hinrich said the country, firstly, should continue to engage in supply-side reform to boost productivity. High-end manufacturing must also be open to the best talent, materials, suppliers, processes and innovations wherever that can be found in the world. Taxation reforms currently underway can also offer powerful support for competitiveness.

Mainland private enterprises must also gear themselves up to deal with market changes. "It's true the government, typically, does not make good industry decisions. Small-and-medium size enterprises in China do not participate to the extent they should," he said.

Hinrich said China trade should also be made more sustainable.

According to Hinrich Foundation's Sustainable Trade Index 2016 prepared by the Economist Intelligence Unit, China's trade sustainability ranked 12th among 19 Asian countries surveyed.

The index measures the capacity of economies to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection and increased social capital.

It shows that China trade is relatively less sustainable than that of other countries and regions with a similar gross domestic product level. China scored poorly in the environment, sustainability of its labor force and in educational attainment.

oswald@chinadailyhk.com

|

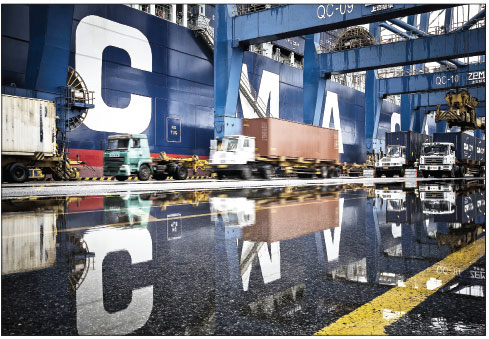

A view of the Guangzhou South China Oceangate Container Terminal in Guangzhou. Experts believe that China's exports will soon move from low-end paroducts into more high-end products, just like what Japan achieved 50 years ago. Qilai Shen / Bloomberg |

|

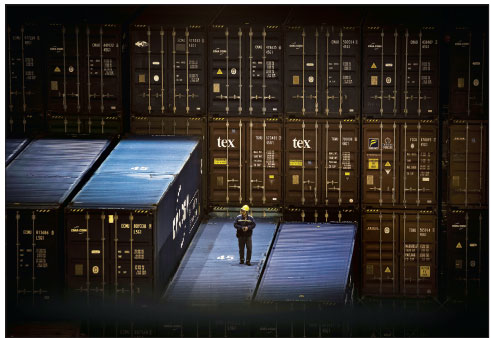

A crew member stands on top of a shipping container at the Guangzhou South China Oceangate Container Terminal in Guangzhou. To move up the industry's value chain, mainland private enterprises are expected to take a more vigorous part in the market. Qilai Shen / Bloomberg |

(HK Edition 05/04/2016 page9)