Investors unflinching over HK equities

Updated: 2016-04-12 08:22

By Emma Dai in Hong Kong(HK Edition)

|

|||||||

|

A worldwide survey by Legg Mason Global Asset Management shows that the majority of Hong Kong investors remain positive about the local equity market this year despite recent market volatility and worries about a new global financial crisis. Edmond Tang / China Daily |

Local stocks still seen as world's 'best investment opportunity' over next 12 months

Despite apprehension over continued market volatility and another global financial crisis, most Hong Kong investors polled say they still have faith in the SAR's equity market.

The response came in a survey conducted by US-based Legg Mason Global Asset Management. It contrasts sharply with the stand of banking giant HSBC, which has remained firm on its negative outlook for the city's equity market, citing the current weakness in its property and retail sectors.

According to the results of the poll released on Monday, the majority of Hong Kong investors are positive about the local equity market this year, with 71 percent of those above 40 years of age and 65 percent in the younger age group believing that domestic stocks are the "best investment opportunity" around the world over the next 12 months.

More than half of the investors interviewed, or 52 percent of those over 40 years old, believe that the city's stock market will climb in 2016. On average, they are looking for a gain of 15.7 percent.

The survey, carried out from last December to January this year, covered 5,370 individuals with at least $200,000 investable assets across 19 markets worldwide. They included 1,267 who are below 40 years old, while a total of 1,341 interviewees are Asia-based. Some 200 investors were interviewed in Hong Kong.

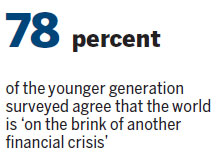

However, it was found that Hong Kong investors' confidence has been shaken by recent volatility in the equity markets. Four among five local investors older than 40 feel that the world is "on the brink of another financial crisis", with 78 percent of the younger generation surveyed agreeing.

Against such a backdrop, local investors above the 40-year-old bracket who are optimistic fell to 55 percent this year from 80 percent a year ago. Among younger investors, only 38 percent are still positive this year. Roughly a third of local investors are worried about global economic instability, while another 30 percent are worried about the slowdown in the Chinese mainland's economy, the survey found.

Meanwhile, in a report on Monday, HSBC maintained its negative outlook on the city's equity market with an "underweight" rating for Hong Kong equities. The bank cited "a combination of poor external demand and a weakening domestic retail sector" in 2016.

"There is little to cheer as the retail sector continues to face a decline in inbound tourism, particularly from the Chinese mainland. Weakness in domestic consumption continues while the property market is in a correction phase, putting further downward pressure on retail sales," Herald van der Linde, head of Asia Pacific equity strategy at HSBC, said in the report.

He warned that with the US Federal Reserve likely to raise interest rates again later this year, "the continued weakness in the tourism sector and the appreciation of the Hong Kong dollar are likely to exert further downward pressure on retail sales in the coming months".

He described consensus expectations of 5.6-percent growth in companies' earnings per share for 2016 as "ambitious".

HSBC said it foresees the SAR's GDP growth decelerating from last year's 2.4 percent to 1.5 percent in 2016.

It also forecast that the benchmark Hang Seng Index will dive 16.6 percent within 12 months and slip 6.2 percent in two years, while the market's price earnings ratio is expected to decline from an estimated 15 times by end of this year to 13.9 percent by late 2017.

emmadai@chinadailyhk.com

(HK Edition 04/12/2016 page8)