Chinese strike gold in Dubai with booming homes market

Updated: 2016-02-05 09:15

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

Residential properties in Dubai are becoming increasingly attractive for Chinese investors seeking to diversify their property portfolios due to the Persian Gulf city's attractive capital appreciation growth rates and returns on investment.

Over 15 home developers from Dubai, including Nakheel and Jumeirah Golf Estates, showcased their residential projects valued at approximately HK$8 billion at the Dubai Property Show held in Hong Kong in late January.

The show was organized by Dubai Land Department, the government regulatory body for the city's home market, and Sumansa Exhibitions. Showcased property prices ranged from HK$752,000 for an apartment to HK$2.92 million for a villa.

Dubai, the commercial center in the United Arab Emirates (UAE), has a booming home market increasingly fuelled by global demand, including Chinese investment.

According to Juwai.com, as at August 2015, Chinese investor interest in the Dubai home market had soared by 1,200 percent compared to a year ago.

The Dubai Land Department says Chinese investors have emerged recently as one of the fastest-growing buyer groups in the city's home market.

Low property prices, lucrative rental yields, unrestricted repatriation of funds, zero rental income tax and capital gains tax, investor protection, a stable political environment, residence visas on property purchase above 1 million UAE dirhams ($272,000), as well as property security and quality are the compelling factors driving more mainland investment in this home market, global real estate advisory firm Jones Lang LaSalle said in a research report.

According to Global Property Guide, a company that compiles and analyzes property price performance of the world's big economies, returns on property investment in Dubai are up to 7.21 percent, compared with 2.82 percent in Hong Kong.

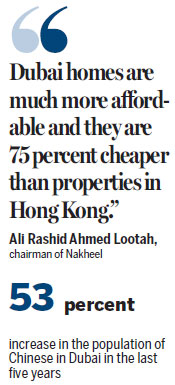

The other factor is increasing trade linkage and business cooperation between China and Dubai. The Chinese population in Dubai has grown by 53 percent in the last five years to about 230,000. In the last five years there has been a 170 percent increase in the number of Chinese students attending universities in Dubai. Also, more than 4,000 Chinese companies operate in the UAE to capitalize on Dubai's gateway status to the Middle East and African markets.

"We share a vision of positioning Dubai as the world's premier real estate destination and a byword for innovation, trust and happiness," said H.E. Majida Ali Rashid, assistant director general at Dubai Land Department.

Yousuf Kazim, chief executive officer at Jumeirah Golf Estates, told China Daily that rental yields in Dubai start from 8 percent to 10 percent for apartments, depending on location, and 5 percent to 6 percent for luxury villas. Capital appreciation currently stands at 20 to 30 percent annually for apartments and more than 15 percent for villas.

"Dubai homes are much more affordable and they are 75 percent cheaper than properties in Hong Kong," Ali Rashid Ahmed Lootah, chairman of Nakheel, told China Daily in an interview.

Investors from the Chinese mainland, Hong Kong and Southeast Asian countries have already bought Nakheel's properties worth $245 million, with mainland investors accounting for nearly 80 percent.

And developers in Dubai are not worried that the slowing down of the Chinese economy or the recent yuan volatility would crimp the growth of the Emirati city's property market.

"The recent yuan weakness has slashed our construction material costs by 30 percent, so it can ensure our profitability," Jumeirah Golf Estates' Kazim said. "We do not see yuan exchange rate volatility exerting any negative impact on the Dubai property market."

Kazim added that the company has a land bank of approximately 1,100 hectares, whereas only 370 hectares have been developed.

oswald@chinadailyhk.com

|

Chinese homebuyers are increasingly being drawn by the allure of Dubai, which has a booming real estate market fuelled by global demand. Global Property Guide, a company that compiles and analyzes property price performance of the world's big economies, says returns on property investment in Dubai are up to 7.21 percent, compared with 2.82 percent in Hong Kong. Jasper Juinen / Bloomberg |

(HK Edition 02/05/2016 page8)