Elderly people in HK urgently need more retirement income

Updated: 2016-01-04 09:25

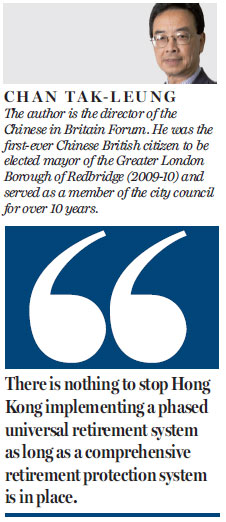

By Chan Tak-Leung(HK Edition)

|

|||||||

The government's Commission on Poverty (CoP) recently embarked on a six-month public consultation, inviting citizens to send in their views on a set of questions relating to the delivery of retirement protection for a growing number of retirees. Like most developed nations and cities in the world, the number of citizens reaching retirement age is increasing in Hong Kong. It is expected to reach 2.14 million by 2040. The CoP has approached the question of retirement protection based on principles advocated by the World Bank, namely, adequacy, sustainability, affordability and robustness.

I find the two simulated options offered in the CoP report confusing and contradictory. First, universal retirement protection in most developed nations such as Britain, referred to as a state pension, is being called the "regardless of rich or poor" option in the CoP report. However, there is no proposal to set up a publicly managed mandatory contributory plan similar to the national insurance contributions in Britain. There, all working people are obliged to sign up when they start employment for a 30-year period. This is in order to enjoy state pensions, supplemented by incomes from a combination of other contributory personal pension schemes.

Since no contribution is necessary in this option, the World Bank's four principles are being put in jeopardy right away. Despite this, the CoP report still maintains that retirement protection is a "basic right" and not a "welfare benefit".

It is indeed laudable for the CoP to encourage Hong Kong citizens to enjoy their rights during their retirement, but how can a responsible civil society promote rights without any personal responsibilities?

Second, the other simulated option targeting "those with financial needs" certainly meets the World Bank's principles. But there is still a need to manage those who are "asset rich, income poor". The existing Reverse Mortgage Programme might help those who remain in their homes with a stable monthly income. But the government might want to consider putting a charge on properties should pensioners require long-term residential care. These pensioners will be looked after without any financial worries while the government will pay for this care in the meantime. Deferred payments will be paid back eventually as agreed with service users.

The CoP report recommends that the Mandatory Provident Fund (MPF) which has been in place since 2000 will be improved and strengthened. This is to deliver mutual benefits to both employers and employees. In order to boost the fund for individual employees, perhaps it will allow for top-up contributions - something similar to the national insurance top-ups in Britain. The remaining three pillars - social security, voluntary savings and public services - will be strengthened as well to develop an effective retirement protection system in the city.

Since a retirement protection system has long been overdue in Hong Kong, most citizens are likely to offer their views in the current consultation exercise and look forward to its early implementation. The difficult part will be for Hong Kong's diverse stakeholders not to politicize the issue, as this will make the delivery of a consensus impossible and cause further delays in the legislative process. Legislators no doubt will propose amendments and challenge some parts of the proposal. Some might also adopt filibustering tactics to prolong the legislative and funding allocation process in order to make personal political statements.

There are already dissenting voices among community organizations opposed to a means-test scheme. I think their protests are both unrealistic and illogical. Since we are not talking about the introduction of a fully paid-up pension scheme in Hong Kong but are referring to elderly people living in poverty who have neither MPF schemes nor other matured insurance policies, bonds or shares, there is a need to carry out financial assessments. This is to ensure their individual needs will be met through a combination of available social security and other publicly funded benefits.

Moreover, is it not true that under Article 5 of the Basic Law Hong Kong was conferred with the right to a way of life based on a capitalist system rather than a socialist one? A blanket retirement protection scheme for all retirees regardless of their personal wealth and other financial resources sounds socialist to me, and goes against the grain of a capitalist way of administering the city.

As to the question of setting income and asset limits, Hong Kong could follow the example of what has been practiced for years under successive community care laws in Britain. So we should be more relaxed about the notional figure of HK$80,000 being used in the CoP report. I believe it is only an example and people should not focus on a single figure, as whatever the amount is will have to be changed over time.

Finally, there is nothing to stop Hong Kong implementing a phased universal retirement system as long as a comprehensive retirement protection system is in place. The fact remains that there are elderly citizens in need of financial and/or care support services now rather than sometime in the future.

(HK Edition 01/04/2016 page11)