Govt has moral responsibility to ensure for every elderly citizen a decent living

Updated: 2015-12-29 07:48

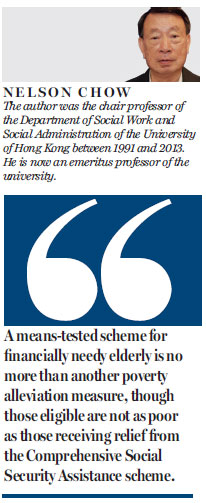

By Nelson Chow(HK Edition)

|

|||||||

A consultation paper on the future development of retirement security in Hong Kong, issued by the government on Dec 22, invited the public to comment over the next six months on the various proposals it contains.

Though the paper covers a wide spectrum of issues related to retirement security, like a review of the offset mechanism for Mandatory Provident Fund contributions, what it actually requests the public to do is to choose between two options, which the government describes as two different ways in which Hong Kong might provide retirement security for present and future generations of aged citizens.

The two options, or assimilated models, suggested in the paper, came from a study that a University of Hong Kong research team led by me conducted on behalf of the Commission on Poverty in 2014. In brief, the first option is the introduction of a universal pension scheme that ensures every Hong Kong citizen reaching old age would have a secure and reliable monthly income of around HK$3,200. The second option is to improve the present social security system for the elderly by introducing an additional layer that would provide a monthly allowance of HK$3,200 to the financially needy ones with assets of no more than HK$80,000.

The government has also given projections up to 2064 - almost 50 years from now - on the extra resources that would be required to finance the two options. The result is: A universal pension for all citizens reaching old age would cost 10 times more than a means-tested scheme that only helps the financially needy elderly.

While I have no dispute with the figures projected in the paper, I have grave doubts about the way in which they have been presented. My concern, which is also my disappointment, is that the government has not given the public a true picture of the issues at stake and has misguided the man on the street to a conclusion the government would like to see.

First, the two options that the government has offered the public do not represent a genuine choice as they are totally different in nature. The idea of universality is to treat every citizen as a rightful member of society who would thus be entitled to a stable income in old age, just like free and compulsory education for children of school age. A means-tested scheme for financially needy elderly is no more than another poverty alleviation measure, though those eligible are not as poor as those receiving relief from the Comprehensive Social Security Assistance scheme.

Instead of having to choose between the two options, I believe both options would be welcomed by the public. As revealed by the Commission on Poverty, chaired by Chief Secretary for Administration Carrie Lam Cheng Yuet-ngor, around 30 percent of our elderly were living in poverty in 2014 and they certainly required a greater effort from the government to lift them out of their misery.

Furthermore, Hong Kong already lags far behind other economically mature societies in developing a comprehensive income support scheme for those reaching old age. Hence, the two options are not mutually exclusive and they are burdens that the SAR government must shoulder at the same time.

Another controversial point in the paper relates to the additional costs that the two options would incur by 2064. As the two options are entirely different in what they intend to achieve, as well as the numbers of those who would benefit, it is not surprising that the resources needed to finance a universal pension scheme would be far higher than a means-tested scheme assisting a limited number of needy elderly. I wish the government could be more honest in its presentation of the financial implications and let the public know that a universal pension scheme would benefit not only the 1.1 million elderly presently in our population but eventually the more than 5 million citizens who would reach old age in the next 50 years.

I have also found the government paper mean and unkind in its treatment of retirement security for the elderly. In the government's eyes it seems the issue at stake is nothing but what the government has to pay. Hence, the government's position is that the universal pension proposal is simply too expensive and should be ruled out. And what the public, in fact, has been asked to give their views on is how the means-tested scheme should be implemented to ensure "value for money".

The government has forgotten its moral responsibility to ensure for every citizen a decent living in old age. With its huge reserves it does not lack the resources to finance a universal pension scheme aimed at providing every elderly person the minimum financial support.

(HK Edition 12/29/2015 page9)