Yuan interest rate in HK hits 2-month high on funding crunch

Updated: 2015-12-03 06:41

By Bloomberg in Hong Kong(HK Edition)

|

|||||||

|

The Hong Kong Monetary Authority will consider holding more renminbi-denominated assets after the currency's inclusion in the International Monetary Fund's Special Drawing Rights basket. David Gray / Reuters |

HKMA calls cross-border financing suspension a temporary measure, says more yuan assets on agenda

The cost of borrowing yuan in Hong Kong rose to a two-month high on Wednesday as a suspension of cross-border financing and a dim sum sovereign bond sale reduced the availability of funds.

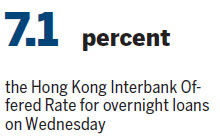

The Hong Kong Interbank Offered Rate for overnight loans climbed 203 basis points to 7.1 percent, the highest level since Sept 29, according to a Treasury Markets Association fixing. It had risen 173 basis points in November.

The People's Bank of China has asked some onshore banks to stop offering cross-border financing to offshore lenders and ordered a halt to borrowing from the mainland through bond repurchases, people familiar with the matter said on Nov 19. The Ministry of Finance auctioned 14 billion yuan ($2.2 billion) of government notes in Hong Kong last week.

"The suspension of offshore borrowing from onshore and the government debt issuance last week are the main causes for the tightening market," said Becky Liu, Hong Kong-based senior rates strategist at Standard Chartered Plc. "The impact of the bond auction is fading, so the liquidity stress will ease soon."

Standard Chartered estimated in a Nov 13 report that offshore banks' outstanding bond repo positions were around 100 billion to 200 billion yuan and said the inability to roll over existing positions would tighten offshore yuan liquidity.

The suspension of cross-border financing should be a short-term measure, Hong Kong Monetary Authority (HKMA) Chief Executive Norman Chan Tak-lam said on Nov 26.

Also, the HKMA will consider holding more yuan assets after the currency's inclusion in the International Monetary Fund's Special Drawing Rights basket, Chan said in a briefing in Shanghai on Wednesday. Preliminary data show that Hong Kong's yuan pool stabilized in November after declines in the previous two months, he added.

The seven-day repurchase rate, a gauge of interbank funding availability in Shanghai, was unchanged at 2.34 percent as of 5:11 pm local time, a weighted average from the National Interbank Funding Center shows.

(HK Edition 12/03/2015 page8)