HK homes prices seen to dip further

Updated: 2015-09-17 07:44

By Oswlad Chan in Hong Kong(HK Edition)

|

|||||||||

|

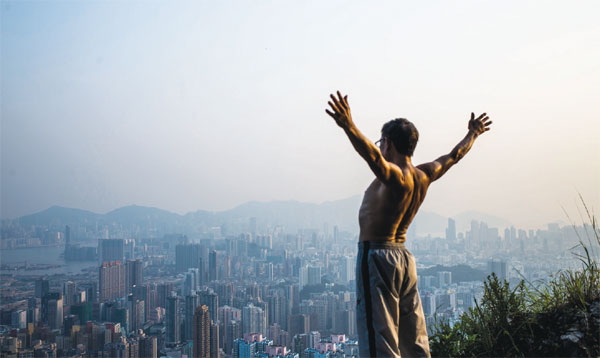

A man stretches his arms on a peak overlooking Hong Kong's Victoria Harbour. Market experts are worried that any changes in the macroeconomic environment, such as US interest-rate hikes, a further deterioration in the city's economy and stock market volatility, would exert unforeseen changes in the local homes market. Justin Chin / Bloomberg |

Hong Kong's property prices are likely to fall further this year, based on market research which has revealed the steepest price hikes recorded for the past two decades in the absence of robust transactions.

The scenario emerges as the city's de facto central bank warned of a "highly uncertain" local property market arising from volatile equity markets in Hong Kong and on the mainland, as well as widely expected US interest-rate rises, that could dampen prices.

According to real estate agency Midland Realty, the total number of secondary-homes transactions registered in the first eight months of this year was only 32,222, while property prices during the same period soared by almost 9 percent.

For 2013 and 2014, total transactions involving secondary homes recorded in the first eight months were 30,470 and 31,684, respectively, with corresponding price increases of 5 percent and 5.8 percent.

Midland Realty compiled the figures for secondary-homes transactions for the first eight months from 1996 to 2015. The data revealed that for 2015, although the total number of transactions was less than 35,000, the steepest prices increases were recorded.

Market research suggests that the recent surge in real estate prices have not been accompanied by robust transactions in the secondary market, and that even a small number of transactions can drive up prices.

Market experts are worried that any changes in the macroeconomic environment, such as US interest-rate hikes, a further deterioration in the Hong Kong economy and stock market volatility, would exert unforeseen changes in the local homes market.

The US Federal Reserve is to begin a two-day meeting on Wednesday and Thursday, with financial markets expecting it to raise interest rates for the first time in nearly a decade, possibly within this year, although investors are divided on the scale of the increase.

Meanwhile, Norman Chak Tak-lam, chief executive of the Hong Kong Monetary Authority (HKMA) - the city's de facto central bank - has warned that the local property market faces a highly uncertain future due to a combination of regional and global factors.

"The volatility of the mainland and local stock markets has taken a toll on the Hong Kong homes market. Coupled with the prospect of a US interest-rate hike, the current status of Hong Kong's property market is highly uncertain," he told the Treasury Markets Summit 2015 in Hong Kong on Wednesday.

"The HKMA will monitor the market situation very closely and will launch appropriate measures to protect the city's financial and banking system when it's needed," he said at the event, jointly organized by the HKMA and the Treasury Markets Association.

"If the US raises interest rates, Hong Kong's base rate will follow suit. However, we believe that a US interest-rate increase should not lead to immediate hikes in mortgage loan interest rates in the city," Chan said.

Buggle Lau Ka-fai, chief analyst at Midland Realty, told China Daily that a rise of between 0.25 percent and 0.5 percent in US interest rates should not have a drastic impact on the city's property market as local homes owners have already taken such an increase into consideration.

"However, if the US interest-rate hike is more than expected, coupled with consistent land supply increases by the Hong Kong government and a rise in unemployment as the city's economy deteriorates further, then property prices may fall by a larger extent," Lau warned.

oswald@chinadailyhk.com

(HK Edition 09/17/2015 page8)