Local fast food chains hint at modest price increase to cover climbing costs

Updated: 2015-06-24 07:56

By Celia Chen in Hong Kong(HK Edition)

|

|||||||

Two major Hong Kong-listed restaurant chains, Caf de Coral Holdings Ltd and Fairwood Holdings Ltd, posted widely different results while predicting modest increase in prices despite worsening business environment.

Caf de Coral Holdings said its net profit for the year ended March 31 increased 1 percent from a year earlier to HK$587.46 million on revenue of HK$ 7.36 billion, up 7.8 percent.

The performance of Caf de Coral on the mainland was lackluster and company said that its profitability in that market was under pressure from rising labor and rental costs. Segment result from the company's mainland operation dropped 28.55 percent to HK$83.17 million from a year ago on revenue of HK$1.23 billion, down 0.42 percent.

The company said that it had adjusted its shop-opening strategy on the mainland by slowing down the pace of expansion because of the worsening business environment and adverse market trend.

Mike Lim Hung-chun, chief financial officer of Caf de Coral, said his company would try to "exercise restrain" in raising food prices to cope with rising costs.

Caf de Coral's Hong Kong operations had outperformed market expectations, achieving a 10 percent increase in revenue to HK$6.1 billion for the 12 months ended March 31.

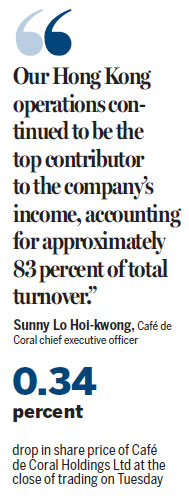

"Our Hong Kong operations continued to be the top contributor to the company's income, accounting for approximately 83 percent of total turnover," said Caf de Coral Chief Executive Officer Sunny Lo Hoi-kwong.

The other fast food chain, Fairwood, which competes directly with Caf de Coral, posted a 33.8-percent rise in net profit to HK$144 million with revenue rising more modestly by 10.2 percent to HK$2.2 billion for the year ended in March 31. During the period, its gross profit margin advanced by 1.3 percentage points to 14.9 percent.

In Hong Kong, Fairwood achieved an increase of same store sales of approximately 8 percent.

Meanwhile, on the mainland, the group recorded an operating loss despite improved turnover with same-store-sales growth of approximately 12 percent after closing several underperforming stores in northern mainland and peripheral cities in Guangdong, the company said.

Dennis Lo Hoi-yeung, Fairwood's executive chairman, said he expects the Chinese mainland operations will be profitable in this fiscal year.

Chan Chee-shing, Fairwood chief executive officer, said that the company could be forced to raise prices to cover rising rental and labor costs. But he said that any increase would be limited to less than 2 percent.

The share price of Caf de Coral Holdings Ltd closed 0.34 percent lower at HK$29.1, while Fairwood Holdings Ltd increased 6.25 percent to HK$23.8 on Tuesday.

celia@chinadailyhk.com

|

Performance of two major Hong Kong-listed restaurant chains - Caf de Coral and Fairwood - took a hit on the mainland in 2014 due to rising labor and rental costs. Caf de Coral's segment result from mainland operations dropped 28.55 percent to HK$83.17 million from a year ago, while Fairwood's mainland operations posted a loss in 2014, despite a 34-percent hike in overall net profit. Asia News Photo |

(HK Edition 06/24/2015 page6)