'Mainland IKEA' launches HK$6b share sale in SAR

Updated: 2015-06-17 08:54

By Agnes Lu in Hong Kong(HK Edition)

|

|||||||

Red Star Macalline Group Corp Ltd - the mainland's answer to Netherlands-based global furniture giant IKEA - launched its Hong Kong initial public offering (IPO) on Tuesday, seeking to raise HK$6.34 billion to be used mainly for market expansion.

As the largest home improvement and furnishings shopping mall operator on the mainland, the Shanghai-based company is offering 543.6 million H shares, equivalent to about 15 percent of its share base, and priced at between HK$11.18 and HK$13.28 apiece.

Assuming the final offer price to be HK$12.23 per share - the mid-point of the initial price range - the net proceeds are projected to hit HK$6.34 billion.

"With China's urbanization progress, as well as the backflow of migrant workers, there will be boundless business opportunities for the furniture industry," Red Star Macalline's Chairman and Chief Executive Officer Che Jianxing said, adding that the company has 25 shopping malls now under construction.

Red Star has secured $330 million in investment agreements with five cornerstone investors, including China National Building Material Co Ltd, Falcon Edge Global Master Fund LP, and Hong Kong Gree Electric Appliances Sales Ltd.

About 40 percent of the net proceeds will be used to finance nine of the new shopping malls in major mainland cities, including Wuhan, Tianjin and Nanjing, while 26 percent will be used for investment or acquisition of retailers and smaller competitors. The rest of the money will be for refinancing, developing its O2O (online to offline) business and company operations.

Trading in the new shares is due to begin on June 26.

Red Star had previously sought a listing in the mainland A-share market, but subsequently withdrew its application. The management said it values Hong Kong's capital market for its high transparency and internationalization.

"We've kept an open mind for us going international, and we're confident in our future earnings and profits," said Xi Shichang, the company's chief financial officer.

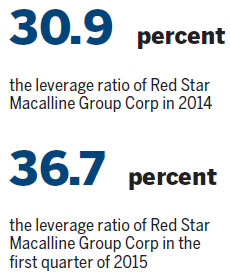

Given that Red Star recorded a net gearing ratio of 30.9 percent last year, compared with a ratio of 36.7 for the first three months of this year, Xi said the company still has abundant cash to cope with debt repayments.

Analysts said while the recovery of the mainland's property market might have a positive effect on the company's future performance, the selection of sites for its future shopping malls can be crucial.

"Its share prices on offer don't seem very attractive in the market if you compare them with mainland real-estate stocks. But it cannot be fully categorized into the property sector, and it has very limited peers in the H-share market," said Hanna Li Wai-han, a strategist at UOB Kay Hian (Hong Kong) Ltd.

The "Red Star Macalline" brand with its first branded shopping mall was launched in 2000. The company has since mushroomed into a network of 158 shopping malls with more than 18,000 product brands across 115 cities in 26 mainland provinces.

Last year, the company posted total revenue of 7.9 billion yuan and a net profit of 3.9 billion yuan - with 3.6 billion yuan net profit attributed to owners of the company.

During the same period, it had taken up 10.8 percent of the mainland's chain retail-mall market, 3.9 percent of the shopping mall market and 2.6 percent of the total retail market in terms of turnover.

agnes@chinadailyhk.com

|

Mainland furniture giant Red Star Macalline Group says about 40 percent of the funds raised through its Hong Kong listing will be used to finance nine of the new shopping malls in major mainland cities. Photo / IC |

(HK Edition 06/17/2015 page10)