Bankers see windfall in freer RMB

Updated: 2015-04-29 07:10

By Emma Dai in Hong Kong(HK Edition)

|

|||||||||

|

With more diversified renminbi-related services available on the market, renminbi-denominated assets have become popular among investors. Dennis Owen / Bloomberg |

|

The central government's signal to further open up its capital account and make the renminbi an International Monetary Fund basket currency has lifted bankers' confidence in the red back, experts said. Asia News Photo |

Major Hong Kong banks are looking forward to the central government's efforts to promote the renminbi (RMB) as an International Monetary Fund (IMF) basket currency, noting that such a move would further liberalize the capital account and broaden access to mainland assets.

"The central government had sent strong signals in March that it aims to make the renminbi convertible for capital account transactions. We believe this is aimed at facilitating its application to make yuan an IMF basket currency," said Zhang Zhiwei, chief China economist of Deutsche Bank AG in Hong Kong.

"This message is important to investors. It means the central government will likely take significant measures to open up its capital account this year," Zhang said. "The market may be surprised in the next few years by the rapid pace of renminbi internationalization and capital-account liberalization."

At a meeting with IMF Managing Director Christine Lagarde on March 23 this year, Premier Li Keqiang said he would like to see the RMB included in the IMF's Special Drawing Rights (SDR) basket.

Li said China will speed up "the basic convertibility of the yuan on the capital account" to meet SDR requirements.

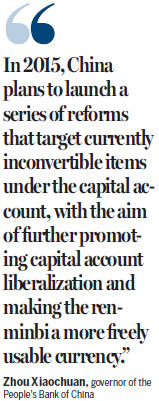

In a statement issued on April 18, Zhou Xiaochuan, governor of the People's Bank of China, reaffirmed the nation's commitment. "In 2015, China plans to launch a series of reforms that target currently inconvertible items under the capital account, with the aim of further promoting capital account liberalization and making the renminbi a more freely usable currency," he said.

Kelvin Lau, a senior economist at Standard Chartered Bank, said: "We believe the case for renminbi's inclusion is solid, especially if Beijing liberalizes its capital account further between now and November. Renminbi has come a long way since the last IMF review (in 2010)."

According to Standard Chartered, offshore usage of renminbi has expanded more than 21 times since 2010, making it the world's fifth most widely used payment currency as of January this year.

About 24 percent of the mainland's merchandise trade was settled in renminbi in February this year - up from an average of 11 percent in 2013 and 18 percent in 2014.

Zhou told the IMF that China will create channels for cross-border investments by individual investors, including the pilot Qualified Domestic Individual Investor program. The mainland would also introduce the Shenzhen-Hong Kong Stock Connect program, and non-residents will be allowed to issue financial products on the domestic markets with the exception of derivatives, he said.

Meanwhile, the Shanghai-Hong Kong Stock Connect program, launched in November last year, has been operating smoothly after a slow start. In the stock market rally earlier this month, the daily quotas for two-way investment flows were fully utilized on most trading days, prompting calls to raise the ceilings.

The central government will continue to facilitate overseas institutional investors' access to the mainland capital markets as well as the international use of the renminbi by removing unnecessary policy barriers, Zhou said.

However, the mainland is not seeking "the traditional concept of being fully or freely convertible", he added. Instead, it "will adopt a concept of managed convertibility".

"In a largely transformed manner, China will retain capital account management in cross-border financial transactions" to prevent abuse, Zhou said.

Economists have expressed concern that the liberalization of capital account controls could trigger a massive capital outflow from the mainland. But bankers in Hong Kong have opposite views.

Zhang of Deutsche Bank said he expects the proposed relaxation of foreign exchange controls to open the floodgate for an inflow of funds into the mainland.

"The current low foreign ownership (in onshore debt market) is due to the lack of market access rather than a lack of appetite. Inflows can be significant when access to the domestic bond market is widened," Zhang said.

He added that in the mainland's onshore bond market, the share of foreign investors is no more than 2.3 percent, compared with 6.8 percent in South Korea and 40 percent in the US.

"Renminbi-denominated assets have become a category too important to ignore," said Sally Wong Chi-ming, chief executive officer of the Hong Kong Investment Funds Association. Compared with dim sum bonds, the onshore debt market offering longer durations and higher liquidity has greater appeal to foreign investors, she said.

Qu Hongbin, Greater China chief economist of HSBS, said: "Capital account convertibility will go hand-in-hand with financial-market reforms, the pace of which is likely to be faster than expected."

emmadai@chinadailyhk.com

(HK Edition 04/29/2015 page9)