Blue Nile sees sparkles on the mainland

Updated: 2015-04-21 09:04

By Emma Dai in Hong Kong(HK Edition)

|

|||||||

US diamond-ring maker cashes in on growing affluent couples tying the knot

US online diamond-ring maker Blue Nile is exploring growth potential on the Chinese mainland - one of the world's largest diamond-jewelry markets - targeting burgeoning middle-class couples and their bulging wallets.

"We're really excited about the Chinese mainland. The engagement-ring market is already bigger than that of the US," said Jon Sainsbury, international president of Blue Nile Inc, a Nasdaq-listed online jewelry retailer featuring customized diamond rings. "On average, Chinese are not spending as much yet. But the day will come as the middle-class continues to grow. The market potential is huge," he said.

According to Sainsbury, up to 12 million people walk down the aisle on the mainland each year, creating annual demand for at least 2 million diamond rings. In the US, such a market has room for only about 1.5 million rings, and fewer couples have been getting married there every year since the 1960s.

Having set up its first mainland office in 2012, the Seattle-based company posted revenues of $30 million last year, making the country its largest market outside the US. While total sales grew by 5.2 percent to $473.5 million in 2014, sales on the mainland rose by 37 percent on-year during the same period. The world's second-largest economy is not just a performance driver for Blue Nile, but also a catalyst for the global diamond business.

The Shanghai Diamond Exchange - the mainland's sole international trading platform for the gem stone - imported $2.24 billion worth of polished diamonds, or 1.71 million karats, last year, representing 31.1-percent on-year growth.

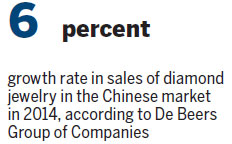

According to a report published by industry leader De Beers Group of Companies in March, sales of diamond jewelry in the Chinese market, including Hong Kong and Macao, grew by 6 percent last year to 62 billion yuan ($10 billion). The country, accounting for 16 percent of the global market share, remains the world's second-largest market for diamond jewelry.

Bridal diamond jewelry - wedding rings and engagement rings - is the second-biggest segment in China, making up 23 percent of total sales value and a fifth of pieces sold. While almost half of urban Chinese women identify fine jewelry as "the most coveted" luxury item, the penetration rate of diamond jewelry is still low even in top-tier mainland cities, De Beers reported. The peak years in the US and Japan saw about 80 percent couples getting married with diamond rings, whereas in China, the ratio was only 48 percent in 2012.

Although the country's economic growth is decelerating, the consumer base for diamond is likely to widen. McKinsey & Co predicts that, by 2020, "mainstream" consumers - well-off households with annual disposable income of between $16,000 and $34,000 - will make up 51 percent of Chinese urban households. Another 6 percent affluent households will have even more money to spend.

To lure the growing wealth among mainland customers, Sainsbury said it's vital for Blue Nile to offer an "unrivaled selection" and the best value for money.

"Customers are in control of their purchases. We're not trying to sell you what's off the shelf," he said. "There's nowhere else to find more than 200,000 diamonds with more than 200 settings in one store. Literally, we offer tens of millions of combinations of diamond rings. Our customer services people don't work on commissions. There is a 24-hour mandarin-speaking service to educate customers and help them decide."

According to Sainsbury, Blue Nile's offers are "typically 20 to 40 percent" cheaper than those of brick-and-mortar jewelers, thanks to the lower cost of doing business online.

Meanwhile, diamonds on the website are either certified by the Gemological Institute of America or the International Gemological Institute - two world-respected grading labs. "That helps with trust," Sainsbury said, adding the fact that Blue Nile, established in 1999, is the "original online diamond jeweler" also resonates with consumer confidence.

However, it requires some twists on the original model to cater to Chinese shoppers. "One of the things unique about China is the strength of its marketplace platforms. Our products are not on any third-party site in the US, but in China, we have to be there. It's as much about direct sales as about being aware of the brand," said Sainsbury.

Last fall, Blue Nile launched its flagship store at Tmall.com, one of the shopping websites of e-commerce giant Alibaba Group Holding Ltd. It participated in the Nov 11 Shopping Festival, which generated $5.8 billion sales revenue within 24 hours.

But customized service is still only available on Blue Nile's site. "This is probably the way that's going to stay because it's our secret sauce," Sainsbury said.

Besides, Blue Nile introduced Alipay, a popular third-party payment service on the mainland, on its official site in March, hoping it will smooth purchases. It also plans to match man's and woman's rings on its Chinese mainland site this year given that, in China, it usually takes a couple, instead of the man alone, to buy rings.

Sainsbury also pointed out that half of the consumer traffic on its site comes from mobile devices and, in China, the share is even higher. To further catch up with the trend, Blue Nile is to redesign its website in a way that the same contents can be presented elegantly on different screens.

"In both China and the US, customers are shopping across devices. They may start with mobile phones, use their tablets in the evening and shop from their PCs while at work. We want to ensure a consistent experience across all devices," he said.

emmadai@chinadailyhk.com

|

Online jewelry retailer Blue Nile introduced Alipay, a popular third-party online payment service on the mainland, on its official site in March, hoping it will smooth purchases in the mainland market. Parker Zheng / China Daily |

(HK Edition 04/21/2015 page9)