Property, stock indexes seen to hit new highs

Updated: 2015-04-21 09:04

By Agnes Lu in Hong Kong(HK Edition)

|

|||||||

The debate is still raging: Will the stock-market boom, which saw records tumble in the past few weeks, give property prices another big lift?

Interpretations may vary, but real-estate experts generally point to a positive relationship between the two sectors although they regard the housing sector as more of a laggard, with the stock market much susceptible to both internal and external influences.

The consensus, nevertheless, is a win-win situation for both markets.

"Under the latest wealth effect, it's very likely that both sectors will see new record highs simultaneously," reckoned Louis Chan Wing-kit, chief executive officer (residential) for Asia Pacific at Centaline Property Agency.

"Homes prices have been benefiting from the quantitative easing monetary policies in many countries, plus the housing shortage pushing up prices in Hong Kong as well. That's why we've been experiencing a prosperous property market in the past two years, led by small- to medium-sized homes," he said. "But, the stock market has, apparently, been underestimated."

Sammy Po Siu-ming, chief executive officer at Midland Realty's residential department, said he has seen homes buyers switching to larger apartments in the primary market recently.

"Basically, luxury homes costing more than HK$20 million are in demand, and buyers admit they've become bolder after making a fortune in the stock market," he said.

In his view, the real boom in real estate has yet to come. "It's just the beginning, and many are still investing in the stock market. We have to wait until the HSI has soared for a while and people start taking profits and pump them into the housing market."

Property developers are, seemingly, over the moon.

Justin Chiu Kwok-hung, executive director of CK Hutchison Holdings Ltd, said sales at the group's latest residential project Hemera at Tseung Kwan O have been impressive amid a booming stock market.

The project released its last batch of units for sale last Sunday, in which all 516 apartments were sold out in a day. A total of 1,648 apartments in the project were snapped up in two weeks.

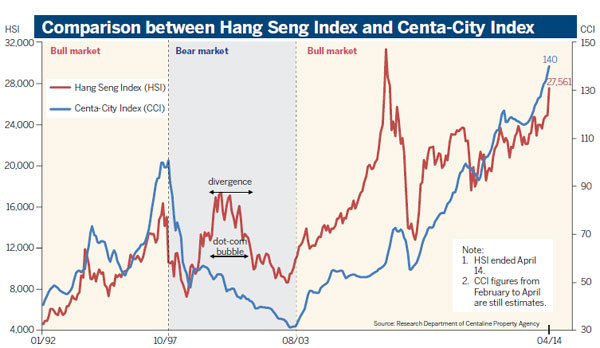

Data compiled by Centaline Property Agency show that the Centa-City Index (CCI) has been going hand-in-hand with the Hang Seng Index (HSI) for years, with only a few exceptions. The CCI is a monthly index based on all transaction records registered with the Land Registry to reflect property price movements in Hong Kong's four districts in previous months, with July 1997 used as the index base period.

Both the HSI and the CCI hit a record high in 1997 before the financial bubble burst, with the HSI reaching its peak in July that year and the CCI in October. Following the global financial tsunami, the HSI hit rock bottom in August 1998 and the CCI in October the same year.

However, the HSI soared again before 2000, while the CCI climbed for a brief period as the HSI kept rising. Both indexes hit another low in 2003 in the wake of the SARS epidemic.

The stock market saw another boom in October 2007. The CCI had been fluctuating since hitting a bottom in 2003, but it was not until five months after the HSI slump under the weight of the financial crisis that it started falling as well.

Both the CCI and HSI took a U-turn in December 2008 and February 2009, respectively, and have maintained a fluctuating but upward trend since.

Since 2012, the CCI's rise has been far more dramatic than the HSI, with the former shattering records almost every month after breaking through 120 points.

Centaline Property Agency expects the CCI to surpass the 140-point barrier this month - a 20-percent advance in 27 months.

agnes@chinadailyhk.com

(HK Edition 04/21/2015 page8)