Tonva sees strong profit growth

Updated: 2015-03-28 07:43

By Sophie He in Hong Kong(HK Edition)

|

|||||||

|

With nearly 80 percent of its revenue generated from petrochemical products trading, Shanghai Tonva will explore new areas in the bridge construction business, including road planting in urban construction projects, which are usually very profitable. Qilai Shen / Bloomberg |

Shanghai Tonva Petrochemical Co Ltd, a mainland petrochemical products trading firm, expects its revenue to rise significantly this year, but with a squeezed gross profit margin.

The company is in the process of acquiring a firm engaged in the trading of refined oil products, maritime bunkering, vessel holding and vessel chartering. The deal is due to be completed in the next three months, and would drive up Tonva's revenue, Chief Executive Officer Lorvin Mo told China Daily.

Tonva's business of trading in petrochemical products will also be boosted, adding the high profit margin business of vessel chartering to the company's portfolio, he said.

According to Shanghai Tonva's financial results for the year ended Dec 31, 2014, it recorded a turnover of 6.2 billion yuan ($998 million) - 5.6 percent more from a year ago. Nearly 80 percent of the revenue came from petrochemical products trading, with the gross profit margin from this sector reaching 3.3 percent - down from about 5 percent in 2013. The company's share price slumped 6.8 percent at the close of trading on Friday.

Tonva had to give up part of its gross profit margin in order to expand its business and retain customers, said Wang Liguo, the company's executive director and vice-president.

He said that, currently, the average gross profit margin in the commodity trading industry is about 2 percent, and Tonva plans to step up its petrochemical products trading operations by expanding its business to include natural gas trading. However, the company's overall profit margin may dip further in future.

"But, along with the expansion of our trading businesses, our net profit is expected to continue growing," said Wang.

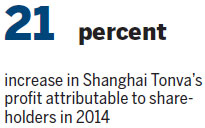

Last year, Tonva's profit attributable to shareholders stood at 168 million yuan - an increase of 21 percent over 2013.

Apart from trading in petrochemical products, Tonva is involved in road and bridge construction, which did well in 2014. During the year, the sector recorded revenue of 1.29 billion yuan - up 28 percent from a year ago, with a profit margin of 17.7 percent. Mo expressed optimism in its future infrastructure operations.

"We're seeing growing investment in interconnection construction and infrastructure construction, boosted by rapid urbanization, the Western Development Program as well as the 'One Belt, One Road' initiative," he said.

Tonva will explore new areas in the bridge construction business, including road planting in urban construction projects. Such projects are usually very profitable, he said, and the gross profit margin is normally between 20 and 30 percent. "We will also try to get the license to build subways."

Mo added that asphalt trading used to be the company's major business as the profit margin was about 10 percent, but its customers were having cash-flow problems and unable to make payments on time. Thus, Tonva decided to gradually withdraw from the business. "The profit margin in the asphalt business was good, but we had to withdraw as we couldn't get paid," he said.

sophiehe@chinadailyhk.com

(HK Edition 03/28/2015 page7)