Future assured for online insurers

Updated: 2015-03-13 06:32

By Luo Weiteng(HK Edition)

|

|||||||

E-commerce has come to the insurance sector, and the prospects are bright as mainland Web giants get in the game. Luo Weiteng gets the story.

The old-fashioned but lucrative insurance trade is attracting big names in mainland e-commerce, giants that seek to introduce new trading forms and entry points to the industry.

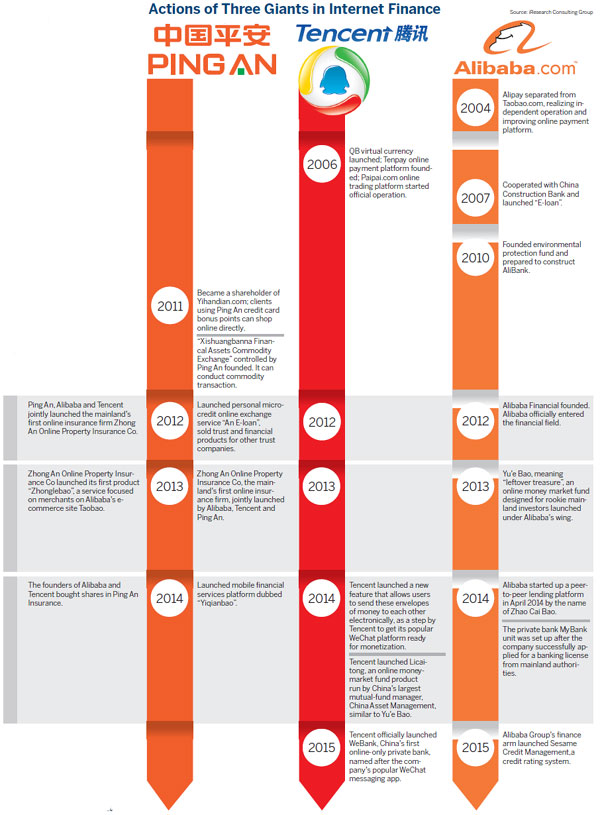

In December, the founders of mainland Internet giants Alibaba Group and Tencent Holdings bought shares in Ping An Insurance, the second-largest mainland insurer.

The move put Ping An in pole position to seize market share in the nation's fast-developing Internet finance sector.

The move marked the third instance of cooperation among the "Three Mas" - Alibaba founder Jack Ma Yun, Tencent's Pony Ma Huateng and Ma Mingzhe, chairman of Ping An.

Ping An, Alibaba and Tencent in October 2012 set up a new venture, named Zhong An Online Property Insurance. It is the mainland's first online insurance company and aims to tap the rapidly growing online sales sector.

According to the Insurance Association of China, online insurance sales involved a total of 62.2 billion yuan ($9.93 billion) in the first three quarters of 2014, at 195 percent higher posting nearly triple the full-year figures for 2013.

By the end of June last year, 50 life insurance companies had launched online sale businesses, three more than the 47 companies in the first quarter.

Taking on tradition

Andy Ng, Greater China Insurance leader at Ernst & Young in Hong Kong, believes online insurance - though an emerging business - will make a dent in the traditional property and casualty insurance sectors on the mainland.

The burgeoning mainland insurance industry, with 10 to 20 percent expected annual growth, could generate economies of scale for its online sales, said Ng.

Tencent's popular WeChat messaging platform is already able to provide third-party payment service, as well as wealth management product, credit card and money transfer services.

Ng pointed out it is a mere matter of time for insurance products to be bundled with WeChat.

"If that happens, explosive growth for online insurance business can be anticipated on the mainland," said Ng.

Given the large population, rising wealth levels and mainlanders' familiarity with trading on the Internet, it is no surprise that two of the leading mainland Internet moguls jumped on the chance to invest in the nation's second-biggest online insurer, said Dominicus Chim Che-kong, senior manager for client administration at BOCI-Prudential Trustee Ltd in Hong Kong. However, he does not expect online insurance to be a game changer for Hong Kong insurers since local customers still tend to trust human agents, preferably from among their friends or relatives, rather than buy policies in the virtual market.

The narrow local market makes it harder to achieve economies of scale with the insurance business going online, Ng at E&Y Insurance pointed out.

More importantly, the city does not boast Internet sensations like Alibaba and Tencent pushing the business and whose pioneering moves in Internet finance have created great opportunities for mainland insurers.

Baby steps on Internet

Clarence Wong, chief economist for Asia-Pacific at reinsurance company Swiss Re, said the idea of selling insurance policies via information technology is not new in the region even though the business is still in its initial phase of growth. Auto insurance and medical services are just two of the areas undergoing dramatic changes amid the online revolution, he noted.

Both life and non-life insurers will enjoy more scope for distribution through the Internet, said Wong, who predicts that online non-life insurance trading will eventually extend to home contents, travel and accident liability policies as well.

Auto insurance in particular, which has sparked interest among Internet companies and can be seen advertised everywhere in mainland cities, is expected to see a difference by trading online, said Terrence Wong, director of insurance at Fitch Ratings.

On Nov 11, the mainland online version of the Black Friday sales day in the US, Ping An hit a record daily sales volume of 3.7 billion yuan for its car insurance products, with more than 100 million yuan worth of insurance products sold within a few hours.

Terrence Wong noted that the development of online insurance business sets higher requirements for customers' understanding of the products, and thus such online business can only be expected to appeal to tech-savvy young customers.

On the supply side, simple products like short-term life insurance will be more suitable for reaching customers through the Internet, he suggested.

An insurance company's greatest strength lies in being equipped with an array of data about people's backgrounds, habits and interests, and that is exactly what technology firms could offer, added Clarence Wong.

From an insurance perspective, a huge data base can provide a much more accurate picture of the exposures, hazards and risks of the insured item or life.

The power of technology means major mainland insurers cannot wait to embrace a revolution driven by the booming Internet finance sector.

Privately owned Ping An, which controls separately listed Ping An Bank, has been actively trying to shift its business model toward Internet finance. Its affiliates include peer-to-peer lending platform lufax.com and online payment company 1qianbao.com.

"Internet finance is a must for traditional insurers. To some extent, it is something they feel compelled to do," said Ng. "If Ping An lags behind in this field, there will be no lack of competitors pursuing Internet finance more aggressively."

"To take the initiative in Internet finance and establish its own platform, Ping An wants to ensure it is taking a big share even as competitors get moving and fighting for the market," added Ng.

In fact, the importance of Internet finance is well-heeded by large insurers in emerging markets across the Asia Pacific and they are increasingly branching out region-wide, observed Terrence Wong.

But the number of deals the Internet platform has been able to generate so far is by no means enough.

"That is because it will really take time for the traditional insurance industry to redefine its business scope and models," said Terrence Wong. "Online and brick-and-mortar insurance businesses complement each other, and insurance agents will never completely disappear."

Contact the writer at sophia@chinadailyhk.com

(HK Edition 03/13/2015 page9)