HKBU student investors in hit winning ways

Updated: 2015-02-04 07:47

By Wiki Su(HK Edition)

|

|||||||||

|

Hong Kong Baptist University students are learning to be young informed investors with the skill to take on the stock market. Photo provided to China Daily |

Derek Cui Bofeng, 21, a junior at the Hong Kong Baptist University (HKBU), has just finished a job interview. Without changing out of his business suit, he turns to the school's study zone to do some revisions for class. Later, he will start preparing for a committee meeting where stock investment decisions will be made based on his analyses.

University students are often seen as inexperienced and worlds away from the hard realities of the equity market, due to the gap in information gathering. Yet Derek, along with peers at the Fund Management Committee (FMC) at HKBU, is breaking that stereotype in leading the charge of young informed investors with the skills to take on the stock market.

FMC operates under the Investment Club at HKBU, the first among the eight universities in Hong Kong to invest in the local equity market with real money.

Founded in 2006 with endowments from school alumni totaling HK$900,000, the Investment Club aims to provide opportunities for students to learn asset allocation and investment strategies by managing a real investment fund.

FMC members are in charge of managing a fund portfolio, and each year they will buy-in or sell certain stocks traded on the Hong Kong stock exchange, in order to make the fund generate tempting returns on a long-term timeframe.

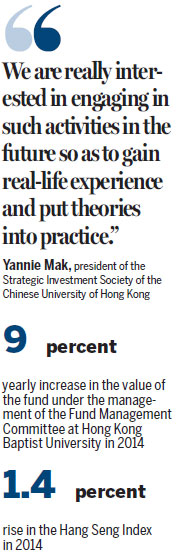

According to the FMC annual report, the fund size for the year 2014 grew to HK$1.2 million, representing an accumulated growth of 33.3 percent since its inception in 2006. The figure increased by 9 percent on a year-on-year basis as of the financial year ended Nov 28, 2014. The local market gauge, the Hang Seng Index (HSI), gained 1.3 percent in 2014.

Retail investors with comparatively smaller capital outlay have always lagged behind in terms of transaction time in the practical operation process.

At FMC for example, students work as a team and they will each present their view at weekly meetings on whether to buy-in or dump a specific stock in their fund portfolio.

The next morning, young fund managers will seek the approval of the professor-in-charge and submit the valid document to the school's financial secretary the following day. Not until the financial secretary hands over the filing to the stock broker is the transaction formally complete. That means it may take about a week to close a transaction.

This drawback partly forces the young team to focus on long-term dividend returns rather than short-term capital gains. FMC will retain each stock it buys for at least three months, and their expectations for the fund performance is evaluated on a "super long term", that is, on a 10-year basis, according to Derek.

Taking risk management into account, the FMC stock portfolio is mainly composed of blue chips.

Shares held include CLP Holdings Ltd, Hong Kong's largest electricity supplier, with its one-year return reaching 17.2 percent. By the end of the FMC financial year on Nov 28, share prices of CLP increased by 11.3 percent compared with the close on Jan 1, 2014.

Energy stocks cover 20 percent of the whole fund portfolio, the second largest proportion after cash, as seen in the annual report for 2014.

Returns from China Mobile Ltd reached almost 38 percent, with share price up by 8 percent, while the stock price of China Construction Bank Corp grew 7.9 percent.

In addition to these blue chips, also bought were the shares of Hong Kong-based logistics firm Kerry Logistics Network Ltd in December 2013 and Internet services center operator SUNeVision Holdings Ltd in September the same year, anticipating that these may see rapid growth.

"Investing with real money will push me to keep learning, and I will seriously regard myself as a future fund manager," said Derek, who has also come to realize how real investment is a completely different ball game from what he learned in the class. And all thanks to his participation in the FMC.

Classroom learning provides a solid foundation for students to navigate the real world of finance. However, there are many other skills that cannot be taught in class, and one of the best ways to acquire them without excessive financial suffering is through this real-money investment, said Alexander Fung, assistant professor at HKBU's Finance and Decision Sciences department, in an e-mail interview.

And as in class, mistakes are made as well. The FMC has seen its share of losses. In 2013, its fund holding slid by 1.2 percent to HK$1.1 million, even thought the HSI rose by 2.9 percent the same year. But just as Fung said, the first priority is education. Making money to sustain the program comes second.

He sees great value in such investment activity. He believes that by working as a team, students learn how to present their ideas in a convincing way and, more importantly, find out what a fund manager needs to know, which will give them an edge in finding a place in the world of finance.

HKBU is not the only university to think about stepping into the field of real-money investments.

Yannie Mak, president of the Strategic Investment Society of the Chinese University of Hong Kong, said: "At this stage, our society does not invest real money into the market due to various concerns. However, we are really interested in engaging in such activities in the future so as to gain real-life experience and put theories into practice."

Students are a minority in the investment market. Even though they can get information from public sources, company managers may still be unlikely to grant them interviews or firm visits to observe the reality of their operations. Students thus have less time and opportunity to mingle with finance professionals to understand what market expectations are, Fung said.

But no matter what kind of institution the individuals work in or what position they hold in the investment market, the success of an investment clearly requires street smarts, teamwork, emotional maturity and risk-management skills, in addition to book smarts.

For China Daily

(HK Edition 02/04/2015 page9)