Equity index futures next in stock link

Updated: 2015-01-22 04:51

By Celia Chen in Hong Kong(HK Edition)

|

|||||||

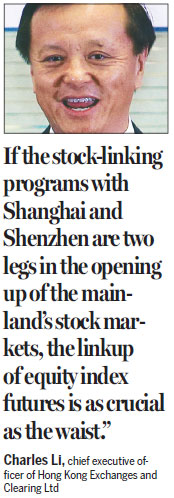

Equity index futures will be included in the Hong Kong-mainland stock cross-trading link in the coming months, according to Charles Li, chief executive officer of Hong Kong Exchanges and Clearing Ltd.

"Without equity index futures, the dual stock-linking program is imperfect," said Liao Qun, chief economist at China CITIC Bank International. "Equity index futures, as one kind of important equity derivatives, are expected to be connected in both markets first after their linkup as they are essential parts in improving the dual stock connecting program," he said.

Equity index futures - a futures contract on stocks - are expected to help investors hedge their risks and invigorate trading activities in both markets. "It would be a helpful tool for smoothing the transition to greater A-share inclusion within global market indices, such as the Morgan Stanley Capital International Emerging Market Index," Li said.

To put it simply, equity index futures could be incorporated into the program through two ways - via cross-border licensing of index benchmarks or through the more comprehensive method of allowing cross-border trading.

"If the stock-linking programs with Shanghai and Shenzhen are two legs in the opening up of the mainland's stock markets, the linkup of equity index futures is as crucial as the waist," Li stressed.

Besides equity index futures, the linkup of commodities markets is addressing urgent needs. Notwithstanding the fact that the mainland is today the largest consumer and producer across a number of commodity classes, it is frustrated that it still feels like a "price taker" rather than a "price setter". Experts view that if the mainland truly intends to secure its rightful place in influencing international commodity prices, it will need to take bold action and allow its capital and products to go international and exercise its influence in global markets.

"Commodities futures will be an important tool in helping investors to hedge risks in both markets. But the risks of investing in the Shanghai-Hong Kong stock link program are comparably low as the current turnover on the stock connect is not high," said Liao. "Expanding the turnover should be the priority now."

Nevertheless, Huang Hongyuan, chief executive of the Shanghai Stock Exchange said he expects the daily turnover in southbound trading via the program to increase with mainland retail investors getting more familiar with Hong Kong's stock trading systems.

celia@chinadailyhk.com

(HK Edition 01/22/2015 page8)