Graying population lifts medtech market

Updated: 2014-12-31 09:48

By Huang ying(HK Edition)

|

|||||||

China's medical equipment industry is to enter rapid development in the next five to 10 years, boosted by a rapidly aging population, the government's supportive policies and improvement in manufacturing capability, according to Cai Tianzhi, deputy secretary-general of the China Chamber of Commerce for Import and Export of Medicines and Health Products.

"With the country's improved manufacturing capability, our medical equipment could compete with those produced by multinational corporations in terms of quality, and the comparatively lower cost would still make China a dominant source for importing medical devices among a variety of developed countries," said Cai.

China's medtech market is expected to grow rapidly in the years ahead, becoming the second-largest global market for such products by 2020, a report by Boston Consulting Group showed.

The Economist Intelligence Unit of the London-based Economist Group projects that, by 2016, China's population will reach 1.4 billion - the largest in the world and slightly larger than India's. But the population aged 65 and above is expected to take up a larger proportion, rising from 8.4 percent in 2011 to 9.7 percent in 2016.

The aging population will generate higher demand for healthcare services since senior groups have weaker immune systems, resulting in a higher incidence of illnesses. Currently, the senior population makes up 23 to 40 percent of the prescription drug market and 40 to 50 percent of the OTC (over-the-counter) drug market, according to a report by leading international accounting firm Deloitte.

The Chinese government is increasing its spending on healthcare, including significant investments in public hospitals so as to increase the capacity of the overall system. In addition, healthcare reform has made it possible for all citizens to have access to basic healthcare through public insurance.

The government's per capita cost of medical insurance has seen a hike in the past few years - rising from 20 yuan in 2003 to 280 yuan last year - and is expected to reach 360 yuan in 2015.

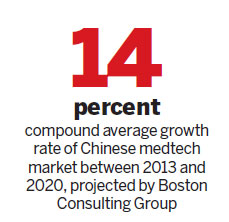

Boston Consulting Group projects that the percentage of total spending on healthcare covered by the government will expand from 30 percent in 2012 to 40 percent by 2020. It also predicts that the Chinese medtech market will enjoy a compound average growth rate of 14 percent between 2013 and 2020, expanding from $22 billion in annual revenues to $55 billion.

Meanwhile, mergers and acquisitions (M&A) in the medical device segment have been active in 2014. In June, Legend Holdings Ltd, the major shareholder of Lenovo Group Ltd - the world's largest personal-computer maker - invested about 1 billion yuan ($161.2 million) into Beijing-based Bybo Dental Group, through which it entered China's healthcare market. Before the deal, Legend had been focusing on information technology, real estate and investment.

In September, funds managed by global asset management firm Blackstone Group purchased a stake in Suzhou Xinrong Best Medical Instrument Co Ltd, a Chinese medical device maker, without disclosing the financial details. Sources close to the deal revealed that the investment was more than $100 million.

Based in Jiangsu province, southeast China, Suzhou Xinrong Best Medical Instrument Co Ltd is one of the country's leading orthopedic implants manufacturers with established distribution networks nationwide.

According to Boston Consulting Group, China's orthopedic implant market will grow from $1.3 billion in 2013 to $4.1 billion by 2020 with a compound average growth rate of 18 percent, driven by an aging population, growing prevalence of diseases, improved treatment rate and rising affordability.

Globally, M&A deals in the medical equipment sector this year have been explosive. Statistics from MassDevice.com showed that the total of 57 deals concluded this year have generated an estimated $86.4 billion - an increase of 504 percent compared with last year's $14.3 billion.

Among the deals, one gigantic purchase accounted for almost half of the total. In June, US medical device maker Medtronic Inc purchased Dublin-based rival Covidien Plc for $43 billion.

Speaking of the challenges facing Chinese medical device makers, Cai said that in the premium and medium market, multinational corporations purchased potential Chinese counterparts to soften rivalry in the Chinese market, while in the medium and low-end market, international competitors resort to price wars to squeeze the living space of Chinese companies.

"Since there still exists quite a certain gap between China and other emerging economies in manufacturing capability, Chinese enterprises should grab the chance to transform or upgrade its business model to deal with the challenges in the future," he said.

huangying@chinadaily.com.cn

|

Analysts warn that Chinese medtech companies in the medium and low-end market may face fierce price competition from international players. Asia News Photo |

(HK Edition 12/31/2014 page11)