Bitcoin: Sink or swim?

Updated: 2014-12-04 07:05

By Deng Yanzi in Hong Kong(HK Edition)

|

|||||||||

Editor's note: We continue with our innovation series this week on exciting pioneering firms in the Pearl River Delta region, with the launch of BitMEX, a derivatives trading platform dedicated to users of the virtual currency, bitcoin.

Bitcoin has been on a rollercoaster ride since 2013. While the extreme volatility of the digital currency may make many flinch, some bitcoin holders seek ways to hedge the risk,while speculators seek an opportunity to profit from the seesawing value.

A newly launched derivatives exchange platform, Bitcoin Mercantile Exchange (BitMEX), aims to meet both those needs.

Arthur Hayes, co-founder and chief executive officer of BitMEX, says he modeled the platform on existing derivatives exchanges for fiat currency.

Traders can deposit bitcoin from their wallet into their BitMEX account, and use them as margin to buy and sell futures contracts, with 0.005 percent trading fee on a completed transaction.

BitMEX won the Hong Kong leg of the Slush startup pitching competition in October, advancing to the main Slush event in Helsinki, Finland, last month. However, it failed to win a place in the Nov 18-19 worldwide contest.

According to Hayes, the present fee pool for bitcoin derivatives is $120 million a year. He expects the market to grow to half a billion US dollars in the next five to seven years, and even bigger when bitcoin becomes globally recognized and gains higher worth.

The value of bitcoin has been extremely volatile, starting at less than 0.1 US cent and skyrocketing in 2013, peaking at approximately $1,240 that November before falling precipitously. The current value of bitcoin hovers around $360, a plunge of more than 60 percent since the start of the year.

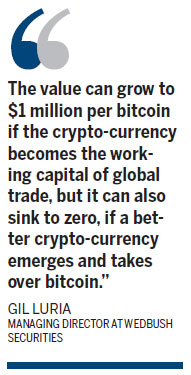

Gil Luria, managing director of Los Angeles-headquartered investment firm Wedbush Securities, sees a growing need for a derivatives market in the bitcoin space. "A vital part of any liquid market is a complementary derivatives market that helps participants hedge their exposure or take leveraged bets on the movement of the underlying asset," he said.

A few derivatives exchanges have emerged in the bitcoin space, with some of the major players being BitVC, 796, BTC.sx and ICBIT.

"It is still a very nascent market," Hayes points out.

Mainland-based BitVC recently sparked outrage among clients as it took 46.1 percent of winners' profits, worth more than $1 million, to cover a "system loss" on Nov 14 - in an act of "socializing losses" commonly adopted by derivatives exchanges.

BitMEX offers a different approach, by taking on the counterparty risk. By standing between buyers and sellers and centrally clearing the exchanges, BitMEX promises to make sure winners are paid out as promised instead of charging them for the bankruptcy of other traders.

Derivatives have been functioning in the traditional economy as financial tools. Jon Matonis, director of Bitcoin Foundation, told bitcoin news site CoinDesk that the emergence of advanced financial services such as futures derivatives is a sign of maturation of the market for the virtual currency.

Created in 2009 by the pseudonymous Satoshi Nakamoto, bitcoin is a crypto-currency backed by mathematics. Without any control or backing from any central bank or government, bitcoin is a decentralized payment system entirely powered by its users.

Use of bitcoin grew gradually after its invention, yet in its early stages, it was largely restricted to the dark corners of the Internet, usually associated with illegal drugs trade and other illicit activities.

The crypto-currency gained growing attention and acceptance when the high-profile American rowers and web entrepreneurs, the Winklevoss twins, as well as other Silicon Valley investors, started to show interest in bitcoin from mid-2013. In November that year, the US lent legitimacy to bitcoin in a Senate hearing, sparking a hype surrounding the currency.

As of now, more than 63,000 businesses worldwide already accept bitcoin, including such big names as PayPal, Dell and Expedia, according to CoinDesk.

Bitcoin investment and trading activity is "one of the first major applications of crypto-currency" that helps "create the payment network infrastructure and monetary base that will facilitate increased economic activity in the future", said Luria and his colleague Aaron Turner in a bitcoin research paper published in August.

Hayes, 28, began his career as an equity derivatives trader in Hong Kong after his graduation from the Wharton School of Business in 2008. After a layoff from Citigroup in May 2013, Hayes devoted himself to full-time bitcoin trading after learning about the currency last year when he read Nakamoto's white paper on the virtual currency.

But the existing derivatives exchange platforms failed to impress the former banker, and Hayes decided to build "something better and more professional" for traders with "a need for serious derivatives products".

Hayes approached his two co-founders, Samuel Reed and a secret third partner, with coding experience for a solution, and started building BitMEX in January. The platform officially went live on Nov 24.

Luria believes the major challenge for a new derivatives platform is to "create enough liquidity" to attract traders, which was also top of Hayes' task list in the final stages before the launch.

BitMEX sought partnership with an anchor market maker to ensure a liquid exchange, and eventually traded over 75,000 contracts with nearly 1,000 bitcoin in customer deposits in the first 36 hours since its launch.

"The value of the bitcoin currency is particularly hard to predict considering it is unlike any financial instrument ever created," Luria says.

As for bitcoin's value in the future, Luria presents two extreme scenarios. The value can grow to $1 million per bitcoin if the crypto-currency becomes the working capital of global trade, but it can also sink to zero, if a better crypto-currency emerges and takes over bitcoin, Luria says.

The volatility is unlikely to dissipate in the short term, as Luria and Turner said in their report, but traders value volatility.

As derivatives exchanges like BitMEX mature, more speculators will join the fray and more sophisticated financial tools may emerge in the bitcoin space, the pair envisage.

Not all believers, however, are intrigued by the idea of exploiting bitcoin's price volatility. "I am more interested in bitcoin use than it being a speculative instrument," said Yong Ming Kow, an active bitcoin user and researcher at the City University of Hong Kong.

Besides price volatility, the big picture for bitcoin, according to Kow, is even more difficult to predict "because we are not just dealing with changing social prejudice and norms. Bitcoin also presents money transmission risks in the eyes of the legislators".

iris@chinadailyhk.com

(HK Edition 12/04/2014 page9)