PMI indicates business climate still clouded

Updated: 2014-12-04 07:05

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

Market worsened due to ongoing protests, reduced mainland orders

Hong Kong business owners were hit in November by subdued market conditions and a sharp decline in new business from the mainland, the HSBC Hong Kong Purchasing Managers Index (PMI) showed.

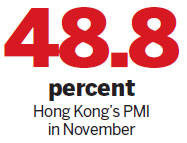

The city's HSBC PMI, at 48.8 in November, showed some improvement from October, but the rate of market deterioration had remained one of the strongest seen in the past three years.

The PMI is a composite index designed to indicate changes in business conditions in Hong Kong's private sector economy through 12 sub-indexes.

Both the Output Index and the New Orders Index declined, with the Output Index falling for the second successive month. Many companies surveyed said the prolonged political protests have soured the business environment, forcing them to reduce output.

The data also showed weakening mainland demand which fell at the fastest rate since March 2009.

Purchasing activity fell for the fifth straight month in November because of a reduction in new orders. Intensifying competition had forced many Hong Kong companies to drastically cut prices to stay in business. The Prices Charged Index exhibited the strongest discounting rate since June 2009.

"Hong Kong's economy is still weakening although the pace of contraction lessened in November," said John Zhu, an economist at HSBC in Asia.

"However, there's increasing evidence that corporate margins are being squeezed due to reduced pricing power. Given the weakness in demand from the mainland, the growth prospects have remained on the downside," Zhu cautioned.

After trimming Hong Kong's economic growth in 2014 from 3 percent to 2.2 percent, the Hong Kong government on Monday warned of new downside risks.

Financial Secretary John Tsang Chun-wah said on Monday: "The business sentiment of local small- and medium-sized enterprises (SMEs) has turned gloomy and the government will launch appropriate measures to help local SMEs in the next fiscal year's budget."

ANZ Bank, in its economic report, said the prolonged protests may further dampen business and consumer sentiment.

A slowdown in job creation, an upcoming US interest-rate hike and the impact of the ongoing demonstrations on tourism and retail will combine to hurt the city's economy next year, warned Tang Man-keung, senior China economist at Goldman Sachs.

But he maintained his forecast of a 3-percent growth in 2015. "The liberalization of the mainland's capital account will benefit Hong Kong's financial sector," Tang said.

oswald@chinadailyhk.com

(HK Edition 12/04/2014 page8)