Northbound shares quota snapped up in three hours

Updated: 2014-11-18 05:32

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||||

The 13-billion-yuan daily quota allowed for purchasing Shanghai-listed A-shares under the Shanghai-Hong Kong Stock Connect program may seem big by any standard.

But the entire amount was snapped up within three hours after the opening bell, mostly by institutional investors eager to snap up many of the A-shares that were considered undervalued.

In contrast, Shanghai investors' appetite for Hong Kong shares was much more restrained. Only 17 percent of the 10.5-billion-yuan quota was utilized at the end of the day.

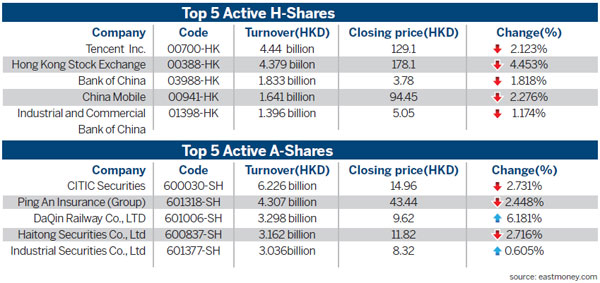

The lukewarm response from Shanghai to the "through train" cross-trading scheme appeared to have caused considerable disappointment in Hong Kong. The benchmark Hang Seng index slipped 1.21 percent to close at 23,797 with a lackluster market turnover of just HK$83 billion ($10.71 billion).

"The financial strength of mainland institutional investors is much less than their international counterparts and this explains why the utilization of the daily quota to buy H-shares was low," Credit Sussie managing director Vincent Chan said.

Core Pacific-Yamaichi 's head of research Castor Pang told China Daily said: "The Stock Connect can allow overseas investors much easier access to the mainland share market than the existing Qualified Foreign Institutional Investor program, so this explains the positive response of overseas investors." Mainland retail investors, on the other hand, are not familiar with Hong Kong shares and they preferred to stay on the sidelines on the first trading day, Pang explained.

"Mainland investors' interest in buying H-shares may grow in time," he said. But their interest is expected to focus mainly on small-cap stocks for speculative purposes, he added.

"The mainland A-share market is one of the attractive equity markets in the world because of its low valuation, with a forecast price-to-earnings ratio of nine times in 2015," Kingston Securities research director Dickie Wong told China Daily. "This explains why interested overseas investors are eager to acquire A-shares through the Stock Connect." "We cannot ascertain the effectiveness of the Stock Connect just by the first day's trading. We believe mainland investors are interested in Hong Kong-listed shares," said Chow Chak-tze, personal banking and product management's deputy general manager at Bank of China (Hong Kong).

"We think northbound flows will likely be more active because of pent-up northbound demand from investors already active in the A-share market, and many mainland high-net-worth individual investors may already own significant offshore holdings," UBS Wealth Management chief investment officer Patrick Ho said.

oswald@chinadailyhk.com

(HK Edition 11/18/2014 page8)