Shenzhen loses out in retail property sector

Updated: 2014-10-24 08:03

By Chai Hua in Shenzhen(HK Edition)

|

|||||||

Shenzhen has failed to perform well in retail property investment among key mainland cities, having lost much of the lure to neighboring Hong Kong, according to a report by CBRE - a leading commercial property management and investment consultancy.

The special economic zone (SEZ) is the only first-tier city on the mainland that failed to make it to the top four rankings, finishing sixth, in an analysis of retail property investment opportunities in 17 major cities.

Analysts found Shenzhen a surprise underperformer in that sector although its residents had the highest average disposable income of 44,653 yuan ($7,289) last year among top-tier mainland cities, according to the Shenzhen Municipal Statistics Bureau. The findings mean that although the consumption power of Shenzhen residents is among the highest in the country, a huge proportion of the city's consumer spending, especially in the high-end sector, has gone to Hong Kong.

"Hong Kong remains an attractive shopping location for Shenzhen residents as it offers a wide variety of goods and services, and better quality goods at cheaper prices," explained Chen Zhongwei, executive director of CBRE's research center.

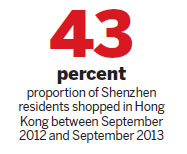

According to the Shenzhen General Chamber of Commerce, more than 43 percent of Shenzhen residents shopped in Hong Kong between September 2012 and September last year - a significant jump on the previous corresponding period when only 24 percent of Shenzhen's population went to the SAR to do their shopping. During the same period, Shenzhen's per capita spending reached 11,567 yuan - nearly double the figure recorded for 2012.

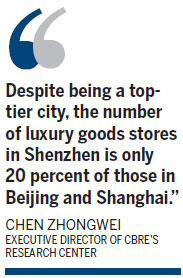

"In the luxury goods sector, the advantages of product variety and pricing in Hong Kong are even more significant," Chen said. "Despite being a top-tier city, the number of luxury goods stores in Shenzhen is only 20 percent of those in Beijing and Shanghai," he added.

Beijing, for instance, has six Louis Vuitton stores compared with four in Shanghai, while Shenzhen has opened only one such store since 2009.

Besides, Shenzhen's retail rental growth is limited due to abundant new supply of retail space. At present, the SEZ has the second-highest amount of retail space per capita among prime mainland cities - more than twice the volume of retail space per capita in Shanghai or Hangzhou.

CBRE predicts that about two million square meters of new retail space will come on line in Shenzhen in the next three years, making it even more difficult for the city's shopping center landlords to secure tenants.

Investor structure is also one of the major reasons for analysts' bearish outlook for Shenzhen's retail-property sector. "Individual investors are active in the retail-property market, and most transactions in the city have been strata-title transactions, limiting opportunities for en-bloc investments as a result," Chen said.

The CBRE report identified Shanghai, Beijing and Wuhan as the top three office investment destinations on the mainland, but suggested that investors must exercise caution when seeking opportunities in second-tier cities, such as Tianjin, Ningbo and Qingdao.

grace@chinadailyhk.com

|

Causeway Bay - one of Hong Kong's busiest shopping centers. The SAR's retail business still outperforms Shenzhen in product variety and pricing. Moreover, Shenzhen's soaring property prices have made the city a less favorable destination for high-end retailers. Provided to China Daily |

(HK Edition 10/24/2014 page8)