US money manager upbeat over A-shares

Updated: 2014-10-16 08:04

By Luo Weiteng in Hong Kong(HK Edition)

|

|||||||

Analysts dial up expectations as launch of the 'through train' nears

Global investment firm BlackRock said it expects the A-share market to be helped by economic reform and the rollout of the Shanghai-Hong Kong Stock Connect scheme.

New York-based BlackRock is one of the world's biggest money managers, with $4.3 trillion under its management.

In its Emerging Markets Outlook report released on Wednesday, BlackRock overweight China, citing that countries with current account surpluses should generally benefit from a pick-up in exports with a stronger US economy.

Despite recent economic data pointing to slowing growth, Helen Zhu, head of China equities at BlackRock, said she believed policy makers have enough tools at hand to keep growth at a healthy clip.

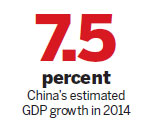

As Premier Li Keqiang told the seventh China-Germany Economic and Technical Cooperation Forum in Berlin on Oct 11, China has conditions and capabilities to achieve the goal of economic growth of about 7.5 percent this year and keep it within a reasonable range.

"The upcoming fourth plenum session and APEC summit will provide an opportunity to see if the mainland is on track with reforms and international goals," noted Zhu. "Investors will be watching for updates on deregulation, improved social safety nets and fiscal reforms."

Zhu said the reform bodes particularly well for the energy and telecommunication sectors as state energy companies are forced to adopt market pricing and target their capital expenditures more effectively. Likewise, telecommunications companies are reducing their subsidies, resulting in greater profit potential in the future.

"We do not foresee the possibility of a hard landing of mainland's economy in 2014," she added.

Meanwhile, Zhu felt optimistic about the mid- and long-term prospects of the Shanghai-Hong Kong "through train" program which is expected to benefit investors in both cities.

"Comparatively, the A-share market could benefit more from the cross-border stock trading, given that investors have long been bound hand and foot in the mainland equities market," observed Zhu.

"We definitely think the Shanghai-Hong Kong Stock Connect will increase investments in Hong Kong, and will probably help investments on the mainland," said Frdric Lamotte, global head of markets and investment solutions at Crdit Agricole (Suisse) SA.

"However, with so many uncertainties looming ahead, we could hardly measure the impact it may have on the mainland," he added.

The recent weak performance of the Hong Kong stock market should be viewed in the context of global macro-economic data failing to meet expectations, Zhu said, adding that both the US and European stock markets are performing poorly while the mainland stock market is doing better than before.

In its report, BlackRock gave an underweight rating to Hong Kong, as the city's economy is highly sensitive to any rise in US interest rates.

However, Lamotte said concerns about the expected surge in US interest rates are overdone. Since Japan and China have committed to keeping their interest rates at low levels, and Europe is moving toward quantitative easing, the US is unlikely to raise its rates too high to risk an appreciation of the dollar.

As predicted by Lamotte, the US Federal Reserve is not expected to raise rates anytime soon. "We're still buying equities in the global markets, including Hong Kong," he said.

Gladdy Chu in Hong Kong contributed to this story.

sophia@chinadailyhk.com

(HK Edition 10/16/2014 page8)