Clamor for 'green gold'

Updated: 2014-10-07 10:17

By Luo Weiteng(HK Edition)

|

|||||||||

Jade is long revered by Asians as a symbol of good luck, good health and vested with the power to resist evil spirits. As sourcing rough stones or jadeite from Myanmar becomes challenging, and jade prices continue to rise, gemstone dealers hoard the stock, hoping to make a killing when prices stabilize. Luo Weiteng reports

Law Chi-kwong, president of the Hong Kong Jade Association (HKJA), wound up his trip to this year's Myanmar gemstone emporium with a few light bags - packed with a handful of rough jade stones costing a total of HK$2 million ($258,000) - a lot cheaper than the price he paid for similar stones in previous years.

"At an emporium teeming with products that come with pseudo-high prices, it's quite hard to get high quality jadeites at reasonable prices. After all, given my price range, I don't have a large pool (of stones) to choose from," said Law, without regretting too much that he had either disposed of some precious jade too early or too easily. "Top-quality ones can hardly be spotted at the emporium."

Every year, in March, June and November, the Myanmar government opens its doors to the world for auctioning its rough jade stones, dubbed "green gold" by some. Thousands of jade merchants flock to the Myanmar event to buy rough Burmese jade and export them for manufacturing. But this year, the national emporium was held only once in late June in Myanmar's capital, Naypyidaw - the Mecca for jade dealers, collectors and speculators.

Apart from Myanmar, jade dealers are left with little choice. Russia and Ukraine, albeit abounding in jadeite, mainly produce medium-and-low-grade jade, while Guatemala, another rare supplier of top-grade jade, is unable to produce on a large scale.

Myanmar's gemstone emporium is a very significant mega event of the jade industry to showcase its gemstones, as about 90 percent of the world's jade supply, as well as the best, are mined in the country.

Of the raw jade stones imported by China annually, 90 percent is from Myanmar, including 80 percent of which is sourced via the emporium, said Zheng Ziyu, executive director of Baohezhai, a jade company in Yunnan province, which borders Myanmar.

For thousands of years, no gem in China has been given the same status and honor as jade, the gemstone which is at the heart of Chinese culture and mythical lore. The valuable green stone is said to bring good luck and protection from misfortune.

Jade has been used to make imperial seals in ancient times, carved into ornaments in the shape of gods or mythical wild animals to protect the wearer from misfortune. More recently, it was embedded into the gold medals for the Beijing Olympic Games in 2008.

Fears of shortage

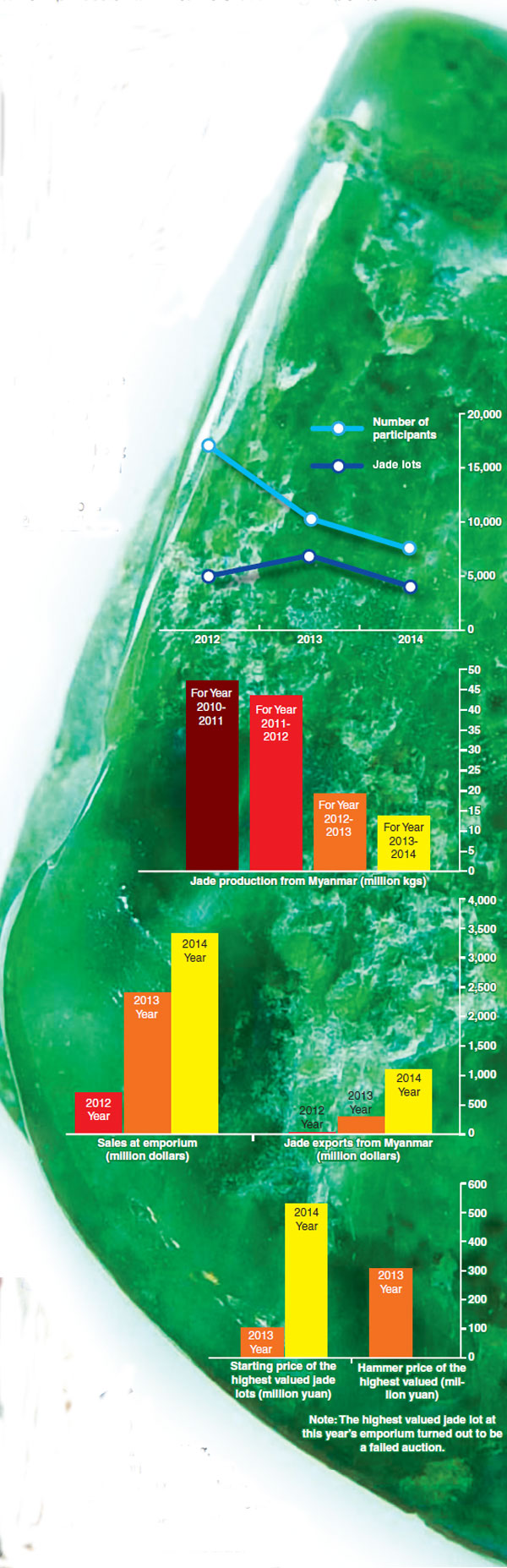

Zheng told China Daily the raw jade's soaring prices is largely fueled by fears over a shortage of Burmese jade or the possible introduction of hungry marketing measures by Myanmar's reformist government that would limit jade exports and force jade-processing to take place in the country. "The number of raw jade stones for auction at last year's emporium was over 10,000, but there were merely 7,500 pieces this year with brokers from dozens of countries scrambling for them," Zheng said.

In contrast, the turnover of this year's emporium was as high as 23 billion yuan ($3.74 billion) - 3 billion yuan more than last year's turnover - according to Zheng. "It is no exaggeration to say flour is much more precious than bread at this emporium. For instance, a piece of raw jade, whose base price was 90,000 euros ($120,277), was auctioned off at 9.29 million euros, costing 13.37 million euros in total, inclusive of taxes. And the star gem of the bidding, a raw jade stone with a base price as high as 528 million yuan did not find a buyer," said Zheng. "Only 50 percent of winning bidders took delivery of their goods at the 2013 emporium, showing that bidders, who were not satisfied with the pricing, broke off the contract by giving up their cash deposit of 50,000 euros for admission rather than complete the deal grudgingly."

"Normally, a 20 to 30 percent premium on the original prices is common place (for a piece of jade) at the annual emporium. For me, hammer prices which are two or three times more than base prices are quite acceptable," said Law. "But what makes this year so abnormal is prices were hiked up to 10 times or even hundreds of times higher than base prices."

Some people hiked the prices through their bidding without any intention of buying, thus leaving the bulk of rough jade stones with hefty price tags minus buyers. Most of these "hostile bidders" have already been blacklisted in Myanmar's gemstone emporium, but somehow, some still managed to show up at Myanmar's less-regulated emporium this year, said Law.

But Law doesn't think the staggering price hikes will burst the jade market bubble. "Unlike the property market and stock market where bubble prices have no difficulty in finding irrational investors, the real jade market buyers are largely prudent merchants who know the ropes and will not buy impulsively."

For merchants like Law, the general response to the pseudo prices is to simply reduce their purchases. As a regular gemstone fair participant during the past decades, he feels it was much quieter this year than in 2012 and 2013, with high prices putting dealers off.

"The rising cost of jade is somewhat making the trade far less profitable. Thanks to its tax-free policy, Hong Kong jade dealers may feel less burdened, unlike their mainland counterparts, who are subjected to three types of taxations -3 to 3.9 percent for tariff, 10 percent for sales tax and 17 percent for value added tax - and they are more likely to suffer a lot," said Law. "But in general, no matter in Hong Kong or on the mainland, the industry is facing a tussle with merchants who cannot afford to buy the stones being knocked out of the game."

Yet, Law observed, brokers who left the fair empty-handed still had access to buying the raw jade, particularly the untaxed jade that was smuggled across the country's border into China through unregulated trade every year.

"At present, there is no shortage of raw jade and finished products in the market. Many merchants also have their stocks as the market needs time to absorb them," said Ngan Wai-ming, chairman of Wai Lun International Ltd - a jewelry company located in Harbor City, not wishing to overemphasize the influence of the skyrocketing prices of Burmese jade over Hong Kong's jade industry.

"At this year's emporium, it was common to see people offering roughly HK$30 million or even HK$50 million for a piece of raw jade worth no more than HK$10 million. You have to admit the market bubble does exist to some degree," Ngan said, adding that the hammer prices at Myanmar's emporium could hardly be accepted by the industry.

"Generally speaking, the soaring prices are a real blessing for our holders of raw jade. Since the prices are bound to soar in the near future, we believe we can keep benefiting," said Tang Kam-hung, chairman of Kam Wing Cheong Jewelry Ltd, located along the famous Jade Street strip on Canton Road, where many wholesalers sell finished jade items as well as raw jade.

He is not too worried about the big drop in consumer numbers due to the prohibitive prices tags.

"Unlike diamonds or gold, every piece of jade is unique in its color distribution and translucency, making them almost unlikely to be measured in money terms," he said, brimming with confidence. "Moreover, ordinary consumers usually don't know exactly how much a piece of jade is really worth. Therefore, more often than not, the price hikes will not be vividly felt among them. Even if they know the prices are going up, their penchant for jade can hardly be lost. After all, the vast majority of Chinese could never resist the charm of jade."

His only concern, if any, is that the supply of quality raw jade from Myanmar is dwindling or even disappearing as the country plans to process and sell its own jade products. "Nowadays, finding top-end raw jade in the market is becoming increasingly difficult since most traders are too reluctant to sell them," Tang added, saying it's common not to find any stones all year long.

Tang says the demand for high-quality jade jewelry, which is somewhat immune to price fluctuations, remains strong, making some people believe the market situation could improve. However, for HKJA members, most of whom operate on Jade Street, there is nothing much to do.

Jade quality down

Law noted Jade Street customers are usually not the ones willing to blow big bucks on jade. High-end business has mainly gone to best-known chain retailers like Chow Sang Sang, Chow Tai Fook and Tse Sui Luen. "The declining jade quality and fluctuating prices make well-heeled consumers more willing to believe popular brand-name jewelers guarantee good quality and reasonable prices, even though the bulk of their jade items may actually be bought wholesale from Jade Street and are being sold to them at high prices," said Law. "The jade retail market is polarizing, with famous brands enjoying much media exposure and a good reputation as they keep a firm grip on high-end consumers while merchants on the street have little chance to do business with the well-off."

According to Law, the heyday of Hong Kong's jade industry in the 1970s and 1980s is over. Back then, about 90 percent of jade items in the global market were produced in Hong Kong.

Law travels on business to the mainland from every Wednesday to Sunday and returns to Hong Kong on Mondays and Tuesdays. He has set up several factories in Guangdong province and transferred all his business to the mainland.

"Without an international pricing system, uncertainties and speculation surrounding (the) jade trade are almost inevitable," said Baohezhai's Zheng.

"The growing spending power of the wealthy Chinese, who are willing to invest more in jade, is likely to see jade prices escalate - mainly that of top-quality jade which is woefully scarce, while prices of the mid-quality jade will remain comparatively stable in the long term," said Zheng.

Contact the writer at sophia@chinadailyhk.com

(HK Edition 10/07/2014 page9)