Treasures: What's still left?

Updated: 2014-09-24 05:51

By Luo Weiteng(China Daily)

|

|||||||

With Internet finance scaling new heights in the region, particularly on the Chinese mainland, key market players have called for regulations to check its advance and prevent defaults. Luo Weiteng reports

When e-commerce giant Alibaba launched Yu'e Bao - its online investment fund, meaning "leftover treasure" in Chinese - Rain Li was among the first batch of retail investors in Hong Kong to jump on the bandwagon.

At the very outset, it sounded a rather sweet deal for Li, seeing her returns on an initial investment of HK$100,000 ($16,255) chalk up nearly 200 yuan ($33) daily.

But, it wasn't to be a bed of roses that would last a lifetime. With the yield from her account sliding from a peak of 6.763 percent shortly after the Chinese New Year down to 4.16 percent by Sept 23, Li decided it was time to trim her investment, albeit hesitantly, by a tenth to just 10,000 yuan.

"I used to check the balance of my Yu'e Bao account and show it off on WeChat and Weibo almost every day. But now, since it's paying just above 4 percent, only slightly higher than the 3.3-percent interest one would earn for a one-year deposit at bricks-and-mortar banks, and less attractive than the wealth-management products sold by lenders, the appeal seems to have waned," said Li, an accounts executive with a local financial public relations agency.

As Alibaba led the charge in Internet finance in June last year with Yu'e Bao (offered under Tianhong Asset Management), there was a flood of optimism that investors like Li would be rewarded with juicy yields plus the convenience of instant withdrawals.

Rivals Baidu and Tencent have also since entered the fray with their respective products, Li Cai and Li Cai Tong. However, optimism has since turned into apprehension over whether such Internet-based funds would eventually fizzle out.

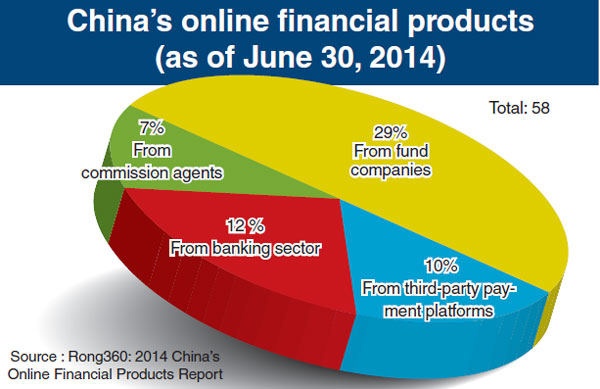

The boom and bust of the mainland's Internet-based funds mirror the staggering and somewhat chaotic growth of Internet finance in the world's second-largest economy - ranging from peer-to-peer (P2P) lending, crowd-funding, Internet banking and third-party payment platforms to more exotic investment products.

"China's Internet finance is barely two years old, yet its scale has come as quite of a shock to its Western counterparts who have taken more than 10 years to develop it," commented Andy Chen, who's based in the SAR as head of the China unit for Chappuis Halder & Company which has offices worldwide.

Young market

According to Chen, in 2013, the astonishing transaction volume of electronic banking business on the mainland stood at 1,200 trillion yuan - 21 times of the country's GDP - while those of third-party payment and P2P lending were only 5.4 trillion yuan and about 80 billion yuan, respectively.

"With China's Internet finance rising way beyond the remit of the traditional banks, this highly competitive market is still pretty young, just dating back to 2008," said Dominic Wu, a Hong Kong-based managing director and senior risk manager at the Bank of New York Mellon (BNYM). "Normally, it takes 10 to 20 years for a new market to evolve into a competitive one, yet China is definitely a surprise exception. But, more often than not, what you can expect when the market becomes intensely competitive is nothing but a mushrooming of problems," Wu noted.

The pace of growth has been rapid enough to prompt boisterous demands, mainly from banks, to regulate upstarts although the total amount of money invested in Internet finance products is still small compared with the length and width of the traditional financial sector.

"Banks, especially those in second- and third-tier cities on the mainland, regard these disruptive innovators as a serious long-term threat to them," said Wu, who has been invited by several banks to talk on Internet finance. "They're desperately regaining the ground they've lost by making their business go mobile, which, in my opinion, should be defined as 'financial Internet', to be exact."

But, tech-savvy competitors, long known for their thriving e-commerce business and sprawling empires, are not prepared to let the opportunity of laying claim to a part of the lucrative market slip.

"However, just like the Internet is not the trump card of many traditional banks, finance is not the strength of tech giants, and you cannot count on them in thinking about the corresponding risk management too much when dabbling into the Internet finance market," Chen said.

Chen and Wu were not surprised that the People's Bank of China (PBOC) and the China Banking Regulatory Commission (CBRC) are, reportedly, considering lifting the entry threshold of Internet finance providers' registered capital to 10 million yuan - a move that could force small-scale providers out of the game.

"Systematic risk is always there. The liability backing these assets like Yu'e Bao are all day-money that can be withdrawn at any time, akin to an open-end money market fund. But where the money raised is invested is still largely unclear, thus making many people regard the fund as more of a shadow banking operation," said Vincent Lam, chief financial officer at Hong Kong-based VMS Investment Group. "If there's a large-scale redemption, a systematic risk could hardly be avoided."

Citing US e-commerce giant eBay's PayPal money market fund, which was taken off the market in June 2011, Lam said the grim warning about Internet finance in the global arena should serve as a wake-up call to mainland players.

Due to the 2008 financial crisis and the painfully low interest rates resulting from the US federal government's Quantitative Easing policies, the yields of the PayPal interest-earning fund - one of the highest yields in the US at one time - ended up near zero.

Moreover, moral hazards pose a long-standing problem within the Internet finance domain, especially when it comes to P2P lending, which helps meet the huge cash demand of the mainland's small-and-medium enterprises (SMEs).

"SMEs, a catalyst for China's GDP, are starved for cash almost all the time," said Chen. "I know of many real-estate agents, plagued by financing problems, who don't have much of a choice, but to see their lucrative projects cut off."

"In the US, borrowers can turn to private equity funds and venture capital, apart from banks, for direct lending while in China, where standard commercial banks hold 99 percent of market capital, SMEs are not left with too many options," he said.

As banks dominate the market through "indirect lending" and have a big say in interest rates, Chinese commercial banks can easily feed themselves via borrowings from State-owned enterprises (SOEs), Chen said. "Why would they bother with competing for customers like SMEs?" he asked.

Chen pointed out that the mainland's current interest-rate liberalization effort would make banks willing to offer loans to SMEs but, so far, each loan application to banks is still assessed on a case-by-case basis.

Olympian task

"Dealing with loan applications from SMEs, small in volume but large in number, is an Olympian task if they're approved case-by-case. Without a credit database covering the majority of enterprises in China, banks still lack the incentive to lend money to SMEs," said Chen.

"Moreover, moral hazards occur when SMEs with low credibility default on their debts on China's less-regulated P2P lending platforms, where we witness the birth of a P2P firm every day and the collapse of another 20 P2P enterprises monthly.

"That's why lenders in the ecosystem would not dare to be SME creditors. Therefore, most SMEs still rely much on the current 1,263 P2P lending units in China," he added.

BNYM's Dominic Wu called for "full-fledged" regulations to deal with the issues arising from Internet finance in the Asia Pacific region. "The more robust Internet finance is on the mainland, the more urgent it is for regulations to be enforced. Admittedly, the market needs time for self-regulation, but what we also need is for big players who have failed to raise the alarm to deter all other players," he said.

"In the Asia Pacific region, China outstrips all other countries in the Internet finance business, and we need to put a cap on the market. India, with the second-largest Internet population after China, is fairly prudent in launching Internet finance products," Wu added.

Contact the writer at sophia@chinadailyhk.com

(China Daily 09/24/2014 page9)