More ways to slash MPF fees and improve MPF return

Updated: 2014-09-16 06:20

(HK Edition)

|

|||||||||

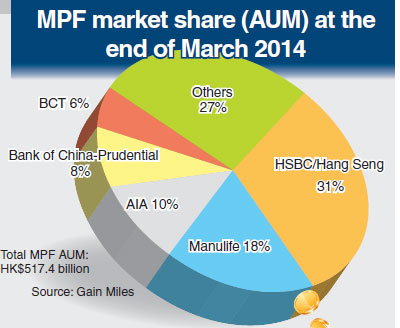

Fund industry practitioners cautioned that introducing core funds alone is not sufficient in reducing total MPF expenses. "Core fund itself also involves portfolio management fees so that the government has to look for ways to slash active management fees needed for implementing core funds," Gloria Siu, chief executive of MPF advisory firm Gain Miles, told China Daily.

BCT's Lau said other MPF scheme stakeholders should also contribute to trimming total MPF expenses. "The government can consider streamlining compliance procedures that may help MPF providers cut compliance costs, and employers and employees concerned should also embrace automation to manage their MPF accounts that enable MPF providers to trim MPF expenses."

"The fees involved in MPF investments not only include fund manager investment charges, but also other costs associated with the huge costs in regulatory compliance, report disclosure and client servicing. Therefore, establishing core funds is not the only way to slash fees. The MPFA should also ponder other solutions to cut costs in other value-chain segments of the MPF investment," HKIFA Chief Executive Officer Sally Wong told China Daily.

Apart from launching core funds, expanding into more diversified asset classes can help improve the risk-return relationship of MPF investment.

"The MPFA can consider expanding the investment market and accommodating other asset types for MPF schemes, for example, investing in yuan-denominated financial assets, the Asian equity market, infrastructure assets and even others that are not liquid assets to enhance MPF's investment flexibility and better match the long-term retirement investment needs of MPF members," Wong noted.

(HK Edition 09/16/2014 page9)