Shanghai-Hong Kong Stock Connect too big to ignore: Goldman Sachs

Updated: 2014-09-05 05:27

By Emma Dai and Selena Li in Hong Kong(China Daily)

|

|||||||

Mainland household names only listed in HK is another approach to invest southbound

The Shanghai-Hong Kong Stock Connect, also known as the through train, is "too big to ignore", said a research report published by Goldman Sachs on Thursday in Hong Kong.

"The combined market cap of the mainland and Hong Kong stock markets is going to hit $6.7 trillion, which is the second biggest in the world, only after the $19.2 trillion of the New York Stock Exchange," said Kinger Lau, chief China strategist at Goldman Sachs. "In terms of cash turnover, it's also on track to be the third largest in the world. Global institutional investors will have to have some allocation in a market of such (a) scale."

To be launched in October, the scheme is to provide international investors access to A-share market on the mainland.

Lau pointed out the expectation that international benchmarks will include the A-share fueling global investors' appetite to boost their exposure to the market.

"Since the launch of Qualified Foreign Institutional Investor (QFII) scheme in 2012, the mainland has done a lot to open its equity market. The conditions are in place for indices such as the Morgan Stanley Capital International (MSCI) and FTSE to add A-shares. We believe it's very likely that the MSCI will include A-shares to its emerging market index within a year," Lau said in the press briefing.

In terms of A-share investment strategy, Lau said sectors highly-related to GDP growth - such as banks, retailing, and capital goods - are worth-noticing, to see which way investors can benefit from a faster growth rate on the mainland.

Meanwhile, stocks with high dividend yields would also be attractive, he said, adding that on average the global markets provide a 2.5 percent rate in 2014, while the average dividend yield of the A-share market is between 3 to 4 percent.

"We estimate that at least $40 billion of global high-yield funds will be interested in such stocks," he said, adding that focus could be given to insurance and energy sectors.

To acquire a safer A-share portfolio, Lau adviced investors look into stocks with a higher shareholding from QFII investors, who already had "done (their) due diligence". Dual-listed stocks with discount to H-shares are also recommended because "their corporate governance could be better".

Separately, Lau said though it's hard to predict which side of the stock connect will benefit more, there was a need for mainland investors to increase their overseas exposure.

"On average, 70 percent of mainland household assets rest in property. This is even higher than the percentage in Japan in the 90s. Only 6 percent of total assets are in equities. The stock connect is a good opportunity for them to diversify their portfolio," Lau said.

"Hong Kong has lots of companies getting most of their revenue from outside mainland. Buying multinationals such as HSBC and Hutchison Whampoa can help diversify their geographic exposure," he said, adding on a sector basis, Hong Kong niche stocks such as Macao gaming, upstream oil and gas firms could be favored.

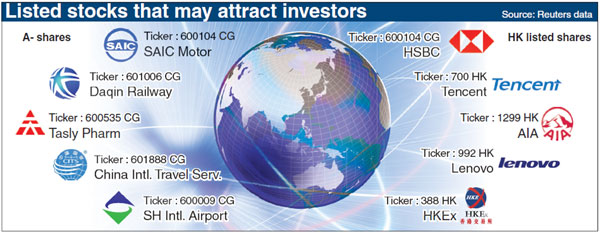

Additionally, mainland household names only listed in Hong Kong is another approach to invest southbound. Out of the 50 most valuable mainland brands, only 12 are listed in the city.

Contact the writers at emmadai@chinadailyhk.com and selena@chinadailyhk.com

(China Daily 09/05/2014 page8)