Profound changes to lead to more financial reforms

Updated: 2013-11-22 07:19

By Oswald Chan(HK Edition)

|

|||||||

The structural changes in the shape and drivers of the Chinese economy will provide the impetus for China to execute further financial reforms and entice the yuan internationalization process to flourish in the years ahead.

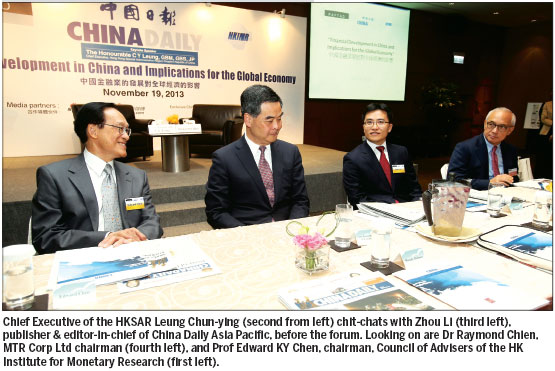

Standard Chartered Bank (Hong Kong) Executive Director and Chief Executive Officer Benjamin Hung made this assertion at a China Daily Asia Leadership Roundtable panel discussion.

"China will change from the world factory to become the world of consumer and the world of investor," Hung said. "As the consumption and investment flow of China will be more important, this brings up the question over what currency will be used."

"The bridge (yuan internationalization) has been built, but the issue is whether there is international traffic (yuan and foreign currency transaction volumes) going through this bridge, and this process will take time for convergence, but that trend is very clear," Hung said at the roundtable conference.

The south-south trade corridor growth is an example to illustrate how yuan internationalization can benefit from the growing trade between China and the emerging markets.

For example, the China-Africa trade corridor is a reciprocal balanced trade flow between the two parties, where African countries export commodities to China while the country in turn ships heavy machinery and telecom equipments to Africa.

Contracts settlement

"(When) China becomes (a major) consumer and (also a) great buyer with (strong) bargaining power in the foreseeable future, major commodities contracts will be settled in yuan," Hung envisaged.

The structural changes of the Chinese economy not only will propel the yuan internationalization process but will also encourage the Chinese authority to pursue more financial reforms, including capital account liberalization and interest rate deregulation.

"If I were to guess what is on Beijing's mind, two words come to my mind. Hurry (up) slowly. Obviously they would like this (capital account liberalization) to be fast, but they also want it to be ready. A lot of what is happening in Hong Kong shows that the mainland is using Hong Kong both as an experimental ground as well as a firewall," Hung said.

Hung also cited the recent establishment of the Shanghai Free Trade Zone (FTZ) which is to test the capital flow between the Shanghai FTZ and the onshore market. Hung expected the central government to open the market slightly to test the water.

However, Hung refused to give a specific date when China will fully liberalize the capital account because this depends on how things evolve.

Amid the trend of gradual financial reform in China, Hung envisioned that foreign banks like Standard Chartered Plc can tap the business potential of the Chinese market.

"Regarding the onshore market, there will be growth of financial products through disintermediation, through capital market, through securitization, and through equities. China quite relies on bank financing as the primary source of financing, and down the road, there will be opening up of other financial instruments as well," Hung said.

"Also, Chinese companies are growing trading and investing with worldwide partners. As there are certain product areas or solutions that are not available in China, foreign bank players like us can deliver financial solutions to these companies outside the country. It is supporting and facilitating Chinese companies reaching out and dealing with external parties. That is the role of Standard Chartered," he said.

Contact the writer at oswald@chinadailyhk.com

China Daily

(HK Edition 11/22/2013 page4)