China's capital account convertibility spectrum

Updated: 2013-11-22 07:19

By Sophie He(HK Edition)

|

|||||||

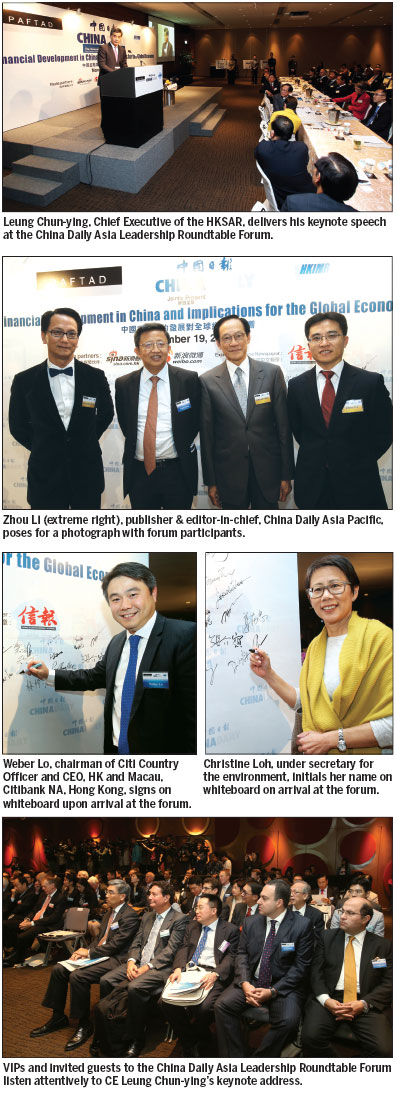

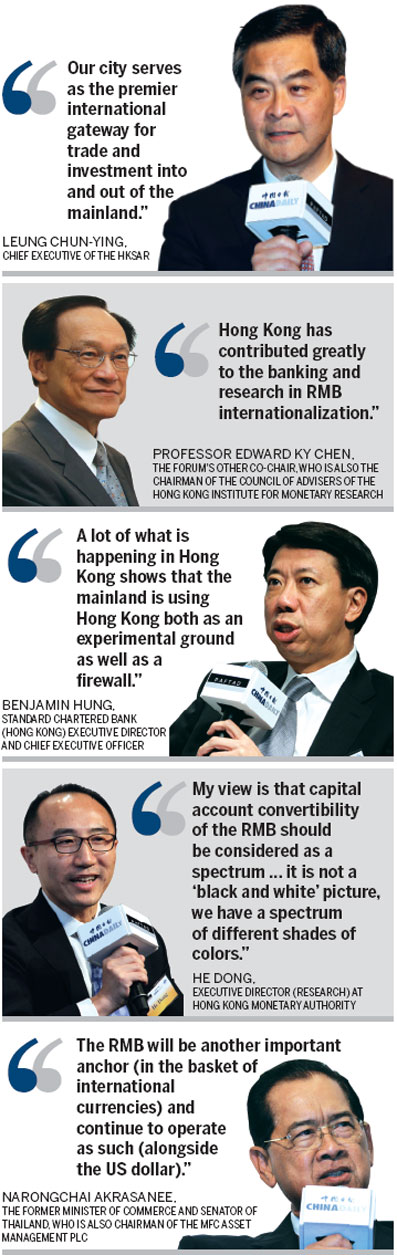

China's capital account liberalization is a process and the capital account convertibility should be considered as a spectrum, He Dong, executive director (research) at Hong Kong Monetary Authority, said at the China Daily Asia Leadership Roundtable Forum.

"We can anticipate that over time, the development of the process will be quicker than what we have seen so far, and the yuan (which has been convertible for current account transactions since 1996) will be convertible for most transactions," He contended.

He drew parallels between the mainland and most others countries which announced the convertibility of their capital accounts on average after seven years.

Many argue that China should announce a timetable for its capital account convertibility, but others are saying that the process should only be considered when appropriate.

"My view is that capital account convertibility of the yuan should be considered as a spectrum it is not a 'black and white' picture, we have a spectrum of different shades of colors," said He.

"As the Chinese leaders have said they will accelerate the pace of yuan convertibility at some stage, so it maybe sooner than you think, and the yuan will be basically convertible for most transactions," he said.

At the moment, the official policies are playing the role of laying pipes, and once the pipes are laid and there is no major blockage, it will be up to the market to decide how much yuan they want to use, He elaborated.

But He stressed that even after the yuan became fully convertible, it will not replace the US dollar.

"I have a lot of faith in the US dollar; I think the US dollar will have a great future as a major international currency. The yuan is not going to displace the US dollar; the yuan will go side by side as a major international currency with the US dollar."

Varied international system

He said that we are going to see a much more varied international financial system, and it will benefit everybody involved. He believes it will not be a healthy situation for any currency to replace the US dollar. "I don't see that happening in anyway," he said.

He told the roundtable that since China joined the WTO in 2001, the whole landscape of the global trade had changed during the subsequent decade. China became the center of the global supply chain in the manufacturing industry, while the production chain was re-organized throughout the Asia Pacific.

The decision of accelerating the pace of capital account liberalization will be extremely significant, in the sense that it will change the landscape of the global capital flows in the next decade, He said.

"If you think about it, the scale is going to be huge, and the reason is that at the moment China has an extremely small international balance sheet," he explained.

"In the decade ahead or in 15 years, I would say that China probably would become the largest source and destination of capital flows of most Asia-Pacific economies, and the size of the scale is very hard for us to imagine at the moment, but it is going to be very exciting."

"What would be the implications for Hong Kong?" He asked, adding that there is a great degree of anxiety in the city about how we are going to be able to compete, when China opens its capital account.

Some people believe that "we will lose out simply because there is going to be a diversion effect".

These people think that Hong Kong's advantage is that the city can do what Shanghai is not able to do due to the restrictions, and when the restrictions are lifted and capital account is liberalized, Hong Kong will lose out.

But He said he does not agree with this kind of thinking.

Some people believe that the pie will get much bigger, as the Chinese international balance sheet will become so much larger. They describe it as the "creation effect", which means Hong Kong will dominate the new business that would be generated making it a very exciting period for the city.

He stressed that Hong Kong being an international financial center, does not depend on the financial services industry itself which maybe not even the most important part of it.

"The most important part of Hong Kong being an international financial center is that it has to be the most open and globalized international city. It has to be the most desirable city for top talents to live in, and it is the most pleasant place to congregate."

As long as Hong Kong maintains itself as the most pleasant and the most internationalized city in Asia Pacific, its position as an international financial center will be guaranteed, He said.

Contact the writer at sophiehe@chinadailyhk.com

China Daily

(HK Edition 11/22/2013 page4)