Awaiting Alibaba's magic words

Updated: 2013-11-01 07:00

By Sophie He(HK Edition)

|

|||||||

How will the Alibaba drama unfold? Where will the HK$100 billion dollar IPO ultimately be listed? These are questions circulating in every major IPO center in the world. Ever since Hong Kong's bourse refused to accept the e-commerce giant's special corporate governance structure. Sophie He reports.

Rumors have been popping up everywhere: Alibaba's going here with its IPO. Wait! It's going there! There was even speculation Alibaba would step back from its initial public offering and wait for all the heat to blow over. That seems to be happening, Things are cooling off. Alibaba and the Hong Kong regulators have been sending out positive signals.

The point of contention has been Hong Kong insistence on its rule that companies listing on the local bourse treat shareholders equally: one share, one vote. At Alibaba things don't work that way. Under Alibaba's dual-class governance structure, authority rests with 28 governing partners who hold only around 10 percent of the stock but all of the executive authority. Company rules also stipulate that Alibaba's Chief Executive Officer must be chosen from among the partners.

Charles Li, chief executive of HKEx, recently wrote a blog entry titled, "Taking the debate forward: Should Hong Kong act on non-standard shareholding structures?" Li took special note of the reactions to the controversy in the market. One point of view held that the exchange won a moral victory through its insistence on the one share, one vote principle. Others contend to the contrary. The Hong Kong Exchange had revealed resistance to adapt to changing times and changing market conditions and risked losing its competitive standing.

"What's lost in the debate (about Alibaba's proposal) is whether Hong Kong should embrace new, innovative companies and, if so, how?" said Li. "Losing one or two listing candidates is not a big deal for Hong Kong; but losing a generation of companies from China's new economy is."

Li thinks it's time to hold a "proper debate" about whether Hong Kong should attenuate its strict listing rules.

Two days after Li's blog appeared on the HKEx website, Hong Kong's Financial Secretary John Tsang Chun-wah told Financial Times there needs to be public consultation before changing the listing rules on the Hong Kong exchange.

"This is a matter for the market to decide," Tsang said, adding he was open-minded about whether the listing rules should be changed.

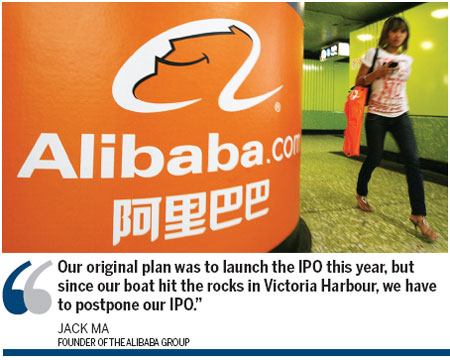

Then, last week, Jack Ma, the founder of the Alibaba Group, met with several members of the Hong Kong media in Hangzhou. He told reporters he thinks Alibaba should communicate more with Hong Kong authorities to work out misunderstandings.

IPO plan postponed

"No matter where Alibaba launched its IPO, the group's influence on Hong Kong will increase," said Ma. Although Hong Kong's market isn't very big, it's a significant market for the whole Chinese community.

"Before this (Alibaba's IPO bid), we thought we knew this city pretty well ... One of my friends joked about it that our boat has made it through the ocean but it overturned in a small harbor."

Ma said he underestimated the complexity of dealing with Hong Kong regulators. Alibaba had gone before the Securities and Futures Commission (SFC) insisting that the company's partnership structure, which ensured that the CEO be one of the partners, was the essence of its corporate culture.

"We thought it was very simple, just like the Chief Executive of Hong Kong must be a Hong Kong resident," Ma said. So Alibaba told the SFC and the HKEx that the company could ensure its day to day operations by giving the company partners control over who sat on the board of directors.

Ma says he told the authorities, "that the group's business is very complex, and it is impossible to even think of the company being led by an outsider." Ma said he believed the negotiations were "private discussions." Unfortunately, he observed, the word got out. There was a leak.

He stressed that Alibaba has "paid the price" in Hong Kong, already. "Our original plan was to launch the IPO this year, but since our boat hit the rocks in Victoria Harbour, we have to postpone our IPO," said Ma, adding that the company certainly will not launch its IPO in 2013 and has not set a new timetable.

Ma said he has read Charles Li's "blog" and he thinks Li sent a very positive message, showing that Hong Kong is willing to discuss the feature.

"Hong Kong has no reason to change anything for Alibaba, but Alibaba is very glad to see that the city is reflecting after the company proposed its IPO plan."

Hong Kong should think about why so many large-scale Chinese Internet companies went to the US for listing, said Ma.

The city should reflect on its principles and rules, he said, adding that he believes Hong Kong's leading principles are innovation and inclusiveness.

Ma argued that rules are meant to protect guiding principles, and if the rules failed then they needed to be changed or reviewed.

The results of the debate are not as important as the discussion, he said, stressing that Hong Kong must be open-minded through the debate.

"Hong Kong should have this debate and if the city does not discuss issues of innovation, it will be very unfortunate," he said, "Alibaba will be happy to participate in the discussion, and we will participate with a positive and optimistic attitude."

Listing rules debate

Ma said he hopes that the debate over listing rules can happen as soon as possible. "I'd be thrilled if the discussion started next week, but everything requires appropriate procedures."

Ma says he is confident the discussion needn't go on for long before there's a consensus. "If the discussion is thorough, I think people in Hong Kong would understand (the pros and cons) in three days."

Ma loves Hong Kong. "Hong Kong is my favorite city other than my hometown Hangzhou, I like everything about Hong Kong, from the weather to the culture."

He says he's spent a lot of time here, bought a house here and wants to spend more time here in the future.

Most people at Alibaba feel slighted by Hong Kong, and are thinking, "Why should we go to a place where we are not welcome?" he said. They think it's time to move on, and list in the United States.

If that happens, Ma said - if Alibaba goes to the US, it will never come back to Hong Kong, even for a secondary listing.

He said that being listed is not a very big deal for Alibaba right now, and where it's listed matters even less, but the partnership mechanism is important. He said he doesn't want to see Alibaba turn into another Yahoo, a company which has had eight CEOs in seven years. Yahoo Inc and Softbank already own 50 percent of Alibaba's stock, data showed.

Ma said he understood Hong Kong's intention to protect minority shareholders. He says what Alibaba wants is not in conflict. Ma insists, the company is not protecting itself from small shareholders. The management team, he argued, comprises "small shareholders." Alibaba is trying to protect itself from being overrun by investors with even deeper pockets.

As Li said in his blog, innovative companies (like Alibaba) are distinct in two ways. First, their success largely comes from the founder's unique vision, rather than from other factors that usually drive success in traditional companies. This vision is a core asset of these companies. Secondly, the founders tend to start with nothing and usually must rely on outside funding when they start out. By the time they consider a public listing, the founders' shareholding may have been diluted by rounds and rounds of financing.

Recently, there have been calls for Hong Kong to accept listings from companies with dual-class shares giving company founders more voting rights than ordinary shareholders. Many large Internet companies operate under that corporate governance structure, including Facebook and Google.

Edward Au, co-leader of the national public offering group at Deloitte China, told China Daily that during the past two decades, Hong Kong has not had an IPO even similar to Alibaba's. A corporate structure involving dual-class shares is completely new for investors in Hong Kong, especially retail investors.

Au noted that the dual-class structure empowers company founders to implement their long-term strategies without constantly looking over their shoulders and having to worry about being kicked out by the board.

Some shareholders seeking short-term investments, are not looking to the long- term vision but are looking for financial gains in the short term.

Retail investors in general feel insecure, knowing that the minority shareholders can control the company by appropriating "voting rights" in excess of their shareholdings, said Au. Ordinary investors with depleted voting rights worry their voices will not be heard by the company board.

Unlike the US market, where the majority of investors are sophisticated, experienced institutional investors, around 20 percent of the market players in Hong Kong are retail investors. That means a lot of "investor education" will be needed before the city can take in any new listing rules, said Au.

He said Hong Kong Exchange may launch a soft-consultation about the city's listing rules very soon, and a public consultation will come after that.

"But it will require a lot of preparation and discussion as well as opinion collection, so I believe from the initiation of the consultation to the point where a conclusion was reached, it will be at least a year."

Alibaba is in no hurry, said Ma. The drama will play out but no one is holding out hope for an early conclusion and certainly not this year.

Contact the writer at sophiehe@chinadailyhk.com

(HK Edition 11/01/2013 page1)