Out of the box

Updated: 2013-09-27 07:02

By Wong Joon San(HK Edition)

|

|||||||

Hong Kong's terminal operators are waving the red flag, warning they are under immense pressure to accommodate the badly needed transshipment business necessary for their very existence. But the roots of the problem lie in the acute shortage of land for backup space. Wong Joon San reports.

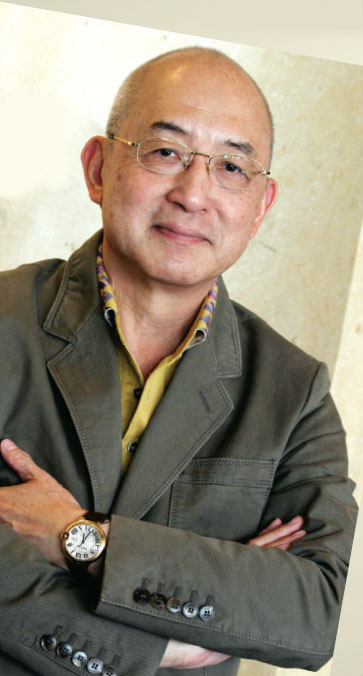

Alan Lee Yiu-kwong, chairman of the Hong Kong Container Terminal Operators Association (HKCTOA), strides into the meeting room of a leading hotel, dressed in a dark grey jacket, sporty shirt and dark pants. A China Daily photographer takes him to the hotel's foyer to have his photo taken.

Lee returns, and once seated begins to tell the story of why Hong Kong's container terminal operators are in "existence mode." It's nothing new. This story has been told and, so far, re-told and fallen on deaf ears.

"The more important thing to note is that our (container terminal) industry is pessimistic," says Lee, explaining slowly and clearly that, "It is not because of the terminal industry's business structure, but rather the shortage of land capable of absorbing increased transshipment cargo and mega vessels. As mega vessels discharge and load higher volumes of containers in a short period of time, they require more backup land for container stacking."

"Backup land," Lee explains, "is land at the container terminals used by terminal operators to store stacks and rows of containers (awaiting shipment) that may require longer storage time than direct shipment containers, and the lack of such backup land means shippers do not bring their containers to Hong Kong, for transshipment through our terminals, to other destinations."

"Although transshipment of containers brings in relatively low revenue per 20-foot equivalent unit (TEU) container - the standard metric for the container industry - compared to direct cargo to Hong Kong port, terminal operators are forced to do more of it to keep their business going," says Lee, who has spent nearly 40 years in the container business. Over time, transshipments have increased while direct export and import shipments have seen a corresponding fall.

Hong Kong port consists of nine container terminals. Hong Kong International Terminals (HIT) operates Terminals 4, 6, 7 and Terminal 9 (South), while Modern Terminals operate Terminal 1, 2, 5 and Terminal 9 (North). Dubai Ports International (Hong Kong) Ltd operates Terminal 3, while an HIT and COSCO Pacific joint venture, COSCO-HIT Terminals Ltd, operates Terminal 8 (East) and Asia Container Terminals Ltd operates Terminal 8 (West).

The veteran container terminal operator, who also serves as an HKCTOA spokesperson and gives advice for increasing Hong Kong port's competitiveness, says: "If you look at the last few years, throughput has been stagnant, and there has been practically no growth for six years. This year, it is down 7 percent."

There are several reasons for the trade slowdown. They include, among others, the global economic slowdown, the lower buying power of the United States and assorted European countries, manufacturers moving away to other lower-cost Asian countries, manufacturers moving inland away from the Pearl River Delta to source more lower-cost locations, and other ports shifting to higher-value cargo resulting in lower demand for sea traffic and a higher demand for air traffic.

Mega vessels

The recent introduction of mega vessels, such as the world's biggest containership, the 18,000-TEU Maersk Mc-Kinney Moller (Triple E-class), which called at Yantian International Container Terminals recently, poses greater challenges for Hong Kong. In addition, 19 more sister vessels will also be coming on stream, with their low fuel burn and economies of scale.

In a separate development, China Shipping Container Lines (CSCL), the second largest carrier in China, has ordered five 18,400-TEU ships from Korea's Hyundai Heavy Industries at a price of $136 million each.

With the emergence of these mammoth vessels, ports are being forced to invest more into cranes and updated technology to be able to accommodate such mammoth vessels.

Aside from bigger ships, local news reports pinpoint labor disputes, reflecting the complexity of port operations.

One recent incident at Hong Kong port that brought container terminals into public focus was the 40-day walkout by workers at Kwai Tsing Container Terminal. The strike was called by the Union of Hong Kong Dockers (UHKD), an affiliate of the Hong Kong Confederation of Trade Unions (HKCTU) on March 28. Unionized employees were angry over the growing practice of Hong Kong International Terminals Ltd (HIT), a subsidiary of Hutchison Port Holdings Trust (HPHT), outsourcing workforce management to contracting companies at the port that resulted in wage disparities.

HPHT is in turn owned by Hutchison Whampoa Ltd (HWL), the flagship company of Hong Kong's wealthiest man, Li Ka-shing. The workers, who demanded better pay and working conditions, ended their strike on May 6, after they accepted a 9.8 percent pay rise offer, bringing their wages closer to where they had been before the outsourcing began.

Local news reports say during the strike, many carriers moved parts of their operations from Hong Kong to southern China. Hong Kong port's market share of south China exports to the US and European countries was 90 percent 10 years ago, but it has dropped to 30 percent today.

Commenting on this trend, Lee thinks it doubtful that the loss of business will return to Hong Kong after the shippers experienced overall lower cost, including terminal handling charges (THCs) imposed by carriers on shippers and the comparable same-service standard as Hong Kong port's, if not better. Many people mistake the THCs - that have nothing to do with terminal operators - with the container handling charges (CHCs), which are much lower than THCs on a per TEU basis.

Shenzhen port

Against this backdrop, between January and June this year, Shenzhen port handled 11.06 million TEU, overtaking Hong Kong which handled 10.71 million TEU.

Thus, officially, Shenzhen's container port is now ranked in third place globally, pushing Hong Kong to fourth. Now all eyes are focused on container volume growth in the second half of 2013 for both places to see which port will take the world's No 3 ranking this year.

Lee says the industry isn't worried about that: "As far as container terminal operators are concerned, we don't think the ranking is important. Whether a port is in the first, second, third or fourth place, it is no big deal. Just look at Singapore which used to be ranked No 1, (it was soon overtaken by Shanghai) pushing the Lion City to second place globally."

"We must bear in mind that when Singapore was the No 1 container port globally, the port handled 95 percent transshipments, meaning there was double counting of the containers (once when the container entered the port and a second time when the container exits the port).

"In Hong Kong, transshipment containers make up 60 percent of the total container throughput. These are counted twice. Forty percent of containers are direct export and import shipments and they are counted only once," Lee says.

So, when people talk about Singapore's port being better than Hong Kong's, and if Shenzhen was brought into the equation, this southern Chinese port would have overtaken Hong Kong two to three years ago, since 95 percent of Shenzhen's throughput deals are with direct export and import shipments, Lee says.

Backup land

Lee urges the government to speed up assistance to provide backup land to make the maritime industry competitive. Failing that, the city will lose out in the longer term, he adds.

"More cargo in containers is coming to Hong Kong via barges and therefore Hong Kong needs more barge berths because the existing facilities are insufficient," he says. "As some of the barges are using the large vessel berths because of the shortage, this wastes a lot of capacity and resources."

Lee says that the HKCTOA had given the government a lot of advice and proposals regarding the increase of terminal backup lands, barge berths and truck drivers, but most of them, if not all, were either ignored or turned down.

Contact the writer at joonsan@chinadailyhk.com

|

Alan Lee, Hong Kong Container Terminal Operators Association (HKCTOA) chairman, urges the government to speed up assistance to provide backup land to make the maritime industry competitive. Parker Zheng / China Daily |

(HK Edition 09/27/2013 page8)