Tower block

Updated: 2013-08-23 07:16

By Emma Dai(HK Edition)

|

|||||||||

Government measures implemented six months ago, to discourage property speculators and bring a measure of sanity back to the real estate market, have created a stalemate with potential sellers hoarding properties and potential buyers spurning what few properties are on offer. Real estate agents don't expect the deadlock to last, while others see the battle enduring. Emma Dai reports.

Early in July, came the Alliance of Double Stamp Duty Victims, the very name capable of evoking most dreadful images of Man's inhumanity to Man. As it happened however, the victims proved to be thousands of Hong Kong real estate agents, upset about their lost commissions. Government measures, implemented to rein in a property market fast becoming affordable only to wealthy speculators, was killing their livelihood, the victims protested.

Protests are commonplace in Hong Kong, such that anyone not directly affected hardly takes notice of those waving placards any more. But here were thousands of real estate agents - who had seen their commissions swept up, blown away and dispersed over the South China Sea - gathered at Tamar to register their displeasure at the procession of government curbs on the property market and vowing to present a petition bearing 200,000 signatures to the Legislative Council (LegCo), demanding a repeal of the measures.

"If the circumstance continues, one-third of all the agent offices in the city will have to close and more than 20,000 people will lose their jobs," said the alliance earlier this month.

No speculators

Real estate agents have reason to worry. The two sides of the property market have turned adversarial and are dug in, engaged in unfamiliar trench warfare that belies the ordinarily fluid, fast-transacting property scape of one of the world's most expensive cities.

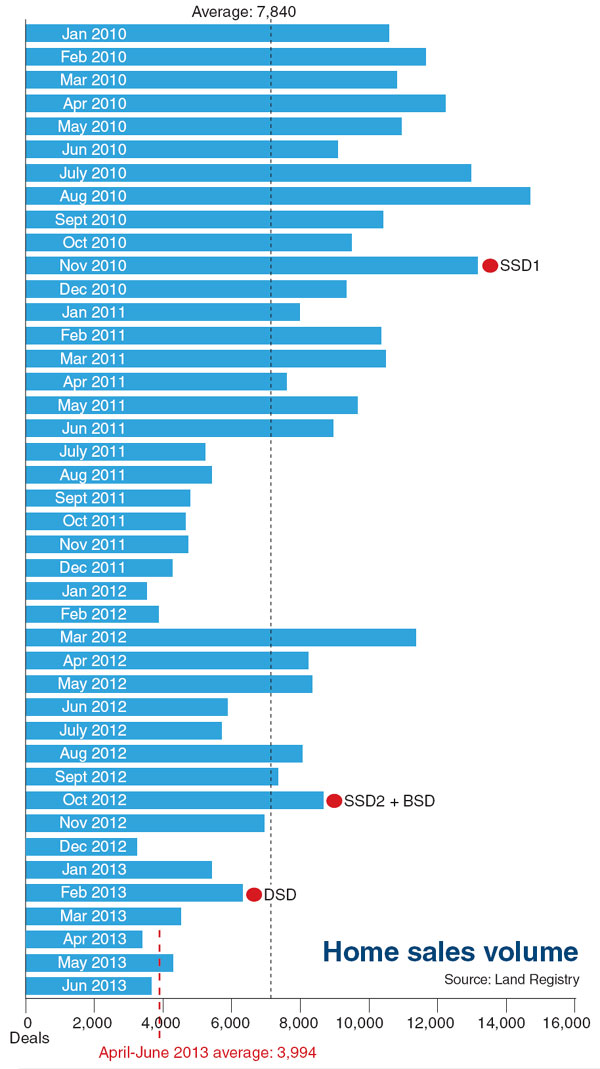

Since March, average monthly transactions by volume in the residential property market crashed to 3,994, a 22-year-low. That's 11 percent worse than during SARS, the severe acute respiratory system scourge in 2003 which pushed average monthly housing sales down to 4,507. The long-term average is 7,840 sales in a month.

The market for luxury homes (once seemingly impermeable to market fluctuation) has lost much of its high-altitude luster. Cushman & Wakefield reports that sales of properties valued at more than HK$100 million ($12.9 million) dropped 55 percent from the first to the second quarter this year. "There are no overseas buyers, no investors or speculators," says Joanne Lee, research and advisory manager at Colliers. "In the traditional luxury home areas - The Peak, Mid-Levels and the South Island, the average monthly transaction volume would reach more than 200 deals per month during the good times. Now it's about 10 to 20," says Ricky Poon, executive director of residential sales at Colliers. "The day the market picks up depends on when the government waives the measures."

The "measures" they are talking about are the stamp duties rolled out by the authorities sequentially, in a series of moves to cool the overheated local market. These include the special stamp duty (SSD) in November 2010, buyer's stamp duty (BSD) last October and double stamp duty (DSD) in February. Curbs apply not only to the residential property market but also to commercial assets such as office space, industrial buildings, retail stores and even parking lots. To acquire a property in today's Hong Kong, foreign and mainland buyers must pay taxes equal to 19.25 percent of the purchase value. For properties above HK$20 million, all buyers, including the corporate variety, were tax-smacked by an additional 23.5 percent.

As may easily be recognized, only local owner-occupiers remain active in the market. "Local buyers who want to upgrade their living standard are little affected by these policies. They can sell their old homes in half a year and get a tax rebate," says Poon. "The impact on mainland buyers, foreign investors and company buyers is enormous. In the luxury property market where they used to dominate, sales have been slow since last October. The BSD is a barrier. The DSD is the second part of the one-two punch."

All of which means, this must have had a salutary effect, opening the door to affordable housing for hundreds of thousands of middle-class folk, priced out of the market through the avarice and the acquisitiveness of the ultra wealthy from beyond our borders. Unfortunately, not so.

Defying record low transaction volume, prices have been unyielding. Data from Cushman reveals prices for luxury homes valued at more than HK$100 million declined only 0.5 percent in the first half. Overall luxury home prices have slipped only 5 percent. Simultaneously, the Centa-City Leading Index during the first half of 2013 hovered in a relatively narrow band around 120, with 100 reflecting property prices in July 1997. The index, published by Centaline Property Agency Ltd, tracks city-wide secondary private residential property prices.

Bargain hunters

Even more discouraging, prices of small- and mid-size homes continued to climb until February when the double stamp duty was introduced," says Colliers' Lee. "Then the price became stable." However, buyers are eschewing what they see as record high home prices. They're looking for real estate that's priced reasonably, maybe even a bargain.

"There are still potential buyers in the market - people want to live better, and they have money. But they are not willing to enter until the market makes its correction," says Poon. "In the short term, if individual owners agree to lower property prices by 10 percent to 15 percent, the market would move. But that's the expectation of local buyers. In terms of overseas buyers, including those from the mainland, they are expecting a 15 percent to 20 percent cut. They are concerned the market has peaked and taxes are heavy."

"A number of mainland buyers showed recent interest in luxury properties," says Kent Fong, executive director of Cushman & Wakefield (HK) Ltd. "But apart from a combined 23.5 percent tax of the BSD and DSD, the mortgage ratio is also capped at 30 percent of the selling price. That means they'd have to pay nearly 100 percent cash up front to buy a luxury home in Hong Kong. They obviously are being deterred."

Besides, the slowing of rental income also dims the luster of real estate as an investment. "We are experiencing a slowdown in the rate of rental growth," Fong says. "Rents have been close to tip top. If the increase stops entirely, we expect it to be hard for home prices to increase. As the return now is just 2 percent to 3 percent, investors' enthusiasm is waning."

But local landlords still believe their golden goose is alive and laying eggs. "The holding power is strong," says Lee. "Most property owners are not under pressure to sell. Currently the liquidity is high and interest rates are low, so there's barely any holding cost. No one wants to sell properties cheaply."

According to the Land Registry, the first half this year saw 22,282 residential sales in the secondary market, plummeting 37.5 percent over the 35,583 deals during the same period last year. Meanwhile, total trade value of second-hand homes was HK$112.5 billion, a 30 percent decline year to year - roughly in line with the slowdown in volume.

By contrast however, 5,435 new homes were sold in the first six months, just 3.3 percent below last year's 5,618 deals, while the value of transactions at HK$43.5 billion during the first half, was a 33.48 percent drop over 2012's HK$65.4 billion. The asymmetric decline shows the effect of the price cut is more evident in the new homes market.

"Developers are more alert to where the wind is blowing. They have changed their strategy to boost sales this year," says Vincent Cheung, national director, Greater China, at Cushman & Wakefield Valuation Advisory Services (HK) Ltd. "They lowered new home prices to lure buyers. Moreover, while people are still paying 1 percent to real estate agents in the secondary market, developers are paying them as much as 6 percent for each deal."

And that's just a start. Developers may try harder in the second half. "In the first half, there was not a lot of supply available - just five to six new projects. The big players haven't entered the battle yet," says Lee, adding developers were busy reflecting on the new rules, namely the Residential Properties (First-hand Sales) Ordinance, which came into effect in April to shield buyers from dishonest sales practices on new flats. Those who violate the ordinance could end up doing seven years in jail.

Inconvenient truth

"But developers have to make up for the poor results so far this year, as the stock of new homes goes up. They may offer deeper discounts," Lee adds. "The price gap between the primary and secondary markets may narrow to within 20 percent. It's an inconvenient truth second-hand home owners have to face. They will be under pressure to make cuts."

"In the next 12 months, we expect the price of small- and mid-size homes will drop 10 percent to 15 percent, whereas luxury home prices will decline 10 percent," says Lee. "That's because home prices in the mass market rose faster than luxury property in 2012," adds Poon. "We are waiting for owners in the secondary market to accept the fact and lower their target prices. If the correction is made, transaction volume would see a 10 percent to 20 percent rebound."

Meanwhile, the government has pledged to boost market supply. "With the existing stock, that could mean up to 30,000 new units each year," Poon says. And given that the US is destined to end QE, the interest rate is expected to rise in the coming years. "If two years later we see a mortgage rate hike from 2 percent to 4 percent, property prices may reply with a sizable decline," says Fong. "It's hard to predict how sharp the correction will be in the long term. There could be a dive."

Contact the writer at emmadai@chinadailyhk.com

(HK Edition 08/23/2013 page5)