Changing the game

Updated: 2013-07-05 07:20

(HK Edition)

|

|||||||

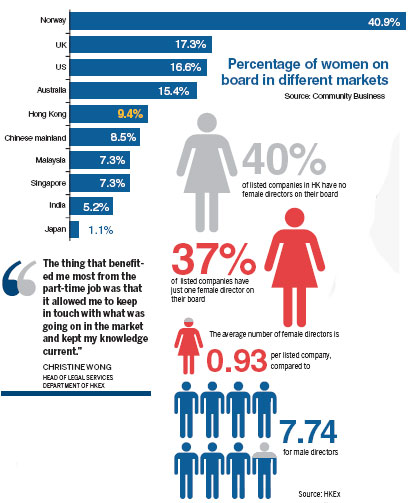

Considerable effort has been made recently in Hong Kong to improve the awareness of gender diversity in boardrooms. At the end of last year, HKEx revised its cooperate governance code to promote board room diversity. Member companies are asked to comply with the code or explain why they have not. The new code, which is to take effect on September 1, urges all listed companies to disclose policies and measurable objectives.

In March, The Women's Foundation, a local NGO, launched the 30% Club Hong Kong. The club aims to raise awareness of the benefits of gender diversity among business leaders and support initiatives to build a pipeline for women into the board room. Initiated in 2010 in the UK, the club is being well-received. Over 40 local business leaders - including Ronnie Chan, Hang Lung Properties chairman, and Richard Li, PCCW chairman - have expressed their support so far. In addition, 12 executive search firms have signed on to a voluntary code to ensure their clients are presented with a diverse range of candidates when recruiting for board positions.

"We are not promoting diversity for the sake of diversity," said Fern. "A lot of bosses don't recognize that a diversified board can contribute to the success of their business." Benefits of female leaders are attracting recognition worldwide. According to a Credit Suisse study of large-cap companies (market capital greater than $10 billion) published last August, share prices of those with female directors have been outperforming those without by 26 percent since 2005. For small-to-mid cap companies, the stock of companies with female directors outperformed stocks of companies that had no women on the board by 17 percent over the same period. Average return on equity of companies with at least one female director on the board was 16 percent, 4 percentage points higher than companies with no female board representation. Net income growth for companies with female directors averaged 14 percent compared to 10 percent for the opposite.

"There was a huge trend over the last few years that big multinationals - such as GE, IBM, Goldman Sachs and Pepsi - looked into their internal policies to create an environment where women could cover both career and family," said Kirti, director of Harvey Nash which committed to the 30% club executive search code. "Flexy hours, better training and development for those who want it, coaching and mentoring - a lot of things are going on."

"People in their mid-30's are at a trigger point where a really successful 10 to 15 years of their career could start - suddenly one may make it from junior manager to senior manager or even take a spot as a future leader," said Marsh of Harvey Nash. "But that's also when things like parenthood cross straight in. So instead of losing talents, companies are losing future leaders. To change that, some companies are now identifying high performing women ages 25 to 29 and getting them ahead by concentrating and accelerating their learning curve."

Whatever changes are happening elsewhere, the needle is moving slowly in Hong Kong. "In a lot of cases, while the top management is highly committed, things stall with mid-level managers. Some might think it's a fluffy thing. They may just want to reach their targets." Fern said. While other sectors may appear a little bit slow, the financial sector is leading the way. The top four HSI companies with the highest percentage of female directors are banks. "There is huge competition for talents in the industry. They do whatever they can to recruit talents. Hong Kong is a market-driven economy. Once the business society understands the value that diversity at all levels can bring them, I believe they will take steps in the right direction."

While many other regions introduced quotas on the share of female directors, the UK has done it voluntarily. "It's the only place comparable to Hong Kong," said Marsh. "The 30% club creates peer pressure, which has changed the status quo in two years. The percentage of women on boards has shot up from 11 percent to almost 25 percent of company directors. And in the last 12 months, almost 40 percent of all new board appointments have been women."

"But Hong Kong has a different make up of its public companies. Many are family owned," he said. "The biggest individual shareholders of the top companies here can have 50 percent stakes, while in the UK it's only about 6 percent. Family companies are a bit more conservative, because there is no real big outside pressure for them. But if they see companies with more diversity perform better, surely they would do something because there is material effect on their long term value."

"Right now we have 10 percent female directors," Marsh added. "I think 20 percent in three years could happen. From that starting point, reaching 30 percent female board members in six years would be great."

(HK Edition 07/05/2013 page4)