iBond juiced by falling interest in equities

Updated: 2013-07-05 07:20

By Oswald Chan(HK Edition)

|

|||||||

The popularity of the third issue of inflation-linked bond (iBond) in 2013 provides further evidence that local investors are turning from speculative investments, to focus on stable returns. Oswald Chan reports.

Sally Hung, a local retiree, depends on her retirement savings and returns on her investments to pay her bills. These days Hung says she relies more on her bond investments than her equities portfolio.

"The share market, real estate investment trusts, high-yield bonds and even high interest rate currencies like the Australian and New Zealand dollars - all of their trading prices have plummeted in recent weeks. The asset markets are getting more volatile but local deposit rates are still low. Actually there are few investment channels providing stable returns," Hung says.

Hung has stopped take new positions in anything that has even a whiff of risk and is focusing on bonds and yuan-denominated savings deposits.

She has deposited part of her savings back on the mainland - the rate on yuan savings deposits is higher than the comparable rate for the Hong Kong Dollar. She has also put about HK$200,000 ($25,785.8) into Soho China's corporate bond which promise a coupon interest of 7 percent. Even at that there's still a corporate default risk.

A more stable way to protect investment returns is to pool money for investment in inflation-linked bond (iBond). The iBond promises a coupon interest linked to the city's semi-annual inflation rate. Hung won allotments of 28 lots of iBond worth of HK$280,000 in the last two iBond sales in 2011 and 2012.

For the third issue this year, Hung applied for HK$500,000 worth of iBond - in the hope of being allotted the highest amount of iBond she could afford.

Stable Investment

"The iBond is a more stable investment nowadays because the investment is supported by the Hong Kong government's fiscal reserves, which are in a strong position," Hung tells China Daily. "The stable iBond investment should be fine for me, as long as it can satisfy my yield-demanding needs. I am not a day trader who is concerned a lot about the daily fluctuations of bond prices."

Andrew Wong, another local retail investor who earns an average monthly salary and who has accumulated many years of experience investing in Hong Kong shares, also has turned to iBond investment. He finds them a good deal more attractive amid sluggish trading and volatility in the local equities market.

In 2012, he put up HK$100,000 and was allocated 4 lots of iBond worth HK$40,000. This year, he raised his bet, increasing his iBond subscription amount to HK$150,000.

"The share market is getting volatile again. The third series of iBond issuance is going to sell-out because investors are piling onto the risk-free product at a time when the rest of the market is sluggish," Wong tells China Daily. "Following the herd, more local investors are flocking to iBond subscriptions in 2013 than in the previous two years."

"As I get older, I feel I need to adopt a defensive approach - to switch part of my assets into bonds. I cannot trust all my nest eggs to risky assets," Wong says. "Besides, the global share market is getting more and more volatile and sometimes it really scares me."

"Therefore I decided to apply for iBond to get more stable coupon payments and - I hope stabilize the performance of my investment portfolio," Wong adds.

iBond investments have shown a steady growth in popularity, given the low-risk and satisfactory returns to local investors who are demanding a safe investment vehicle that will protect their savings from being eaten up by inflation and low Hong Kong dollar deposit rates

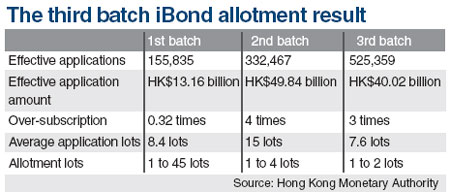

The 525,000 applications for Hong Kong's third release of iBond locked up HK$4 billion, representing a 58 percent jump in applications and a decline of nearly 20 percent in lock-up amount. Due to the highest application number ever in this year, every local investor is permitted a maximum allocation of only HK$20,000 worth of iBond. That is a 50 percent cut from the last year allotment when an investor can get a maximum distribution reaching HK$40,000. This year allotment declines even further more from the result in 2011when an investor can get the maximum allotment of HK$450,000 worth of iBond.

The Hong Kong Monetary Authority is selling the HK$10 billion worth of three-year iBond to inflation-conscious residents as part of a long-term effort to promote the city's bond market and provide more channels for local residents to undertake bond investment.

The bond's minimum denomination will be HK$10,000. Bond holders will be paid interest once every six months at a rate identical to the city's rate of inflation during the corresponding period, or the minimum 1 percent coupon rate, whichever is higher. The minimum 1 percent coupon rate is designed to protect bondholders against the possibility of deflation in the local economy.

The iBond investment does endow investors with stable returns amid the rising volatility in the local stock market.

iBonds do endow investors with stable returns amid the rising volatility in the local stock market.

As at July 4, investors who bought iBond in 2011 could expect a total return - combining secondary-market gains and interest payments - of 16.13 percent if they hold the bond up today. The second iBond issue of 2012 also furnish a return of 9.41 percent to investors who brought the bond at inception and are continuing to hold it now. The third iBond also bestows an investment return of 3.2 percent if the bond are held up to now.

By contrast, the benchmark Hang Seng Index as at July 4 has fallen 9.65 percent from the level recorded in 2012. The Hang Seng China Enterprises Index, also known as the H-Share Index, has even tumbled 21.1 percent in the same period, placing Hong Kong's H-Share market as one of the worst performers among developed equity markets.

More favor to bonds

Given the near-zero interest rate on bank deposits and the sluggish and volatile performance of the stock market, it is expected that local investors are considering allocating more money to safe assets given the increasingly cautious investment sentiment.

A survey of 1,000 investors conducted by the Hong Kong Investment Funds Association from January to March, showed that local investors prefer to diversify their portfolios further in 2013 by holding an average of four investment products. Among these instruments, 10 percent of investors said they intend investing in yuan-denominated financial products in the next 12 months. The current ownership rate of yuan-denominated instruments is 5 percent.

On the other hand, around 14 percent of those interviewed reckoned that they would invest in local securities in the next 12 months, a significant fall when compared to the current ownership rate of 23 percent.

Another survey by the China Construction Bank (Asia) in May, revealed that 41 percent of the 805 investors whose household income exceed HK$20,000 planned to make yuan-denominated savings deposits and time deposits, making these second only to Hong Kong equity investments in terms of popularity. Another 19 percent and 12 percent of the respondents reckoned that they would allocate their assets to yuan-denominated bonds and other yuan investments, respectively.

Contact the writer at oswald@chinadailyhk.com

(HK Edition 07/05/2013 page3)