Laura Cha to head new financial council

Updated: 2013-01-18 07:01

By Sophie He(HK Edition)

|

|||||||

High-level advisory body to further lift city's int'l financial center status

Laura Cha, former vice-chairman of China Securities Regulation Commission, has been appointed chairperson of the newly established Financial Services Development Council, which is tasked to help further boost the city's status as an international financial center, the government said on Thursday.

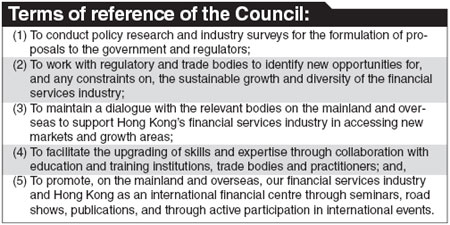

This high-level advisory body will conduct policy research and industry surveys for the formulation of proposals to the government and regulators.

The Commission will comprise 22 members who will each serve for a two-year term commencing fromn January 17, 2013.

The 22 members include five professionals who have either mainland back ground or have experience on the mainland, another five from foreign nations while the rest are Hong Kong citizens, Cha told a press briefing in Hong Kong on Thursday, adding that everyone of them has a considerable position in their respective industries.

"The composition of the FSDC members reflects that Hong Kong is an international market," said Cha.

She pointed out that currently, companies from the mainland account for half of the market capitalization of the city's stock market while over half of the daily turnover (of the stock market) are contributed by mainland companies.

"So there should be no surprise that our members include professionals from the mainland," she added.

"The list of the members speaks for itself," KC Chan, the city's secretary for financial services and the treasury, told a press conference on Thursday.

Chan said that he believes the members are considered to be the best in terms of promoting the development of Hong Kong's financial industry.

Chen Shuang, chief executive at China Everbright; Qin Xiao, retired chief of China Merchants Group; Tse Yung-hoi, life honorary president of the Chinese Securities Association of Hong Kong; Levin Zhu, chief executive at CICC, as well as Anton Liu Tingan, deputy chairman at China Life Insurance (Overseas) Co are members of the FSDC who are from the mainland.

Billy Mak, associate professor of Finance and Decision Science, Hong Kong Baptist University, told China Daily during a telephone interview that he believes it is a very good thing that the FSDC members include professionals from the mainland.

Hong Kong needs to act in line with the country's "12th Five-year Plan" and enhance its position as an international financial center. In order to do so, the integration of Hong Kong and the mainland, especially the integration of the finance sectors on both sides, is very important, Mak explained.

"When FSDC provides its suggestions to the Hong Kong government in the future, it is important that the voice of Hong Kong's finance sector is heard, and it is also important that the opinions from the mainland have been taken into consideration," said Mak.

He also pointed out the combination of members seems to be "okay", at least for now, as the majority of the members are Hong Kong residents, which reflects that the FSDC will consider the city's interests first.

Cha also said that in order to save resources, the FSDC's structure will stay lean. Although at its initial stage, the council may need resources from the government, eventually, the organization will achieve "self-sufficiency".

The FSDC will convene its first meeting on January 22, and is expected to have a meeting once every two months.

sophiehe@chinadailyhk.com

(HK Edition 01/18/2013 page2)