HK expects continuity policy from Obama's new 4-yr term

Updated: 2012-11-08 07:45

By Oswald Chen(HK Edition)

|

|||||||

|

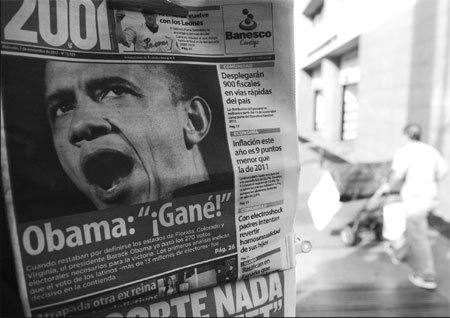

A newspaper in Venezuela headlines US President Barack Obama's reelection on Wednesday. HK's export-oriented economy would keep stable as Obama has been re-elected, local analysts say. Juan Barreto / AFP |

Any US or Eurozone bad news will trigger capital outflow from city

Financial analysts cautioned that Obama's re-election as the US President still cannot resolve the current fragility of the US economy and will fuel uncertainty in the Hong Kong share market in the long run; and local economists reckoned that the election result would keep Hong Kong's export-orientated economy stable.

"The Obama re-election will assure a policy of continuity of the third round of quantitative monetary easing (QE3) and hence will inject a short-term optimism propelling liquidity in the Hong Kong share market," Tengard Fund Management Investment Manager Patrick Shum told China Daily.

The US Federal Reserve initiated the QE3 in September, purchasing $40 billion of mortgage-backed securities per month and will continue the program until the US job market improves substantially.

After the QE3 policy launch, the city's de facto central bank, the Hong Kong Monetary Authority, had to at least initiate 10 interventions in the foreign exchange market in less than two weeks since late October, bringing the sum of balances on clearing accounts maintained by banks with the HKMA to HK$180.9 billion on November 6, according to a Reuters report.

Hong Kong's Hang Seng Index on Wednesday closed at 22,100, representing 1,470 points higher, or a 7.13 percent hike from the closing position of 20,629 registered on September 14 when the QE3 policy was announced.

"The sovereign European debt crisis is still lingering on; and the US will soon face the issue of a fiscal cliff. Any bad news breaking out regarding the European debt crisis or US fiscal cliff may propel a sudden huge capital outflow that may jeopardize the Hong Kong share market," Shum added.

The fiscal cliff denotes a series of federal tax hikes and spending cuts that are set to take place in the US at the end of 2012. However, the Democrat-Obama administration is unable to launch the program of tax hikes and spending cuts due to the opposition of the Republican-led Congress. It is expected that the Obama re-election still cannot resolve the gridlock immediately.

In addition to the unstable US and European economies, the mainland economic growth factor is also weighing on the future price movement of the local share market.

"The mainland government definitively will launch some economic stimulus policies to propel the country's economic growth that will fuel the price hike of the HSI index," Success Wealth Management Executive Director Barry Doo told China Daily.

"Even after the commencement of the 18th CPC National Congress, the new leadership will not announce new economic stimulus policies immediately this month and may announce the details in February. Hence there is a three-month time period during which the Hong Kong share market may be negatively impacted by any unfavorable economic news in US and Europe," Harris Fraser Research Director Andy Lam told China Daily.

Besides the impact on the local share market, the Obama re-election can also stabilize the local export-reliant economy.

"The current Sino-US trade relationship will remain intact after the Obama re-election, and this is good news for the Hong Kong export sector," Chong Tai Leung, an economic professor at the Chinese University of Hong Kong, told China Daily.

However, Chong cautioned that the US QE3 and low interest rate policy will continue to fuel "high property prices, high inflation and low interest rates" in the Hong Kong economy.

oswald@chinadailyhk.com

(HK Edition 11/08/2012 page2)