StanChart's operating profit dented by US settlement

Updated: 2012-10-31 06:32

By Oswald Chen(HK Edition)

|

|||||||

Asia-focused Standard Chartered Plc said its operating profit in the first nine months this year rose by a mid-single digit rate, dented by a huge settlement paid to New York regulators who had threatened to revoke the bank's license in the state over allegations it hid transactions with Iran.

Operating profit would have risen by at least 10 percent if the bank had not been saddled with a $340 million settlement over the license issue, the bank said in a third quarter trading update posted on the Hong Kong bourse on Tuesday.

"Standard chartered has continued to perform strongly in the third quarter of 2012. Although the environment remains turbulent, we are in the right markets and continue to see good momentum across our businesses and geographies," Standard Chartered Group Chief Executive Peter Sands said in the company statement.

In the first nine months of 2012, income grew at a high single digit rate due to the strength of the US dollar against Asian currencies, StanChart said in the statement. Hong Kong, China, Indonesia and the Americas, UK and Europe region have delivered strong performances and more than offset continued currency weakness impacting India's growth, a slowdown in Singapore's wholesale banking business and a muted consumer banking performance in Korea, it said.

Costs remain controlled with broadly neutral cost income jaws - the gap between the growth in revenue and growth in costs, even after including the settlement with New York regulators, plus a legacy legal provision of a commercial nature, the cost of headcount increases and the continued investments in the branch networks in China and Africa, the statement added.

The group will remain cautious toward loans in the future given the slowdown in the macroeconomic environment, the statement said.

"The bank's Indian market is performing poorly due to the economic slowdown in the country. Some other Asian Pacific markets are also not doing well. The net interest margins of the Hong Kong market is still compressed," Kingston Securities Research Director Dickie Wong told China Daily.

"The bank may still deliver record high net profit for the whole year of 2013, but the room for making persistent net profit growth in the future is limited," Wong added.

Investment bank Bernstein analyst Chirantan Barua said he is worried over the bank's weakening outlook. He predicted that the bank's weakening consumer banking as a percentage of loans was expected to rise to 68 basis points in the second half of this year. Wholesale banking weakness as a percentage of loans was seen to grow to 57 basis points in the same period because of provision increases on existing exposures in the Middle East and India.

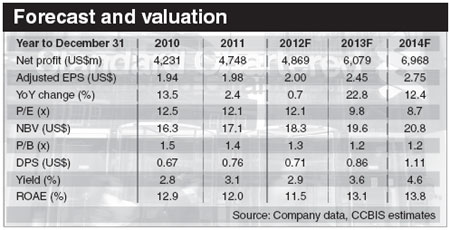

CCB International Securities in its research report maintained an outperform rating for Standard Chartered as the bank will be a beneficiary of the global reflationary effort by central banks given its geographical footprint in emerging markets.

However, the report cited that the bank may face several business risks, including inflation and higher costs, global macro and political risks, as well as regulatory risks.

oswald@chinadailyhk.com

(HK Edition 10/31/2012 page2)