Funds neutral on equities and bonds

Updated: 2012-10-04 05:52

By Oswald Chen(HK Edition)

|

|||||||||

Global fund managers mostly hold a neutral outlook for equities and bonds in the fourth quarter of 2012, according to the HSBC latest Fund Managers survey.

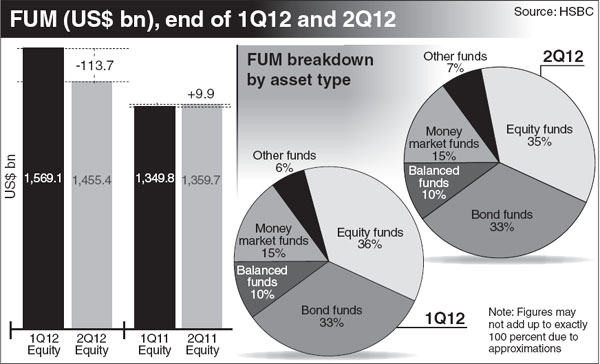

Funds under management (FUM) by 13 of the world's fund management houses' reached $4.14 trillion at the end of the second quarter 2012, down 3.3 percent or around $143 billion, from the first quarter this year.

In the second quarter, the equity funds registered $113.7 billion capital outflows, representing the eighth consecutive quarter outflow due to the lingering European debt crisis and disappointing economic data. Bond funds recorded net minor capital inflows of $9.9 billion in the same period, as high yields and emerging market bonds contributed the most inflows amidst the low interest rate environment.

According to the data released by the Hong Kong Investment Funds Association last week, the city's authorized bond fund capital inflows skyrocketed 111 percent in the first seven months of 2012, while capital inflows turned into outflows for those authorized equity funds in the city over the same period.

Regarding asset allocation strategy, global fund managers' views on equities and bonds in the fourth quarter remain unchanged compared to the third quarter as 50 percent and 60 percent of the respondents still hold a neutral outlook on equities and bonds respectively.

"The survey reflects the nervousness in the market on growth prospects," said Eric Fu, HSBC's Head of Wealth Development at Hong Kong.

"The majority of bond managers hold neutral views toward bonds as the market sees little room for interest rates to go further down, especially in developed countries," Fu added.

However, the survey also showed that another 40 percent of the fund managers are still optimistic toward equities as global central banks' easing actions may support the performance of risky assets. "Equities have long-term appeal underscored by the attractive dividend yield pickup over bonds," Fu said.

Harris Fraser Investment Research Director Andy Lam also echoed HSBC views that equity funds will witness more capital inflows in the fourth quarter of 2012.

"The launch of the US third round quantitative monetary easing policy (QE3) may spur a global stock market rebound based on market liquidity," Lam told China Daily. "Besides injecting liquidity, the QE3 policy should gradually improve the real economy. Economic data in the fourth quarter should improve and can boost more bullish sentiment to drive the market up."

Lam was particularly optimistic toward capital inflow of the China equity funds in the fourth quarter, saying that the relative underperformance of this equity fund segment should boost more room to gain more returns when market sentiment turned positive on risky assets.

"After the 18th National Congress of the Communist Party of China to be held in mid-November, the economic policy of the Chinese government should be clearer and that can boost more capital inflows into China equities," Lam added.

According to the HSBC survey, none of the respondents are bearish toward Greater China shares in the fourth quarter as policy easing is underway and growth may be bottoming out.

oswald@chinadailyhk.com

(HK Edition 10/04/2012 page2)