Mortgage lending value may fall

Updated: 2012-09-19 06:55

By Oswald Chen(HK Edition)

|

|||||||

Cooling property market measures may reduce banks' profits in city

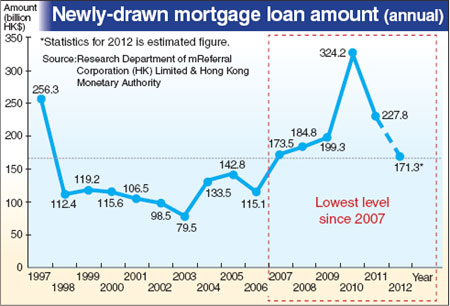

Hong Kong's mortgage lending value is expected to fall 25 percent in 2012 from last year as the government steps up its efforts to cool the overheated residential property market, adding pressure on banks' profits.

The actual newly-drawn mortgage loan amount in 2012 is predicted to fall 25 percent annually to HK$171.3 billion ($22.10 billion), meaning it will reach the lowest level since 2007, as the Hong Kong Monetary Authority's (HKMA) fifth round of property market prudential measures are expected to dampen mortgage loans demand, local mortgage loan service provider mReferral said.

"The HKMA's latest measures, including tightening the maximum debt servicing limit and capping the maximum home loan tenors, will cool home transactions a little bit in the remaining period of 2012," mReferral Chief Economic Analyst Sharmaine Lau said, adding that the measures will also increase the difficulty for some home investors to finance mortgage loans.

According to mReferral figures, the newly-drawn mortgage loan amount in the first seven months of 2012 only totaled HK$98.1 billion, representing just 43 percent of the total amount of HK$227.8 billion recorded in 2011. As the HKMA's new prudential measures may squeeze demand for more mortgage loans, the mortgage loan services provider predicted that the newly-drawn mortgage loan figure will register a 25 percent slump for the whole of 2012 to reach the lowest level in the last five years.

"Local banks may see contraction of the mortgage loan business, and they may launch more marketing efforts to boost more business through offering cash rebates," Lau added. "However, I think local banks cannot slash mortgage rates too much since we already have an ultra-low interest rate environment."

The Monetary Authority on last Friday issued guidelines to banks to tighten their underwriting criteria for loans to borrowers with multiple property mortgages, and a newly introduced ceiling for loan tenors to strengthen risk management in mortgage lending.

According to the HKMA, home buyers' mortgage payments for investment properties cannot exceed 40 percent of their monthly income. Moreover, the HKMA also capped the tenor of all new property mortgage loans to 30 years.

"We see the mortgage loan business of local banks is contracting amid the prudential measures taken by the HKMA," a mortgage loan banker who declined to be named told China Daily. "However, we see little chance that local banks will rush to decrease mortgage rates to compete for more business."

According to the HKMA's Half-Yearly Monetary and Financial Stability Report of March 2012, the weighted average mortgage rate for newly-approved loans increased to around 2.7 percent at the end of 2011, back to the levels last seen in late 2008. The net interest margin of banks improved further in the second half to average 1.28 percent from 1.21 percent in the first half of 2011, partly reflecting the banks' move to raise their HIBOR-based mortgage interest rates.

"The HKMA measures may curtail investment demand for properties, and I predict the newly-drawn home mortgage loan value may slump 15 percent to 30 percent, depending on the actual home transaction amount," Ricacorp Properties Patrick Chow told China Daily. "Property investors may be forced to cut their leverage ratio in property investment."

oswald@chinadailyhk.com

(HK Edition 09/19/2012 page2)