NY ops to cost StanChart $340m

Updated: 2012-08-16 06:48

By Oswald Chen(HK Edition)

|

|||||||

|

The Standard Chartered logo above the gate of the company's headquarters in London is half-covered by tree branches. The UK lender had agreed to pay $340 million to the New York banking regulator on Wednesday to continue banking operation in New York. Simon Dawson / Bloomberg |

Bank's deal, seen as pragmatic move, pushes up HK shares at Wed's close

Standard Chartered Plc has agreed to pay $340 million to New York's State Department of Financial Services (DFS), the banking regulator, in a hastily arranged deal to avert a hearing to defend its right to operate in New York, but still faces a separate probe over its alleged Iran-related transactions by other US agencies.

The bank confirmed that the two sides had reached an agreement, including the $340 million payment, and said detailed terms would be concluded soon. "It was a pragmatic decision in the best interest of shareholders and customers," a bank's spokesman said.

In addition to the civil penalty, the bank agreed to instal an outside monitor who will report directly to DFS to check on risk controls on money-laundering at its New York branch for at least two years.

The deal with New York Superintendent of Financial Services Benjamin Lawsky on Tuesday caps a week of transatlantic tension.

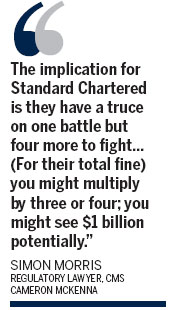

Standard Chartered Plc could pay as much as $1 billion in fines as it settles with other regulators following its agreement with the DFS, according to Simon Morris, a regulatory lawyer at CMS Cameron McKenna in London.

"The implication for Standard Chartered is they have a truce on one battle but four more to fight" with their other regulators, he said in an interview with Bloomberg Television on Wednesday. For their total fine, "you might multiply by three or four; you might see $1 billion potentially."

In his announcement on Tuesday, Lawsky said Standard Chartered "agreed that the conduct at issue involved transactions of at least $250 billion." The $340 million fine will go to Lawsky's agency, DFS, and the New York state.

In Hong Kong, Standard Chartered's shares rose as much as 6.8 percent and the share finally closed nearly 3.6 percent higher to HK$171.7 a share in Wednesday's trading. However, the share price is still nearly 9 percent below where they were before the allegations hit the bank early last week.

"Standard Chartered has probably done the right thing. You just pay up and get on with life however innocent you feel you are. Otherwise, it's something that could hang over you for years," said Hugh Young, Asia managing director at Aberdeen Asset Management, Standard Chartered's third-biggest shareholder according to Thomson Reuters data.

The settlement agreed by the bank is equal to less than 9 percent of its first-half pre-tax profit. At the latest levels, Standard Chartered's market value is around $3.5 billion less than it was before Lawsky's allegations.

Ian Gordon, an analyst at Investec Securities in London, said the risks of further regulatory costs "appear sufficiently contained" to allow the bank's shares to build on a rally from their lows after Lawsky brought his case last week. "Standard Chartered's management team has conducted themselves admirably in the face of extreme provocation," he said.

"Crucially, the settlement eliminates the risk of Standard Chartered losing its banking and clearing license," Shailesh Raikundlia, an analyst at Espirito Santo Investment Bank in London, said. That "would have significantly impaired their wholesale banking operations, especially transaction banking and trade finance."

Lawsky on Aug 6 called Standard Chartered a "rogue institution" that had broken US sanctions on Iran, saying it hid Iran-linked transactions with a total value of $250 billion from regulators in the last 10 years. Standard Chartered strongly denied the allegations last week, saying illegal transactions just totaled less than $14 million.

Standard Chartered is just one of the major banks that has been penalized by the US financial regulatory authorities. Lloyds Banking Group and Credit Suisse Group have previously agreed to pay settlements of $350 million and $536 million, respectively. ING Bank NV paid a settlement of $619 million. HSBC Holdings Plc currently is under investigation by US law enforcement, according to bank regulatory filings. In 2010, Barclays Plc paid $298 million to settle a joint probe with federal and New York authorities.

Reuters contributed to this story

oswald@chinadailyhk.com

(HK Edition 08/16/2012 page2)