China's M&A deals drop 33% in H1: PwC

Updated: 2012-08-15 06:55

By Li Tao(HK Edition)

|

|||||||

Merger and acquisition (M&A) activities on the mainland declined 33 percent in terms of the deal numbers in the first six months over the same period of 2011 due to a huge decrease in foreign inbound investments as well as private equity deals, according to international accounting firm PricewaterhouseCoopers (PwC).

A total of 1,823 M&A deals were recorded on the mainland during the first half this year as compared with the 2,709 deals during the same period last year, while the total deal value also declined 10 percent to $78.9 billion over $87.7 billion a year earlier, PwC announced in Hong Kong on Tuesday.

M&A transactions within the mainland, Hong Kong and Macao, which accounted for 88 percent of total activities, fell by 25 percent to 1,184 from 1,570 a year earlier, approaching 2009 levels, said the firm.

Foreign strategic buyers, in reference to overseas corporate buyers acquiring companies to integrate them into their existing businesses, have also pulled back registering a decline in investment ardor on the mainland notably. The M&A activities fell 42 percent to a mere 156 deals in the first half, down from 267 transactions for the same period last year, as foreign investors are also facing uncertainties in their home markets.

Private equity deals with a value of $10 million or more also dropped sharply, down 39 percent to 129 deals over the previous 210 deals in the first half as deals processing times were intentionally lengthened in anticipation of a further decline in prices, according to PwC.

PwC Greater China Private Equity Group Leader David Brown said the first half-year M&A result was "very surprising" and was even worse than the global financial crisis period. He attributed the dismal results to the global economic challenges that affected market sentiments for deal-making.

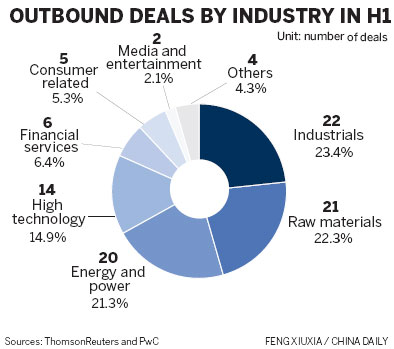

Brown nevertheless recognized the mainland's consistently buoyant outbound investment activities. In the first half, 94 Chinese outbound deals were recorded during the period compared with 100 deals sealed a year earlier, but the value of deals this year has tripled compared with the deals value achieved last year, according to the report.

Supported by favorable government policies, mainland companies are actively acquiring resources, energy and technology-related business abroad. In the first half, nine deals, including seven in the resources and energy sector, with a value exceeding $1 billion were announced, compared with only two during the period last year.

Brown recognized that Chinese outbound activities have become a normal activity on the mainland these days even though such activities were rarely seen four or five years ago.

"These trends will likely continue and the number and size of transactions will grow driven by a number of factors including the increasing experience and confidence of the participants," said Brown.

"Increasing support from Chinese domestic financial institutions and also the private equity industry will also enable buyers to take advantage of opportunities as vendors respond to difficult conditions in their home markets," he added.

PwC remains optimistic that mainland's outbound M&A activities will achieve another record year in 2012. As for other China-related M&A activities, the firm, which holds the view that the current downward trend is only temporary, said that the recovery will depend upon the state of the major economies in Europe, the US and the mainland.

litao@chinadailyhk.com

(HK Edition 08/15/2012 page2)