Home prices to see reverse trend in next 3 years

Updated: 2012-08-10 06:58

By Li Tao(HK Edition)

|

|||||||

Rising supply and anticipated interest rates hikes are likely to put downward pressure on housing prices by 2015, according to international property consultant Cushman & Wakefield.

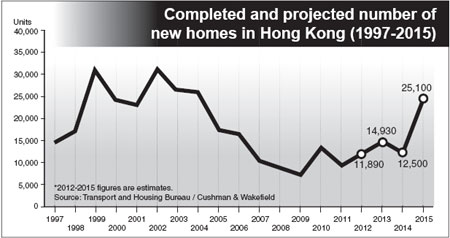

The number of new homes completed in Hong Kong is on an overall upward trend in the next few years, from the estimated 11,890 units in 2012, 14,930 units in 2013 and 12,500 units in 2014, and is likely to peak at around 25,100 units by 2015, said the property advisory.

"Given that interest rates are also expected to hike up from 2014, it will impose pressure on property prices in Hong Kong combined with the substantial increase in home supply at that time," said Vincent Cheung, national director of Valuation and Advisory Service of Cushman & Wakefield.

"Developers, however, will likely adjust the supply by postponing the launch of new properties accordingly to counter the pressure," Cheung told at a media briefing on Thursday.

But the near-term home prices in Hong Kong are unlikely to stay in line with the advisory's previous forecast on the market. In January 2012, Cheung told China Daily in a telephone interview that property prices in Hong Kong had reached a deadlock, and were expected at the most to decline by 15 percent in the mass market this year.

According to the data released by Cushman & Wakefield on Thursday, home prices in Hong Kong gained 6.6 percent in the first half of 2012. Cheung says prices will stay flat for the rest of the year, estimating that they would increase by an overall 6.9 percent in the mass market this year from a year earlier.

Despite home prices remaining firm in the city, transaction volume in the first half has declined over 22 percent over last year due to the market's lukewarm sentiment. But since the new Chief Executive took office last month, the market turned warm again, with transactions climbing 8 percent in July over the same period in 2011, according to the property advisory.

Rents, however, only expanded 4.0 percent over the first six months, at a slower pace compared with the home prices in Hong Kong.

"It added pressure to rental yields", Cheung said. "We anticipate the home price growth to moderate in the second half of 2012 while rents achieve sustained growth - which is likely to grow at an overall 5.6 percent for the full year, causing yields to rise by 3 percent," said Cheung.

In a Knight Frank report released on Thursday, the firm said the residential market sentiment "weakened further over the past month", as the secondary market remained quiet while primary sales rebounded.

"We expect luxury residential prices to drop by up to 10 percent over the next 12 months, while mass residential prices could drop by up to 15 percent during the same period," said the report.

Deutsche Bank said in June that property prices in Hong Kong "may fall as much as 20 percent in the next 12 months" as the supporting pillars for the residential market over the past two years are weakening.

litao@chinadailyhk.com

(HK Edition 08/10/2012 page2)