Casino's income forecast cut again

Updated: 2012-07-27 06:44

By Oswald chen(HK Edition)

|

|||||||

|

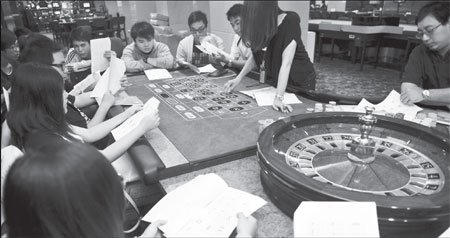

Trainees are taught gambling techniques at a casino in Macao. Hong Kong-listed Macao casino companies generally suffered a share price drop on Thursday after Fitch Ratings trimmed its casino industry revenue forecast again. Dale de La Rey / AFP |

Macao's June gambling revenue lags Bloomberg median estimate of 15.3%

Locally-listed Macao-related casino shares generally tumbled on Thursday as Fitch Ratings trimmed its casino industry revenue forecast for the second time due to spending reduction of wealthy mainland gamblers amid the mainland's slowing economy.

Fitch Ratings said it had revised its 2012 Macao casino industry revenue growth forecast downwards to 10 to 12 percent from 15 percent, "reflecting our more cautious view with respect to the near-term impact of the slowdown on the mainland. This is our second downward revision over the last couple of months."

According to Fitch, casino industry revenue in Macao rose 42 percent in 2011, much slower than the 58 percent growth in 2010.

Gambling revenue growth in the world's largest gambling hub has slowed, rising only 7.3 percent in May - the weakest pace since July 2009. Even though Macao's gambling revenue increased 12.2 percent in June to 23.3 billion patacas ($2.9 billion), it still lagged the 15.3 percent median estimate of four analysts surveyed by Bloomberg News.

The majority of Macao's gambling revenue growth of 70 percent is attributed to high-stake gamblers and VIPs, but it has slowed significantly in the past three months due to lower visitation and diminished spending appetite by the wealthy mainland gamblers amid a weaker mainland economy.

Shares of Sands China slumped nearly 5 percent to HK$21.15 after it posted underwhelming second-quarter earnings, dragging the broader Macao gaming sector lower. The casino operator reported a 40 percent drop in second-quarter profit to $160.5 million from $267.4 million a year earlier on an impairment charge, lower winnings and opening costs.

"Sands China is the big theme today for shorts (short selling)," said Benjamin Chang, chief executive officer of LBN Advisors.

Sands China's weakness also spread to its Macao gaming peers. Concern over the sector's July revenues is beginning to surface, with some suggesting that the Macao industry could see a first monthly decline since 2010, traders said.

Shares in Galaxy Entertainment and Wynn Macau lost 2.6 percent and 3 percent, respectively, while MGM China shed 3.4 percent in Thursday's trading.

"Those Macao casino shares are heavily dependent on the state of the mainland economy and whether the central government will permit more tourist travel to Macao," Tengard Fund Management Investment Manager Patrick Shum told China Daily. "As the mainland economy is faltering and the central government is restricting tourist arrivals to Macao, the gambling revenue growth is poised to diminish in the near future."

Shum added, "The cyclical nature of the Macao gambling shares means that investors should underweight this share segment until the state of the mainland economy improves and the central government's policy direction is clear."

Citigroup analyst Ansi Daswani predicted that the Macao casino industry's revenue growth may even slow down to just 3 percent in July on a yearly basis while Mandy Chan from the Bank of America Merrill Lynch said that gross gambling revenue may be flat or only rise in mid single digit growth.

Reuters and Bloomberg contributed to this story

oswald@chinadailyhk.com

(HK Edition 07/27/2012 page2)