SMEs bearish on Q3 outlook

Updated: 2012-07-25 07:28

By Sophie He(HK Edition)

|

|||||||

|

A truck drives past stacked containers at a storage facility at Kwai Tsing. Hong Kong's SMEs are generally having low confidence on the economy's third quarter outlook due to weakening external demand and rising operating costs. Jerome Favre / Bloomberg |

Despite uncertainties, many still willing to invest and hire staff

Small and medium-sized enterprises (SMEs) in Hong Kong are generally bearish about the economy's third-quarter outlook as weakening external demand amid global economic turmoil and rising operating costs continue to weigh on, according to a newly created Standard Chartered SME Index released by the Hong Kong Productivity Council (HKPC).

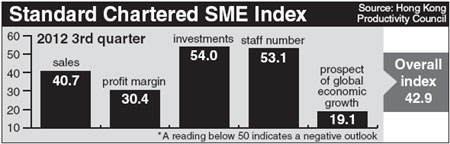

The overall index for the third quarter of this year is 42.9. (A reading below 50 indicates a negative outlook).

The readings of sub-indices for "sales amount", "profit margin" and "global economic growth" are all below 41 for the third quarter, indicating that local firms are pessimistic about the external economic environment and are concerned about their profit margin being squeezed by rising costs, said Leo Lam, director of business innovation at HKPC.

The quarterly survey conducted by HKPC and sponsored by the Standard Chartered Bank is designed to reflect the local business climate outlook of over 800 local SMEs polled. The index comprises five areas, including local SMEs' outlook on their sales amount, profit margin, investments, staff number and the prospect of global economic growth.

According to the index, the readings of "investments" and "staff number" are 54 and 53.1, respectively, meaning that local SMEs are still willing to increase their investment and continue to hire despite the global economy's uncertainties.

Kelvin Lau, a senior economist of Asia at Standard Chartered Bank (Hong Kong), said although this is the first release of the index, he believes the reading of 42.9 is reasonable.

"Hong Kong is an export-oriented economy and the volatility of external economies has a more direct impact on local SMEs' confidence," said Lau.

He pointed out that local enterprises are positive about future investments and staff numbers shows that they have confidence in the medium to long-term economic situation.

"SMEs' outlook is in line with our forecast, which is that Hong Kong's economic growth will start to pick up in the second half, along with more easing measures to be introduced by the central government."

Lau expects the mainland's central bank to cut the interest rate and required reserve ratio as well as increase spending on infrastructure projects to boost the economy in the second half. He forecasts Hong Kong's GDP growth to be 2.3 percent for this year and 5 percent for 2013.

The survey, which interviewed local firms involved in manufacturing, import and export, retail and other five industries, shows that currently, the retail industry has the most bearish outlook for the third quarter, as the industry sub-index reading is 37.4, while the import/export/wholesale industry and manufacturing industry was at 45.6 and 41.5, respectively.

The index's data shows that the local retail sectors' growth is slowing down, affecting the local retailers' confidence, said Lau, adding that retail companies are also more sensitive to the pressure from rising wages and rents.

But Lau stressed that Hong Kong's retail sectors, backed by stable domestic demand, increasing number of mainland visitors and low unemployment rate, will be able to overcome the difficulties they are facing by cutting costs and increasing productivity.

sophiehe@chinadailyhk.com

(HK Edition 07/25/2012 page2)