Funds see strong outflow in Sept, Oct

Updated: 2011-12-13 06:49

By Oswald Chen(HK Edition)

|

|||||||

Net outflows of $469m in Sept, highest since December 2008

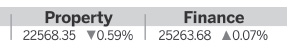

Hong Kong' fund industry saw net capital outflows in September and October, with September's net outflow hitting the highest level since December 2008, in a sign that investors have turned more risk-averse amid economic uncertainty.

The local investment fund industry group, the Hong Kong Investment Funds Association (HKIFA), released the local authorized fund sales data for the first 10 months of 2011 on Monday. The HKIFA has 64 fund management companies as full/overseas and affiliate members.

According to the HKIFA, local authorized funds experienced net capital outflows in September and October for the first time since the financial crisis in 2008. In September, the local fund industry registered net outflows of $469 million, the highest single month of net outflows since December 2008. Net outflows continued in October though the level moderated to $290 million.

"Fund sales are expected to lose momentum due to eurozone debt woes, the weakening US fiscal position and the series of sovereign debt downgrades in the second half of 2011," HKIFA Chairman Kerry Ching said in a Monday press briefing. "However, due to the payment of bonuses at the end of the year, and local investors being more proactive in conducting asset allocation, we expect net fund sales in the city will pick up again in early 2012."

Local fund investors are shifting their asset allocations to defensive bond funds from aggressive equity funds as bond fund sales account for 72.4 percent of the local fund net sales while equity fund sales only occupy 13.3 percent, HKIFA data revealed.

"Due to the continued uncertain market outlook, it is expected that investors will adopt a more cautious approach and interest for higher risk products will be subdued," HKIFA Vice-Chairman Terry Pan said.

Among the bonds component, Asian bond fund net sales attracted the highest inflows at $2.28 billion. This was followed by emerging market bond funds which contributed $948 million. However, the inflows were not across the board - European bond funds witnessed net outflows of $40 million.

Regarding the equity fund spectrum, Hong Kong equity funds attracted the highest net inflows at $485 million.

However, Greater China Region and emerging market equity funds have registered a capital outflow of $554 million and $240 million respectively.

"Capital inflow into the Greater China Region equity funds will be limited as fund investors perceive an economic hard landing on the mainland may be imminent. Whether this equity fund segment will attract capital inflow again depends on the pace of monetary policy loosening by the central government in 2012," Pegasus Fund Managers Managing Director Paul Pong told China Daily.

In the economic research report released by Standard Chartered Bank on Monday, the bank predicted that the mainland's economic growth in 2012 will be 8.1 percent as it predicted that the central government may gradually loosen its monetary tightening policies and kick-start more infrastructure investment projects next year.

oswald@chinadailyhk.com

China Daily

(HK Edition 12/13/2011 page2)