Office rents on the slide?

Updated: 2011-12-03 07:07

By Li Tao(HK Edition)

|

|||||||

|

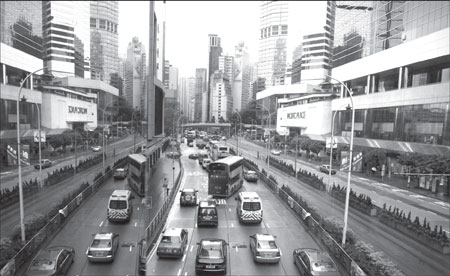

A reflection mirrors a scene of offices and shopping centers in Admiralty. Falling demand has pulled prime office rents down 3.8 percent in the third quarter. Antony Dickson / AFP |

After home prices froze in the city, Hong Kong's surging office rentals are also ticking down due to weakened market sentiment amid lukewarm global economy.

Falling demand has pulled prime Central rents down 3.8 percent in the third quarter of 2011 as some landlords have revised down their rent expectations, CB Richard Ellis (CBRE) said in a report released last month.

A slowdown of absorption by the banking and finance sectors, coupled with rising secondary space returning to the market has resulted in the rental of Central's AAA buildings like International Finance Centre and Cheung Kong Center dropping 3.8 percent to an average of HK$148 per square foot a month, according to the property consulting firm.

It may be due to the potential trickle-down effect from bank layoffs, as a number of financial institutions - considered a leading indicator of the global economy - have laid out plans to axe staff worldwide this year.

HSBC Holdings PLC, the Europ's largest bank, announced in September that they will shed about 3,000 employees in Hong Kong to improve the cost-efficiency ratio in the next three years, which probably has brought about the largest impact locally, said CBRE.

Besides these prime offices, rents in core districts are also expected to soften on the back of weaker demand and rising vacancy.

Average grade A office rents in Central, including these AAA buildings, have experienced its first quarter-on-quarter decline in two years, another report by Colliers International said on October 27.

Colliers also attributed the falls back to deteriorating business sentiment amidst uncertain global economic environment, which caused expansionary demand from the banking and finance industries to weaken.

"Clouded by the fragile economic recovery of the US and the lingering sovereign debt crisis in the eurozone, several multinational corporations temporary shelved their expansion plans, while a number of landlords became more flexible in rental negotiations," said Simon Lo, Colliers' executive director of Research & Advisory, Asia.

According to another study by Colliers in late October, Hong Kong's grade A office rents are the world's most expensive. Average annual gross rent per square foot reached $213.7 as of June 2011, up 32.4 percent from $161.4 a year earlier. It compared with London's West End and Paris, the next two most expensive places in the world, where rents stood at $150.2 and $111.9 per square foot a year in June 2011.

"The big if, is what happens if the eurozone crisis deteriorates," Mark Price, director of business space, Greater China from DTZ, told China Daily.

"The knock-on effect will then be global and we would then expect further cost cutting from both local and international occupiers, which we anticipate would then see tenants reducing occupied floor space with the result being increased vacancy and lower rents," said Price, who added that rents would certainly stabilize after 18 months of hikes regardless of the scenario.

Beyond prime Central district where most financial institutions and professional services gather, rents remain on an uptrend on Hong Kong Island, although the pace of growth slowed considerably compared with earlier quarters, the CBRE report noted.

Office rental in Kowloon recorded faster expansion compared with the Island, which rose 5.3 percent to average HK$36.5 per square foot from last quarter on healthy demand.

Betting on Hong Kong government's ambitious plans to turn Kowloon East - including the site of the former Kai Tak Airport - into another core business district in the city, tenants and investors have expressed optimism on the long-term outlook for the office-space market in Kowloon East district, said a Colliers' survey released on Oct 31.

Current rents in Tsim Sha Tsui are approximately 25 to 35 percent higher than Kowloon East. However, almost half of respondents in the survey said they expected rents in the area to catch up with Tsim Sha Tsui in 10 years.

litao@chinadailyhk.com

China Daily

(HK Edition 12/03/2011 page2)