HSBC shares fall on S&P downgrade

Updated: 2011-12-01 07:52

By Li Tao(HK Edition)

|

|||||||

|

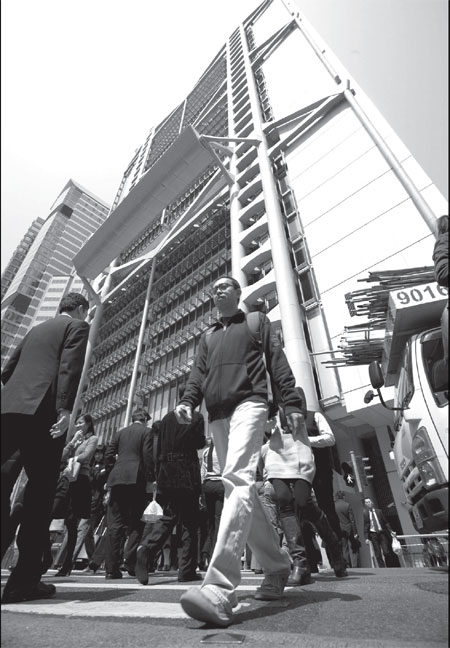

People walk by the HSBC building in Central. The downgrade on HSBC was expected after S&P announced its reassessment on Nov 18. Jerome Favre / Bloomberg |

Banking giant down 2.05% to HK$57.45 as rating cut to A+

Shares of HSBC Holdings Plc fell on Wednesday after ratings agency Standard & Poor's (S&P) downgraded its credit rating from AA- to A+.

Europe's biggest bank tumbled HK$1.20 or 2.05 percent to close at HK$57.45 in Hong Kong trading Wednesday.

HSBC was among a dozen of the world's major banks that had been downgraded by S&P on Tuesday. Western financial institutions including Citigroup, Goldman Sachs, Morgan Stanley, Bank of America and JP Morgan Chase, as well as Barclays and The Royal Bank of Scotland were all among banks whose ratings fell at least one notch on Tuesday.

Hang Seng Bank, controlled by HSBC, was also cut one notch to AA- from AA. The stock nevertheless gained HK$0.10 or 0.11 percent to HK$93.5 on Wednesday.

S&P raised the credit ratings of Bank of China (Hong Kong) Ltd (BOCHK), the city's second-largest lender by assets after HSBC, by two notches to A+ from the previous A-.

The downgrades on the banks were largely expected after S&P announced on Nov 18 that it had been reassessing risk on banks according to how they are funded and the amount of cash they hold.

The new criteria reflects the reduced prospects that the banks would be bailed out by governments if there was another financial crisis, according to the ratings agency.

However, a Hong Kong-based analyst who wished to remain off the record told China Daily that she does not believe that the upgrade on BOCHK or the downgrade on Hang Seng Bank necessarily reflect the companies' fundamentals, but largely relate to the banks' parent firms - Bank of China (BOC) and HSBC.

"It is difficult to judge why S&P downgraded HSBC and upgraded BOC as no details were released on their 'revised bank criteria', but we suspect it may be to do with HSBC's bigger exposure to Europe and the US than BOC," said the analyst.

Downgrades in credit ratings will raise the cost of funding substantially to these financial institutions. Bank of America said in a regulatory filing on Nov 3 that it may have to post of additional collateral and terminate payments on its trades after it was downgraded by ratings agency Moody's on Sept 21.

"The rating cuts may have a negative impact on investor sentiment," said Koji Toda, chief fund manager at Resona Bank Ltd in Tokyo. "What investors are really paying attention to is whether policy makers are going to take steps to resolve the European debt situation."

Bloomberg contributed to this story.

litao@chinadailyhk.com

China Daily

(HK Edition 12/01/2011 page2)